🚀 Broadcom stock prediction 2025 to 2030, 2040, 2050 | AVGO stock price forecast

👉 30 Seconds Summary 👈

Broadcom Inc. (Nasdaq : AVGO)‘s stock has the potential for steady, long-term growth, particularly after its stock split. Based on our analysis, we anticipate Broadcom’s stock price to reach $226 in 2025, $579 by 2030, climb to $913 by 2035, rise to $1,574 by 2040, and hit $2,379 by 2050. While growth may not be rapid, the company’s solid foundation and continued innovation point to a promising future for investors.

When it comes to long-term investing, technology stocks like Broadcom Inc. (Nasdaq : AVGO) are always on the watchlist of many traders and investors. As one of the leading companies in semiconductor and software, Broadcom has consistently shown growth potential, making it a key player in the tech industry.

In this blog “Broadcom stock prediction 2025 to 2050“, we’ll dive into Broadcom’s stock price predictions by analyzing trends, market conditions, and the factors that could influence its future performance. By evaluating Broadcom’s technological advancements, financial health, and evolving industry demands, we aim to provide a comprehensive outlook for investors looking to invest into its long-term growth.

About Broadcom Inc. | Company Information

| Company Name | Broadcom Inc. |

| Stock Exchange | Nasdaq |

| Ticker Symbol | AVGO |

| Sector | Technology (Semiconductor) |

| Headquarter | Palo Alto, California, US |

| Founded in | 1961 |

| Major Shareholder | Vanguard (10.03%) |

| Market Cap. | $ 868.51 billion usd |

| Revenue(2023) | $ 35.83 billion usd |

| Total Assets | $ 72.87 billion usd |

| All-time high closing price | $ 186.42 usd |

| 52-week low | $ 186.42 usd |

| 52-week high | $ 81.17 usd |

| Peer Companies | Arm Holdings Plc (ARM), Qualcomm Inc. (QCOM), Nvidia Corporation (NVDA), Taiwan Semiconductor Manufacturing Company Ltd. (TSM), Advanced Micro Devices Inc. (AMD) |

Broadcom Inc. is a leading global technology company that designs / manufactures, and supplies a wide range of semiconductor and software. Approximately 79% of the company’s revenue is generated from its semiconductor products, while the remaining 21% comes from its infrastructure software and security solutions. Broadcom’s semiconductor are used in variety of industries, including data centers, networking, broadband, wireless, storage, and industrial markets.

Broadcom Inc was founded in 1961 & it went public in 2009 and is listed on NASDAQ under the ticker symbol “AVGO”. Previously, Broadcom was acquired by Avago Technologies in January 2016. The company was initially known as Broadcom Limited, but in November 2017, it was renamed as Broadcom Inc.

Broadcom’s ability to innovate new technologies and along with its strategic acquisitions and growing market share, it has been positioned as a key player in the global semiconductor and enterprise software markets. With a market capitalization of $868.51 billion, Broadcom continues to be a driving force in future of IT technology, focusing on high-growth areas such as cloud computing, networking, and data centers.

Broadcom Inc. (AVGO) Analysis | Past, Present & Future

We’ll look at both technical and financial analysis to help you understand what could impact AVGO stock price in the short and long term. If you’re wondering about AVGO’s growth potential, keep reading to see where this stock might be headed.

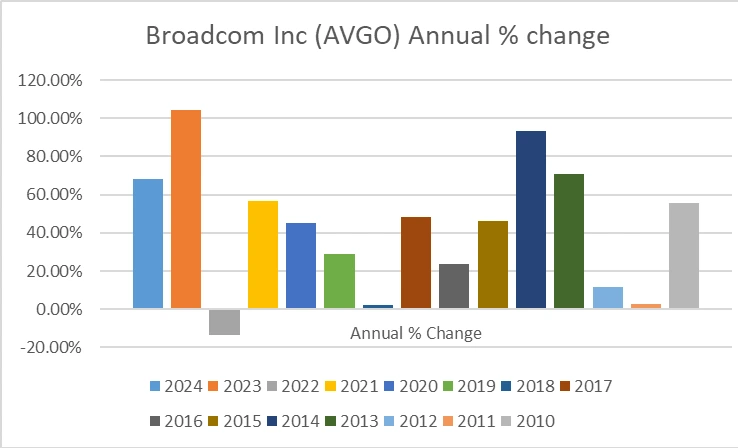

Broadcom Inc. (AVGO) historical price data

In the above graph, we can clearly see that Broadcom Inc. (AVGO) stock gave negative return to its investors only once, i.e. in year 2022 & in rest of its trading history, it assured a positive return year on year. That is the reason, in our Broadcom stock forecast, we are projecting a positive outcome of investor’s money if they choose to invest in this company.

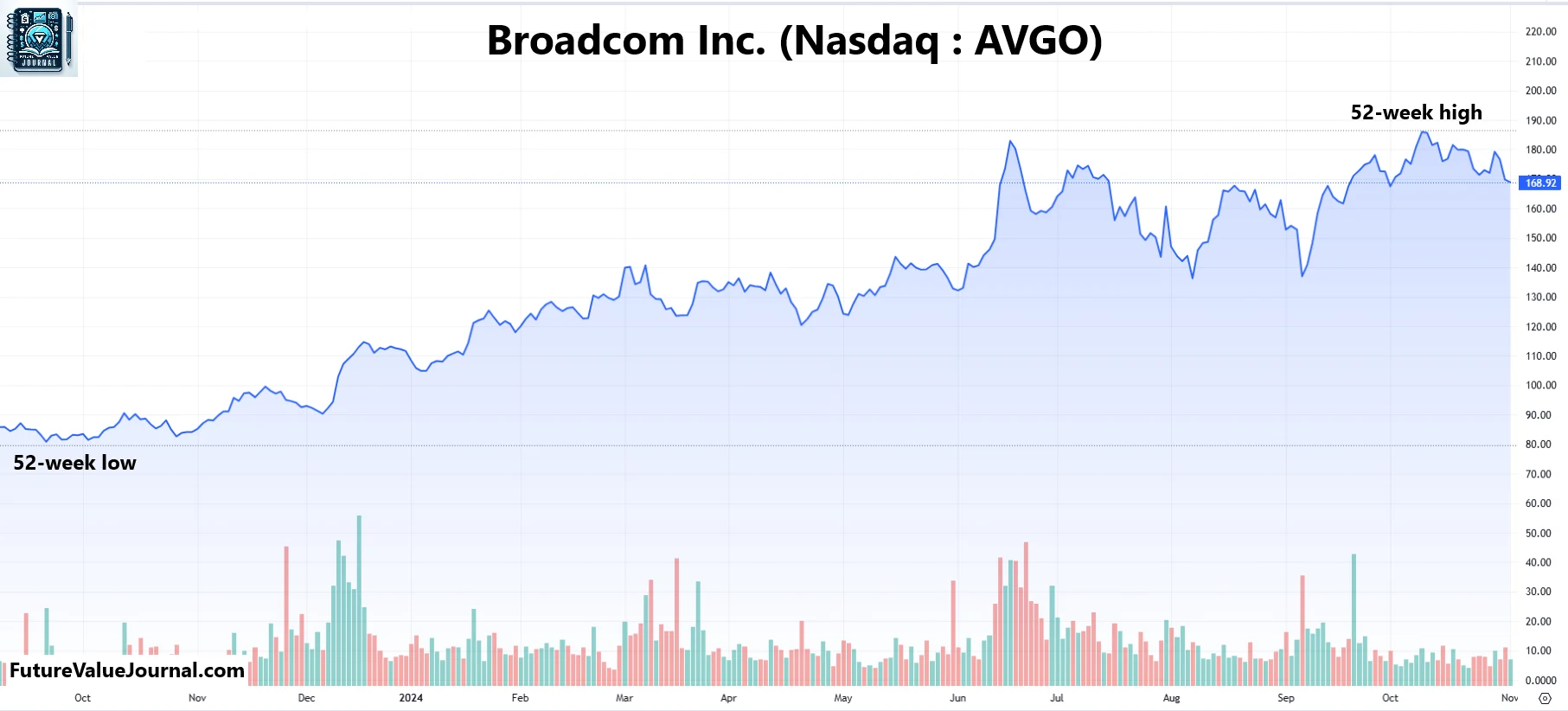

One year Chart Analysis for Broadcom Stock Prediction 2025

While looking at Broadcom’s 1-year chart, we can clearly see that, prior to its split (10 for 1) on July12, 2024, the stock was trending slightly UP.

From Jan to March, it traded in an up trend & then AVGO stock started going sideways. Again from May 24, it started trending up, touching its All-Time High.

After adjusting the Broadcom’s stock split, we can determine that it is trading on its highest side. On the basis of that, we prepared monthly Broadcom stock price predictions for 2025.

Broadcom Stock Live Chart

Above is the live chart for AVGO. Look at the current prices and compare it will the targets we have provided below.

Time-Frame analysis of Broadcom Inc. : Hourly, Daily & Weekly

By analyzing a Broadcom stock price through a timeframe chart, we can gather some key insights that will assist us in determining the final Broadcom stock forecast : –

| Time Frame | Observation |

|---|---|

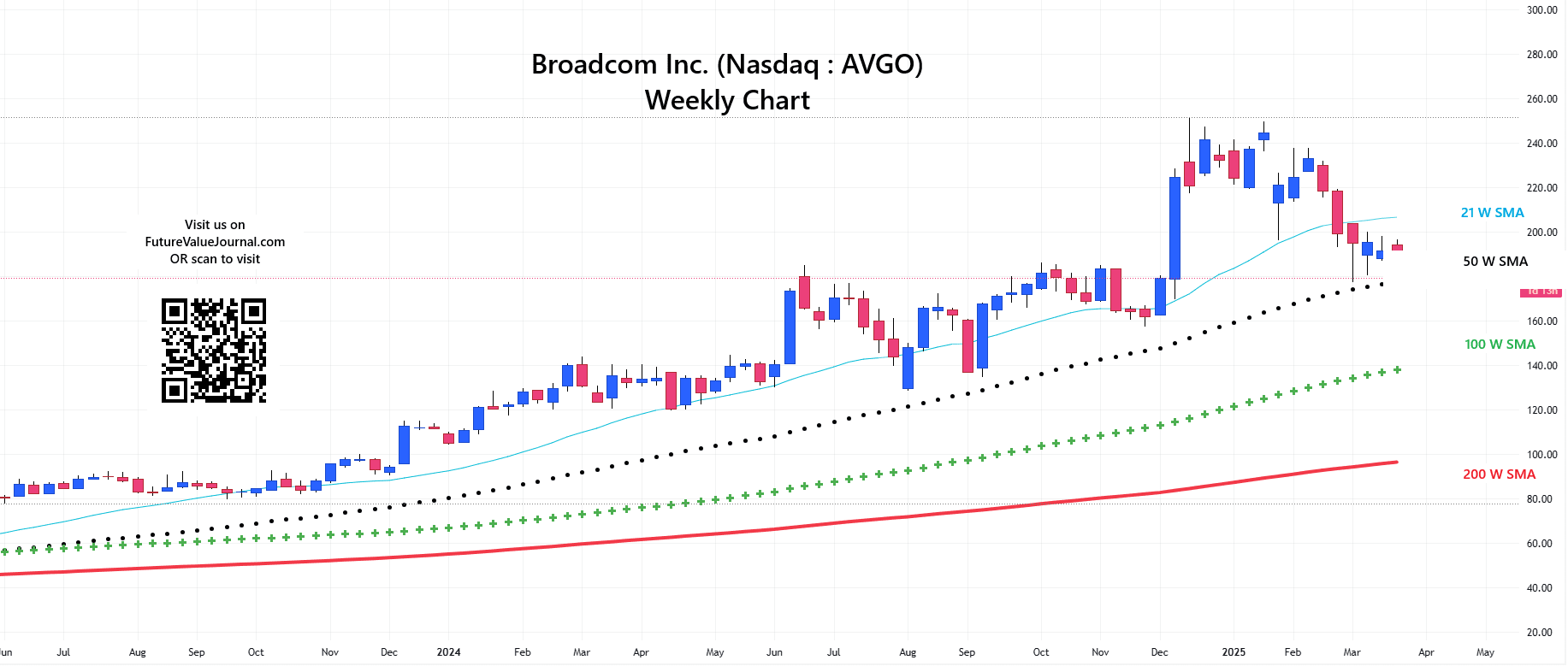

View Weekly Chart (Every candle represents Nasdaq : AVGO share’s trading session of one WEEK. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular week) | On the weekly time-frame AVGO stock is trading BELOW 21 weeks BUT ABOVE 50 weeks, 100 weeks & 200 weeks SMAs. This indicates that AVGO stock has a slight Bearish sentiment but clear Bullish trend in long term.. |

View Daily Chart (Every candle represents Nasdaq : AVGO share’s trading session of one day. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular day) | On daily time-frame, we can observe that AVGO stock is trading BELOW 21 Day SMA, 50 Day, 100 Day & 200 Day SMA. This is the sign of Bearishness in medium term. |

View Hourly Chart (Every candle represents Nasdaq : AVGO stock’s trading session of one HOUR. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular hour) | On hourly time-frame, we can observe that AVGO stock is trading BELOW all the 21 hour, 50 hour, 100 hour & 200 hour. This indicates that the AVGO stock is in Sideways to Downtrend for short term. |

Since there is a NEGATIVE perspective shown by SMAs in Hourly & Daily time-frame while a SIDEWAYS to POSITIVE perspective in Weekly time-frames, We can have a clear picture about the trend only if we observe SMA directions.

By observing the directions of SMAs, we can find that AVGO’s direction is always NEUTRAL to POSITIVE in Weekly & Daily time-frame while NEUTRAL TO POSITIVE in Hourly Timeframe.

Dow Jones, NASDAQ & Broadcom Inc. : A comparative Analysis

Check out the comparative year on year returns of Dow Jones, Nasdaq and AVGO. Here, we are showing the returns by comparing them on closing basis –

| Year | Dow Jones | Nasdaq | AVGO |

|---|---|---|---|

| 2024 | +12.88% | +28.64% | +107.70% |

| 2023 | +13.70% | +43.42% | +99.64% |

| 2022 | -8.78% | -33.10% | -15.97% |

| 2021 | +18.73% | +21.39% | +51.97% |

| 2020 | +7.25% | +43.64% | +34.84% |

Also Read : CrowdStrike | CRWD Stock Price Prediction 2025, 2030, 2040, 2050

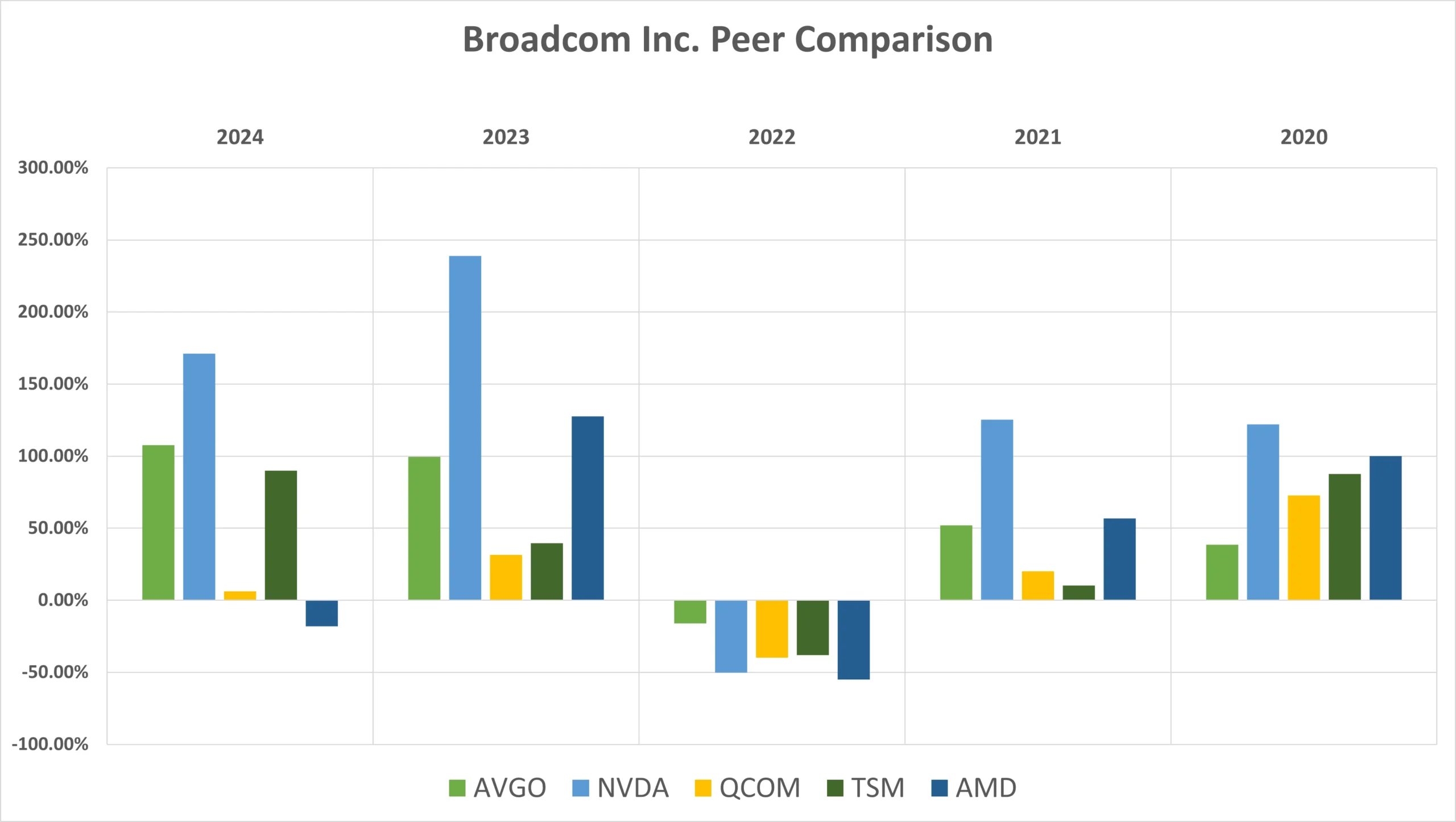

AVGO Peer Comparison / Competitors Analysis

We will compare Broadcom Inc. (Nasdaq : AVGO) to its top competitors. We will see how its peer companies performed year-on-year . Below is the comparative table of Qualcomm Inc. (QCOM), Nvidia Corporation (NVDA), Taiwan Semiconductor Manufacturing Company Ltd. (TSM), Advanced Micro Devices Inc. (AMD)‘s returns from 2020 to 2024 based on CLOSING Prices.

| Year | AVGO | NVDA | QCOM | TSM | AMD |

|---|---|---|---|---|---|

| 2024 | +107.70% | +171.17% | +6.22% | +89.89% | -18.06% |

| 2023 | +99.64% | +238.87% | +31.55% | +39.62% | +127.59% |

| 2022 | -15.97% | -50.31% | -39.88% | -38.08% | -54.99% |

| 2021 | +51.97% | +125.29% | +20.04% | +10.34% | +56.91% |

| 2020 | +38.55% | +121.93% | +72.66% | +87.68% | +99.98% |

| Average Returns | +56.37% | +121.39% | +18.12% | +37.89% | +42.28% |

Here we can observe that AVGO stocks’ performance is at par when compared to its peer companies if we look at the 5-year average returns. We didn’t considered Arm Holdings Plc (ARM) for this comparison as it got listed in 2023.

Broadcom Stock Prediction : Short & Long Term

Broadcom Stock Prediction 2025, 2026, 2027, 2028, 2029

| Year | AVGO Price Target |

|---|---|

| Broadcom Stock prediction for 2025 | $ 226.41 |

| Broadcom Stock prediction for 2026 | $ 306.67 |

| Broadcom Stock prediction for 2027 | $ 379.13 |

| Broadcom Stock prediction for 2028 | $ 427.22 |

| Broadcom Stock prediction for 2029 | $ 482.37 |

- In 2025, we expect Broadcom’s stock price to reach around $226.41, which would be a 21.87% increase from its current price of $185.73 as of March 26, 2025.

- Looking ahead to 2026, we estimate that the AVGO stock price could rise to $306.67, a 65.12% gain.

- By 2027, we predict the stock could reach $379.13, representing a 104.08% increase.

- Further down the line, in 2028, we anticipate Broadcom’s stock could climb to $427.22, reflecting a 130.07% increase.

- In the long term, we project that the stock could reach $482.37 by 2029, which would mark a significant 159.65% surge from today’s price of $185.73.

Broadcom Stock Prediction 2030, 2035, 2040, 2050

| Year | AVGO Price Target |

|---|---|

| Broadcom Stock Forecast for 2030 | $ 579.17 |

| Broadcom Stock Forecast for 2035 | $ 913.43 |

| Broadcom Stock Forecast for 2040 | $ 1574.34 |

| Broadcom Stock Forecast for 2050 | $ 2379.58 |

- Our long-term analysis forecasts Broadcom stock prices reaching $579.17 by 2030, which would represent a significant 2113.83% increase from today’s price of $185.73.

- Looking ahead to 2035, we estimate Broadcom stock prices could reach $913.43, which would represent a remarkable 391.80% returns.

- By 2040, we expect the stock to rise to $1574.34, reflecting a substantial 747.64% gain from the current price.

- Further into the future, in 2050 we anticipate Broadcom stock prices could hit $2379.58, indicating an impressive 1,181.20% increase from its current price.

While it’s challenging to predict the full extent of Broadcom stock prices future growth, the company holds strong potential, particularly with the rising adoption of technology in our daily lives. As Broadcom continues to manufacture and innovate in the semiconductor manufacturing sector, it stands to benefit from the growing demand for new products and devices in the coming years. Though current data provides only a snapshot of Broadcom’s potential, its unique position in the market suggests promising growth as IT technology reaches new heights.

Also Read : CrowdStrike | CRWD Stock Price Prediction 2025 – 2050

Broadcom Stock Prediction 2025 (month-wise)

| Month | AVGO Price Target |

|---|---|

| AVGO stock price prediction for January 2025 | 195.16 |

| AVGO stock price prediction for February 2025 | 196.37 |

| AVGO stock price prediction for March 2025 | 199.73 |

| AVGO stock price prediction for April 2025 | 203.94 |

| AVGO stock price prediction for May 2025 | 206.23 |

| AVGO stock price prediction for June 2025 | 209.78 |

| AVGO stock price prediction for July 2025 | 215.09 |

| AVGO stock price prediction for August 2025 | 218.34 |

| AVGO stock price prediction for September 2025 | 223.89 |

| AVGO stock price prediction for October 2025 | 226.41 |

| AVGO stock price prediction for November 2025 | 225.78 |

| AVGO stock price prediction for December 2025 | 224.19 |

As per our analysis of Broadcom stock, we are expecting that the prices may rise up to $226.41, offering an approximate 21.87% return on its current price of $185.73 as of March 26, 2025. This represents a decent return (ROI) for investors.

From the beginning of 2025, we can expect a slow but steady up move in AVGO stock prices, but during mid-2025, it may turn to slow or no gain. In October – November 2025, we can see its peak touching $226.41 per share and after that, we expect a little decline, which is a trend while analyzing previous charts.

Also Read : Microsoft Stock Prediction 2025 to 2050 : Should You Worry?

Conclusion

Broadcom Inc (Nasdaq : AVGO) is a 63-year-old company (founded in 1961) with a market value of $868.51 billion USD. Its major shareholder is Vanguard, showing strong investor confidence. Over the last five years, Broadcom has given an average return of 56.37%, making it a high-performing stock. On the daily charts, the stock looks bearish, but on the weekly charts, it shows a bullish trend, suggesting long-term growth potential. As Broadcom continues to lead in the semiconductor and networking industry, its stock forecast for 2025 to 2050 looks promising for long-term investors.

Handpicked for you (MUST WATCH)

Frequently asked questions (FAQs)

1) What is Broadcom stock prediction for 2025?

We anticipate Broadcom stock price to rise to around $226 in 2025, which is nearly 22% return on the current price of $185.73

2) Will Broadcom stock reach $2000?

Yes, Broadcom stock price could reach $2000 between 2045-0050. Although it seems a long shot, but if Broadcom continue to innovate new techs in semiconductors, it will continue to grow.

3) Is Broadcom a good stock to buy, sell or hold?

Broadcom is a very good stock to keep in your portfolio. As per our analysis it looks like a STRONG BUY for those who are keen to invest in Technology stocks.

4) What is Broadcom stock forecast for 2030?

During 2030, we are expecting AVGO stock price to trade around $580.

5) What is Broadcom stock prediction for 2050?

In 2050, we can easily see AVGO stock price to hit $2379 if it goes steadily up as per current trends.

6) When did Broadcom stock split?

Broadcom stock spitted on July 12, 2024. Before splitting in 10 for 1 shares, it was trading around $1650.

7) Is Broadcom a long term investment?

Yes, Broadcom Inc is good for a long term investment as per our analysis.

8) Who owns the most Broadcom shares?

Vanguard owns around 10% of Broadcom Inc. shares.

9) Does Broadcom pay dividends?

Yes, Broadcom pay dividends to its investors. Although, the declaration and payments of dividends is always remains subject to approval of its Board of Directors.

Disclaimer : Not an Investment Advice

The content shared here in “🚀 Broadcom stock prediction 2025 to 2030, 2040, 2050 | AVGO stock price forecast” is for general information only. It’s not intended as financial, investment, or professional advice. Always consult a qualified professional—whether legal, financial, or tax-related—before making any investment decisions.

I think the admin of this site is genuinely working hard in support

of his site, since here every information is quality based information.