💻 ACM Research Inc. | ACMR stock forecast 2025, 2030, 2040, 2050

👉 30 Seconds Summary 👈

ACM Research Inc. continues to be a key player in the semiconductor industry, providing specialized equipment for production. After reviewing the company’s fundamentals, technical trends, and the broader market, the stock price is projected to reach $26.19 by 2025, $84.47 by 2030, $113.64 by 2035, $132.81 by 2040, and could potentially rise to $189.52 by 2050.

ACM Research, Inc. (NASDAQ: ACMR) is a global provider of semiconductor process equipment used in the manufacturing of advanced chips. As the demand for semiconductors continues to grow in many industries like automobiles, technology and healthcare, investors are eager to know where ACMR stock price could be headed in the coming years. In this post, we’ll explore the ACMR stock forecasts 2025, 2030, 2040, and even 2050.

With the semiconductor industry rapidly evolving and new technological advancements are happening all around the world, we’ll look at key factors that could influence ACMR’s long-term growth, from industry trends and company performance to broader economic conditions.

About ACM Research Inc. (NASDAQ : ACMR)

| Company Name | ACM Research Inc. |

| Stock Exchange | NASDAQ |

| Ticker Symbol | ACMR |

| Sector | Technology (Semiconductors) |

| Headquarter | California, US |

| Founded in | 1998 |

| Major Shareholder | Hui Wang (9.31%) |

| Market Cap. | $ 1.2 billion usd |

| Revenue(2023) | $ 557.72 million usd |

| Total Assets | $ 1.49 billion usd |

| All-time high | $ 48.27 usd (Feb 16, 2021) |

| 52-week high | $ 34.40 usd (Mar 01, 2024) |

| 52-week low | $ 13.94 usd (Aug 05, 2024) |

| Peer Companies | Axcelis Technologies, Inc (ACLS), Kullicke and Soffa Industries, Inc. (KLIC), Photronics, Inc. (PLAB) |

ACM Research, Inc. is a U.S.-based company that provides specialized equipment which are used in the production of semiconductor chips. These chips are an essential components in the wide range of devices like smartphones and computers to cars and medical equipment.

ACM Research focuses on developing advanced technology that helps chip manufacturers create more efficient and powerful semiconductors. Their equipment are designed to improve the production process, making it faster and more precise, which is especially important as demand for semiconductors continues to grow in industries like tech, automotive, and healthcare.

ACMR was founded in 1998. ACMR has built its strong reputation in the global semiconductor market, with clients across the world relying on their innovative solutions. As the need for cutting-edge chips increases, ACMR is well-positioned to benefit from industry trends, making it a key player in the future of chip technology.

Also Read : Laser Photonics | LASE stock forecast 2025, 2030, 2040, 2050

Whether you’re a long-term investor or simply curious about the future of the semiconductors sector, this analysis will provide valuable insights into ACMR’s stock potential over the next several decades.

ACM Research Inc. (ACMR) Analysis | Past, Present & Future

We’ll look at both charts and key financial data to help you understand what could impact ACMR’s stock price in the short and long term. If you’re wondering about ACMR’s growth potential, keep reading to see where this stock might be headed.

ACM Research Inc. | Historical price analysis [2018-2024]

Here in the above annual percentage change chart, we can observe that ACMR share price gave continuous positive returns to the investors till 2021. In 2020, ACMR stock provided +340% returns. But after 2021, the stock price fell -72.87%. In 2023, the stock price was increased by +153.44%. Although, the overall growth of ACMR stock price is negative after the fall of 2021. It never touched the 2021’s high of $48.27.

Since, the current trend of the ACMR stock is neither positive nor negative it would be good if you wait for some time before investing into it. We have provided more detailed analysis below which can help you better your investment decision regarding ACM Research Inc.

One year chart analysis for ACMR stock forecast 2025

In one year ACMR stock price chart, we can see that after hitting its 52-week high of $34.40 the stock was in a downtrend till August 2024. Form there, it is trying to trade in sideways to up trend.

Now, from Aug, 2024, we have seen a little recovery with high volumes. As on Oct 04 and Oct 07, 2024 the stock tried to break the range with huge volumes but came back due to lack of support from bulls.

By this, we can anticipate that, the ACMR stock might trade in sideways direction for some time and then in up trend as we see increase in the demand of semiconductors. From all these analysis, we formulated the ACMR stock price prediction for 2025 below.

ACMR Stock Live chart

Time-Frame analysis of ACMR : Hourly, Daily & Weekly

To make good predictions, it’s important to consider how the company is performing, what’s happening in the market, and the overall state of the economy. For a stock like ACMR, it’s also crucial to think about how advancements in chip technology could influence its future growth.

Relying on just one method for ACMR stock forecast might not provide the full picture. By combining various trading / investing strategies and opinions, investors can get a clearer idea of ACMR’s potential for both short- and long-term success. As by a simple technical chart analysis we can observe the following –

| Time Frame | Observation |

|---|---|

View Hourly Chart (Every candle represents Nasdaq : ACMR share’s trading session of one hour. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular hour) | On hourly time-frame, we can observe that ACMR stock is trading above the 50 hour, 100 hour and 200 hour SMA but below 21 hour SMA. This indicates that the ACMR stock is in Sideways to Uptrend for short term. |

View Daily Chart (Every candle represents Nasdaq : ACMR share’s trading session of one day. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular day) | On daily time-frame, we can observe that ACMR stock is trading ABOVE 21 Day SMA, 50 Day, 100 Day & 200 Day SMA. This is the sign of clear Bullishness in medium term. |

View Weekly Chart (Every candle represents Nasdaq : ACMR stock’s trading session of one week. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular week) | On the weekly time-frame ACMR stock is trading above 21 weeks, 50 weeks, 100 weeks & 200 weeks SMA. This indicates that ACMR stock has a clear BULLISH sentiment, if we look at it from a very long term perspective. |

Since there is a BULLISH perspective shown by SMAs in Hourly, Daily as well as Weekly time-frame. This can be a really positive indication for a trader/investor. BUT By observing the directions of the SMAs, we can find that ACMR’s direction is always POSITIVE in Hourly & Daily time-frame while while NEUTRAL in Weekly Timeframe.

Also the distance between the current trading price and these SMAs is very high. For example, on Daily time-frame, the current price of ACMR stock is 29.48 (as on March, 19 2025) while 50 D SMA has a value of ~$23. Those trader who trade on the basis of SMAs also consider the gap between current prices & SMA readings.

Dow Jones, NASDAQ & ACMR : A comparative Analysis

Check out the comparative year on year returns of Dow Jones, Nasdaq and ACMR. Here, we are showing the returns by comparing them on closing basis –

| Year | Dow Jones | Nasdaq | ACMR |

|---|---|---|---|

| 2024 | +12.88% | +28.64% | -22.72% |

| 2023 | +13.70% | +43.42% | +153.44% |

| 2022 | -8.78% | -33.10% | -72.87% |

| 2021 | +18.73% | +21.39% | +4.95% |

| 2020 | +7.25% | +43.64% | +340.38% |

Also Read : CrowdStrike | CRWD Stock Price Prediction 2025, 2030, 2040, 2050

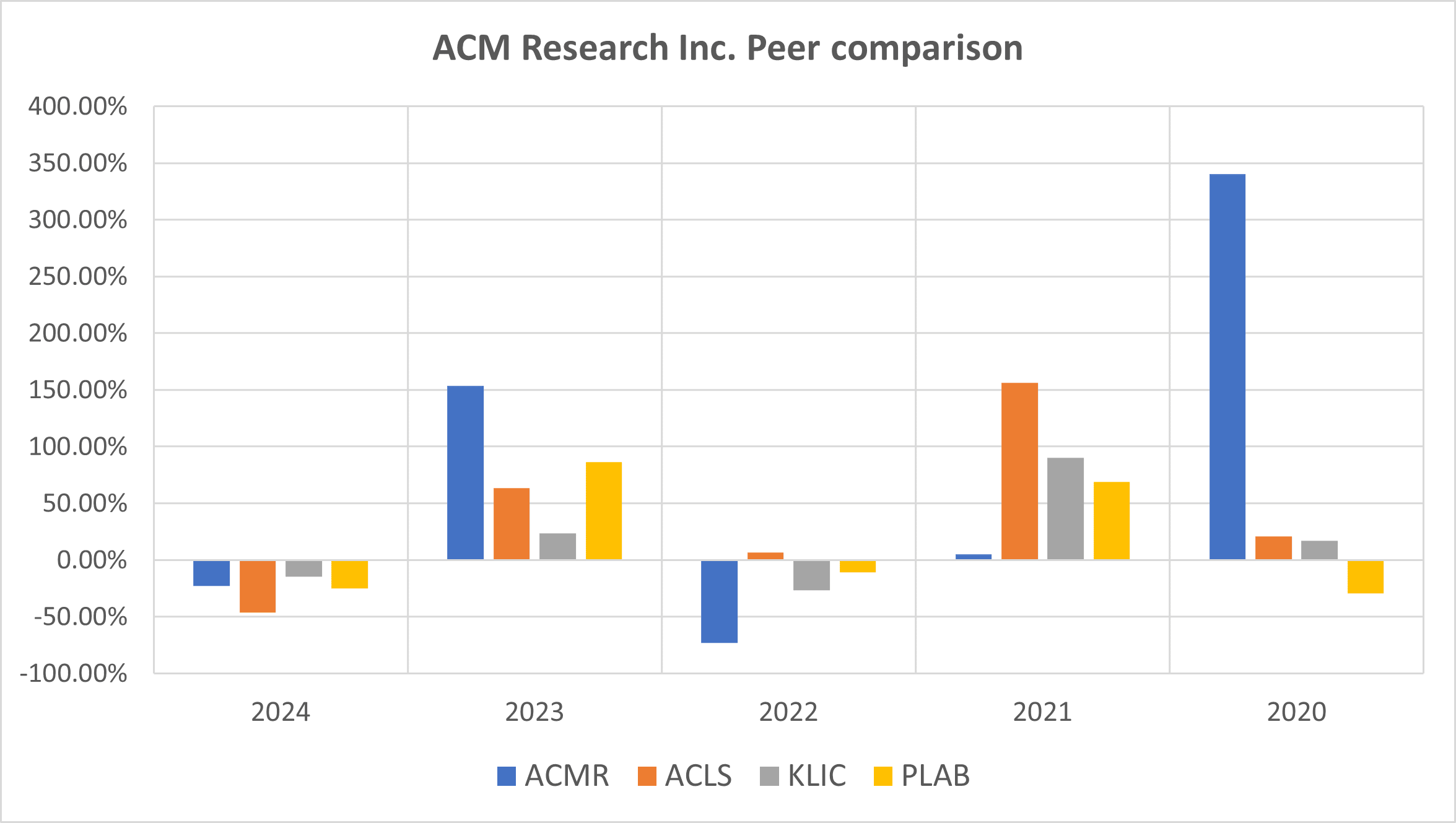

ACMR Peer Comparison / Competitors Analysis

We will compare ACM Research Inc. (Nasdaq : ACMR) to its top competitors. We will see how its peer companies performed year-on-year . Below is the comparative table of Axcelis Technologies, Inc (ACLS), Kulicke and Soffa Industries, Inc. (KLIC), Photronics, Inc. (PLAB)‘s returns from 2020 to 2024 based on CLOSING Prices.

| Year | ACMR | ACLS | KLIC | PLAB |

|---|---|---|---|---|

| 2024 | -22.72% | -46.13% | -14.73% | -24.90% |

| 2023 | +153.44% | +63.42% | +23.63% | +86.39% |

| 2022 | -72.87% | +6.44% | -26.89% | -10.72% |

| 2021 | +4.95% | +156.04% | +90.32% | +68.91% |

| 2020 | +340.38% | +20.85% | +16.95% | -29.19% |

| Average Returns | +80.63% | +40.12% | +17.85% | +18.09% |

Here we can observe that ACMR’s performance is really commendable when compared to its peer companies, if we look at the 5-year average returns.

ACMR Stock Forecast : Short & Long Term

ACMR stock forecast 2025, 2026, 2027, 2028, 2029

| Year | Stock Price Target |

|---|---|

| ACMR stock price forecast for 2025 | $ 26.19 |

| ACMR stock price forecast for 2026 | $ 36.85 |

| ACMR stock price forecast for 2027 | $ 45.04 |

| ACMR stock price forecast for 2028 | $ 56.12 |

| ACMR stock price forecast for 2029 | $ 72.23 |

Based on the above predictions, ACM Research Inc. (NASDAQ: ACMR) stock could see decent growth in the coming years. Starting from its current price of $19.09 (as of January 30, 2025), here’s a breakdown of the expected percentage increases for ACMR stock forecast each year leading up to 2029:

- 2025: The stock price is expected to reach $26.19, reflecting a 37.19% increase.

- 2026: The estimated price is $36.85, marking a 93.03% rise.

- 2027: The forecast price is $45.04, showing a 135.94% gain.

- 2028: The anticipated price is $56.12, indicating a 193.98% increase.

- 2029: The stock is expected to hit $72.23, representing a massive 278.37% surge compared to today’s price of $19.09.

ACMR stock forecast 2030, 2035, 2040, 2050

| Year | Stock Price Target |

|---|---|

| ACMR stock price forecast for 2030 | $ 84.47 |

| ACMR stock price forecast for 2035 | $ 113.64 |

| ACMR stock price forecast for 2040 | $ 132.81 |

| ACMR stock price forecast for 2050 | $ 189.52 |

Looking ahead, ACMR stock is expected to see steady recovery and then growth over the coming decades, offering good returns for long-term investors. Based on the current price of $19.09 (as of January 30, 2025), here are the projected percentage gains for ACMR stock forecast:

- By 2030: The stock price could reach $84.47, marking a 342.48% increase.

- By 2035: It could rise to $113.64, reflecting a 495.29% return.

- By 2040: The stock is expected to climb to $132.81, showing a 595.70% gain.

- By 2050: ACMR stock price could hit $189.52, indicating an impressive 892.77% increase from today’s price of $19.09.

These projections highlight ACMR’s long-term growth potential, but these forecast come with associated risks. Future market conditions and industry developments will play a crucial role in shaping the actual performance of the stock.

Also Read : Nvidia Share Price Prediction 2025 and beyond | Will omniverse & VR succeed ?

ACMR stock forecast 2025 (month-wise)

| Month | Stock Price Target |

|---|---|

| January 2025 | 20.47 |

| February 2025 | 21.53 |

| March 2025 | 22.84 |

| April 2025 | 24.08 |

| May 2025 | 24.97 |

| June 2025 | 25.51 |

| July 2025 | 26.19 |

| August 2025 | 25.93 |

| September 2025 | 25.61 |

| October 2025 | 26.06 |

| November 2025 | 25.13 |

| December 2025 | 24.78 |

As per our analysis of ACMR stock price, we are expecting that the prices may rise up to $26.19 during 2025, offering an approximate 37.19% return on its current price of $19.09 (as of January 30, 2025). This represents a GOOD return for long term investors.

After the fall in early to mid 2024, we observed a slow but steady downtrend in ACMR stock price. However, the stock tried to rise many times, but it came down to a new low every time. Now in the end of 2024, it is trying to change its trend, with volumes, which can be good sign. Want to know more about the company? Keep reading, we also have glimpse of our analysis that explains about how we get these forecasts.

Also Read : MSFT Stock Prediction 2025 to 2050 : Should You Worry?

Conclusion

For very long-term investors, ACM Research Inc. (NASDAQ: ACMR) offers a promising opportunity. We can see that only a few companies are producing such specialized equipment. ACMR stands out as a solid choice for those who are seeking steady, long-term growth opportunity. We hope this article ‘ACM Research Inc. | ACMR Stock Forecast 2025, 2030, 2040, 2050’ has provided valuable insights. Make sure to check out the videos and FAQs section for more in-depth information and advice.

Getting advice from a trusted financial adviser or stockbroker can help you deepen your understanding of the market and create a strong investment strategy. Staying informed about the latest news in the semiconductor industry can also provide helpful insights to guide your investment decisions for ACM Research Inc.

Handpicked for you (MUST WATCH)

Frequently Asked Questions (FAQs)

1) Is ACMR a good stock to buy?

As per our analysts, ACMR stock is neither a BUY nor a SELL right now. As in Oct 2024, ACMR stock is trying to stabilize itself and if it succeed in doing this, it can become a STRONG BUY. If you want to invest in ACMR, wait for some time and see if it starts an uptrend, then only you should invest in it.

2) What is the stock price prediction for ACMR in 2025?

In 2025, we can see the ACMR stock trading near $26 per share.

3) Who are the institutional shareholders of ACMR?

The largest three institutional shareholders include Vanguard Group Inc, BlackRock Inc. and VTSMX.

4) What is the stock price prediction for ACMR in 2030?

By 2030, the ACMR stock price could reach around $84.47 per share which is a return of 342% on today’s price of $19.09 (Jan 30, 2025).

5) What is the ACMR stock forecast for 2040?

In 2040, the ACMR stock price could reach up to $132.81 per share.

6) What is the ACMR stock forecast for 2050?

By 2050, the ACMR stock price could reach around $189.52 per share, which is a return of 892.77% increase from today’s price of $19.09 (Jan 30, 2025).

Disclaimer : Not an Investment Advice

The content shared in the above article “ACM Research Inc. | ACMR stock forecast 2025, 2030, 2040 and 2050” is for general information only. It’s not intended as financial, investment, or professional advice. Always consult a qualified professional—whether legal, financial, or tax-related—before making any investment decisions.

3 Comments