🛜 Spotify Technology | SPOT Stock Forecast 2025-2050 with detailed analysis

30 Seconds Summary

Spotify Technology (NYSE: SPOT) has revolutionized the way people consume music and audio content worldwide, becoming a household name in digital streaming. As investor interest in tech and entertainment stocks continues to grow, understanding Spotify’s long-term potential is more relevant than ever. In this blog post “Spotify Technology | SPOT Stock Forecast 2025-2050 with detailed analysis”, we dive deep into SPOT’s stock forecast from 2025 to 2050, analyzing its financial trajectory, market trends, and projected growth.

Whether you’re a long-term investor or exploring emerging opportunities in the streaming sector, this detailed analysis will provide valuable insights into Spotify’s future. We will compare SPOT’s performance with major indices as well as with its major competitors. We will also analyze SPOT stock on multiple timeframe and based on this analysis, we will estimate its future prices.

About Spotify Technology (NYSE : SPOT)

| Company Name | Spotify Technology |

| Stock Exchange | NYSE |

| Ticker Symbol | SPOT |

| Sector | Consumer Discretionary |

| Headquarter | Stockholm, Sweden |

| Founded in | 2006 |

| Major Shareholder | Daniel Ek (~15.7%) |

| Market Cap. | $ 123.01 billion USD |

| Revenue | $ 16.96 billion USD |

| Total Assets | $ 9.06 billion USD |

| All-time HIGH price | $ 785.00 USD (June 27, 2025) |

| All-time LOW price | $ 62.29 USD (Nov 04, 2022) |

| Peer Companies | The Walt Disney Company (DIS), Netflix Inc. (NFLX), Live Nation Entertainment Inc. (LYV), TKO Group Holdings, Inc. (TKO) |

Spotify Technology S.A., founded in 2006 and headquartered in Sweden, is a global leader in the music streaming industry. With a mission to make all the world’s music instantly accessible to everyone, Spotify has transformed how audiences engage with audio content. The company has grown significantly over the years, generating an impressive revenue of $16.96 billion USD. Traded under the ticker SPOT on the NYSE, Spotify reached an all-time high stock price of $785.00 USD in June, 2025, reflecting strong investor confidence and market performance. As the demand for digital streaming continues to rise, Spotify remains a key player in the global entertainment landscape.

Spotify Technology (NYSE : SPOT) | Past, Present & Future

Spotify Technology (SPOT) | Historical price analysis

| Year | Open | High | Low | Close | % Change |

|---|---|---|---|---|---|

| 2024 | 188.05 | 506.47 | 185.37 | 447.38 | +138.08% |

| 2023 | 81.88 | 202.88 | 79.14 | 187.91 | +138.01% |

| 2022 | 235.25 | 247.20 | 69.29 | 78.95 | -66.27% |

| 2021 | 317.42 | 387.44 | 201.68 | 234.03 | -25.62% |

| 2020 | 151.00 | 346.44 | 109.18 | 314.66 | +110.40% |

In the above graph, we can clearly see that SPOT stock price gave mostly positive results to its investors every year. SPOT stock price hit its all-time high of $785.00 on June 27, 2025.

Also Read : Tempus AI Inc. | TEM Stock Price Forecast 2025-2050 with complete analysis 🚨

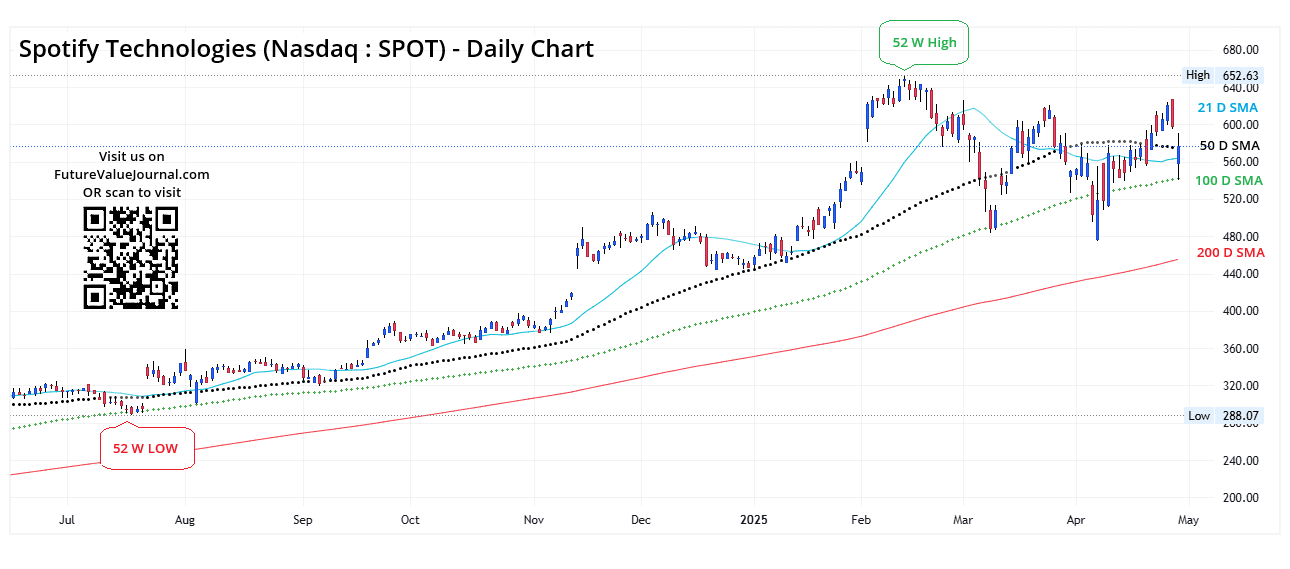

Live chart analysis for SPOT Stock Price Forecast

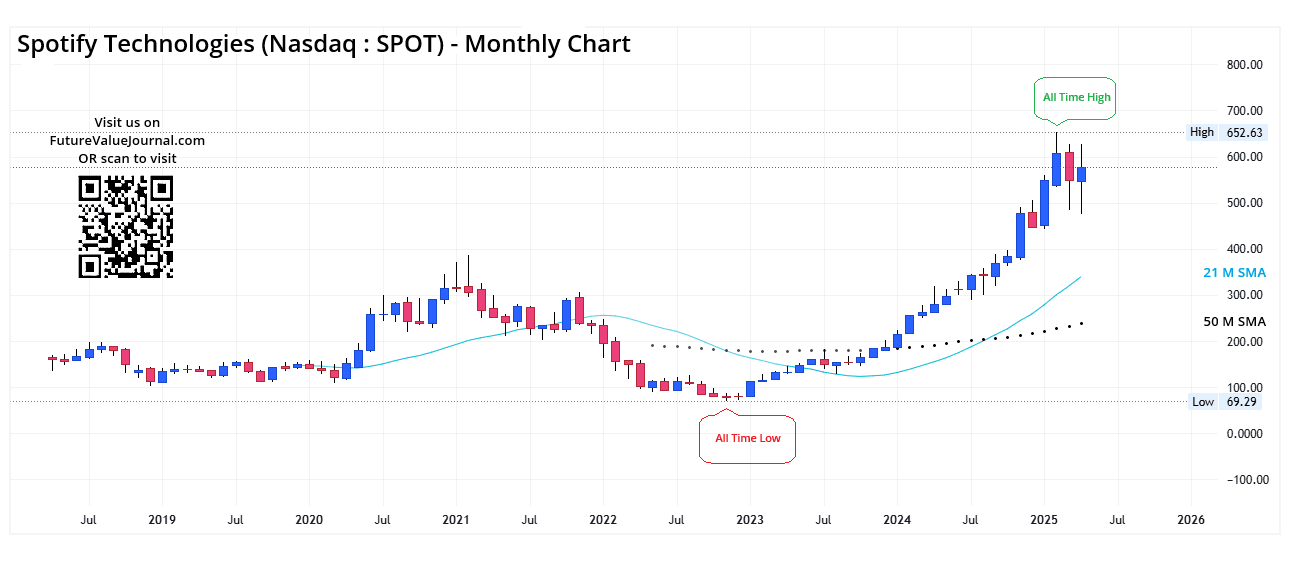

Before we start looking at the future prices of SPOT Stock, have a close look at the live chart so we can understand where it is heading in future. Here, in SPOT’s chart, we can observe that, SPOT started its up trend since January 2023. SPOT started its upside journey after hitting a low of $69.29 in Nov 2023. From January to July 2023, SPOT stock traded in upward direction till $182. Then it got corrected & reached $130. After the above mentioned correction, Spotify stock started its second wave of uptrend. In this wave, it reached to the height of $652 from $130. With two gap up openings & this huge growth, SPOT stock gained investors’ confidence.

Time-Frame analysis of SPOT Corp. : Daily, Weekly, Monthly, Yearly

By a technical chart analysis of Simple Moving Averages (SMAs) on different timeframes, we can observe the following –

| Time Frame | Observation |

|---|---|

View Daily Chart (Every candle represents NYSE : SPOT share’s trading session of one day. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular day) | On the Daily time-frame SPOT stock is trading ABOVE 21 Days, 50 Days, 100 Days & 200 Days SMAs. This indicates that SPOT stock has a BULLISH sentiment in medium term. |

View Weekly Chart (Every candle represents NYSE : SPOT share’s trading session of one week. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular week) | On Weekly time-frame, we can observe that SPOT stock is trading Above all the 21 Weeks, 50 Weeks, 100 Weeks SMA & 200 Weeks SMAs. This is the clear sign of Bullish trend in Long term. |

View Monthly Chart (Every candle represents NYSE : SPOT stock’s trading session of one month. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular month) | On Monthly time-frame, we can observe that SPOT stock is trading Above the 21 Months & 50 Months SMAs. This indicates that the SPOT stock is in Bullish trend for Very Long term. |

The major support can be seen at the levels around $490. If we go for the directional analysis of the SMAs also, we can see a clear BULLISH trend in SMAs directions in multiple timeframes.

Dow Jones, Nasdaq & SPOT : A comparative Analysis

Check out the comparative year on year returns of Dow Jones, Nasdaq and SPOT. Here, we are showing the returns by comparing them on closing basis –

| Year | Dow Jones | Nasdaq | SPOT |

|---|---|---|---|

| 2024 | +12.88% | +28.64% | +138.08% |

| 2023 | +13.70% | +43.42% | +138.01% |

| 2022 | -8.78% | -33.10% | -66.27% |

| 2021 | +18.73% | +21.39% | -25.62% |

| 2020 | +7.25% | +43.64% | +110.40% |

Here in the above table, we can clearly see that their is clear correlation between Dow, NASDAQ & SPOT stock. SPOT stock amplified in the direction of the overall market, whether its positive or negative. So, before taking medium to long term trade you should consider overall market conditions also.

Also Read : 📱NFLX | Netflix Stock Forecast 2025 – 2050 with Detailed Analysis

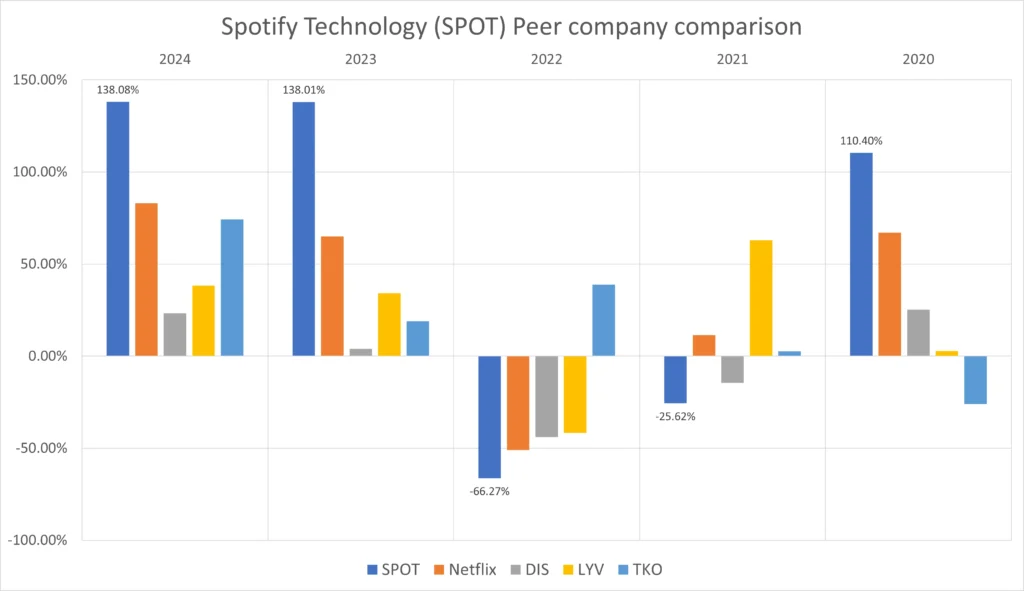

Spotify Peer Comparison / Competitors Analysis

We will compare Spotify Technology (NYSE : SPOT) to its peer companies. We will see how its top competitors performed year-on-year . Below is the comparative table of The Walt Disney Company (DIS), Netflix Inc. (NFLX), Live Nation Entertainment Inc. (LYV), TKO Group Holdings, Inc. (TKO)’s returns from 2020 to 2024 based on CLOSING Prices.

| Year | SPOT | Netflix | DIS | LYV | TKO |

|---|---|---|---|---|---|

| 2024 | +138.08% | +83.07% | +23.32% | +38.35% | +74.20% |

| 2023 | +138.01% | +65.11% | +3.92% | +34.21% | +19.06% |

| 2022 | -66.27% | -51.05% | -43.91% | -41.73% | +38.87% |

| 2021 | -25.62% | +11.41% | -14.51% | +62.89% | +2.68% |

| 2020 | +110.40% | +67.11% | +25.27% | +2.81% | -25.93% |

| Average Returns | +58.92% | +35.13% | -1.18% | +19.30% | +21.77% |

SPOT has given a positive returns of +58.92% to its long-term investors if we look at the 5 years average returns.

Spotify Stock Forecast : Short & Long Term

SPOT Stock Forecast 2025, 2026, 2027, 2028, 2029

| Year | Stock Price Target |

|---|---|

| SPOT stock forecast for 2025 | $ 831.73 |

| SPOT stock forecast for 2026 | $ 1079.45 |

| SPOT stock forecast for 2027 | $ 1288.58 |

| SPOT stock forecast for 2028 | $ 1412.98 |

| SPOT stock forecast for 2029 | $ 1754.80 |

- 2025: Expected stock price of $831.73, reflecting an 85.91% increase from the 2024 closing price of $447.38..

- 2026: Projected stock price of $1,079.45, showing a 141.22% gain from 2024.

- 2027: Estimated stock price of $1,288.58, marking a 188.10% increase over the 2024 level.

- 2028: Forecasted stock price of $1,412.98, indicating a 215.79% gain.

- 2029: Anticipated stock price of $1,754.80, representing a 292.21% rise from the 2024 closing price of $447.38.

SPOT Stock Forecast 2030, 2035, 2040, 2050

| Year | Stock Price Target |

|---|---|

| SPOT stock forecast for 2030 | $ 1916.47 |

| SPOT stock forecast for 2035 | $ 2534.75 |

| SPOT stock forecast for 2040 | $ 4880.45 |

| SPOT stock forecast for 2045 | $ 9396.89 |

| SPOT stock forecast for 2050 | $ 17616.78 |

- By 2030, our long-term analysis forecasts SPOT’s stock price reaching $1916.47, which would represent an increase of approximately 328.45% from its 2024 closing price of $447.38.

- Looking ahead to 2035, we estimate SPOT stock could reach $2534.75, showing a remarkable 466.48% return.

- By 2040, the stock is expected to rise to $4880.45, reflecting a substantial 990.71% gain.

- By 2045, SPOT could climb to $9396.89, marking an outstanding 1999.63% increase.

- Further into the future, by 2050, we forecast SPOT stock could hit $17616.78, indicating an impressive 3837.19% increase from its 2024 closing price of $447.38.

SPOT Stock Price Prediction 2025 (month-wise)

| Month | Stock Price Target |

|---|---|

| SPOT stock price prediction for March 2025 | $620.09 |

| SPOT stock price prediction for April 2025 | $645.37 |

| SPOT stock price prediction for May 2025 | $671.29 |

| SPOT stock price prediction for June 2025 | $693.46 |

| SPOT stock price prediction for July 2025 | $745.81 |

| SPOT stock price prediction for August 2025 | $774.07 |

| SPOT stock price prediction for September 2025 | $799.53 |

| SPOT stock price prediction for October 2025 | $831.73 |

| SPOT stock price prediction for November 2025 | $803.61 |

| SPOT stock price prediction for December 2025 | $786.34 |

As per our analysis of SPOT stock price, we are expecting that the prices may rise up to $831.73, offering an approximate 85.91% return on its 2024 closing price of $447.38. This represents a FANTASTIC return (ROI) for investors.

Also Read : Will your favorite payment corp. ‘VISA’ is a profitable investment in coming year? Lets find out.

Conclusion

In conclusion, Spotify Technology (NYSE: SPOT), founded in 2006, has firmly established itself as a dominant force in the global streaming industry. With a current market capitalization of $123.01 billion USD and annual revenue of $16.96 billion USD, the company continues to thrive under the leadership of major shareholder Daniel Ek, who holds approximately 16% of shares.

Having reached an all-time high of $652.63 per share, SPOT is still showing strong bullish momentum across multiple timeframes while delivering an impressive 5-year average returns of 58.92%. Based on long-term projections, Spotify’s stock could potentially reach as high as $17,616.78 by 2050, offering significant growth opportunities for forward-looking investors.

Frequently Asked Questions (FAQs)

1) Will SPOT stock price reach $2000?

As per our current analysis, we can expect the $2000 per share price of SPOT during 2032-2033.

2) Is SPOT a good stock to buy, sell or hold?

In our opinion, currently SPOT is a good stock to HOLD. If you are looking for a fresh buy, you should wait for some time because it is roaming in the resistance zone. BUT if you get a clear opportunity (i.e. clear Bullish signal) then you can consider SPOT for fresh buying also.

3) What is the SPOT stock forecast for 2030?

In 2030, we are expecting SPOT stock price to reach around $1916.47.

4) What is the SPOT stock forecast for 2050?

During 2050, we might see SPOT stock price to hit $17,616.78.

5) What is the SPOT stock forecast for 2025?

As per current market conditions, SPOT stock price could reach up to $831.73 per share in 2025.

6) What is the SPOT stock price prediction for 2026?

In 2026, we are expecting SPOT stock price to reach around $1079.45.

7) What is the SPOT stock forecast for 2027?

In 2027, we are expecting SPOT stock price to reach around $1288.58.

8) What is the SPOT stock price prediction for 2028?

In 2028, we are expecting SPOT stock price to reach around $1412.98.

9) What is the SPOT stock forecast for 2029?

In 2029, we are expecting SPOT stock price to reach around $1754.80.

10) What is the SPOT stock price prediction for 2040?

In 2040, we are expecting SPOT stock price to reach around $4880.45.

11) What is the SPOT stock price prediction for 2045?

In 2045, we are expecting SPOT stock price to reach around $9396.89.

Disclaimer : Not an Investment Advice

The content shared here in “Spotify Technology | SPOT Stock Forecast 2025-2050 with detailed analysis” is for general information only. The stock price forecasts provided here are based on current market conditions which are subject to change with respect to change in market scenario. It’s not intended as financial, investment, or professional advice. Always consult a qualified professional—whether legal, financial, or tax-related—before making any investment decisions.

I like this site because so much useful stuff on here : D.

Hello there, You’ve done an excellent job. I’ll certainly digg it and personally suggest to my friends. I’m confident they will be benefited from this website.

I conceive you have observed some very interesting points, thanks for the post.

As a Newbie, I am permanently browsing online for articles that can help me. Thank you

Definitely, what a splendid website and educative posts, I definitely will bookmark your blog.Have an awsome day!