🛡️ CRWD | CrowdStrike Stock Price Prediction 2025, 2030, 2040, 2050

👉 30 Seconds Summary 👈

CrowdStrike Holdings Inc., a leading American cybersecurity company based in Austin, Texas, specializes in endpoint security, threat intelligence, and responding to cyberattacks. Based on our analysis, the CRWD stock price is projected to reach $413.88 by 2025, $540.78 by 2030, $746.46 by 2035, $969.66 by 2040, and an impressive $1831.34 by 2050, making it an attractive choice for long-term investors.

Over the years, CrowdStrike has been involved in investigating several major cyber incidents, including the 2014 Sony Pictures hack and the 2016 Democratic National Committee (DNC) email leak. In this article “CrowdStrike Stock Price Prediction for 2025, 2030, 2040, 2050”, we will use both positive as well as negative approach while estimating its future value.

However, on July 19th, 2024, the company faced significant backlash after releasing a faulty update to its security software. This glitch caused widespread computer outages, disrupting key services like air travel, banking, and broadcasting across the globe, raising concerns about the company’s oversight in critical cybersecurity operations.

A recent IDC white paper, titled “The Business Value of the CrowdStrike Falcon XDR Platform,” highlights how the Falcon platform is revolutionizing cybersecurity. For every $1 invested, companies see a $6 return. It also helps teams detect 96% more threats in half the time and conduct investigations 66% faster compared to previous tools, ultimately preventing breaches while saving valuable time and resources.

About CrowdStrike Holdings Inc. | Company Information

| Company Name | CrowdStrike Holdings Inc. |

| Stock Exchanges | Nasdaq |

| Ticker Symbol | CRWD |

| Sector | Technology |

| Industry | Information Security |

| Headquarter | Austin, Texas, United States |

| Founded in | 2011 |

| Founder | George Kurtz, Dmitri Alperovitch, Gregg Marston |

| Market Cap. (2024) | $62.35 billion |

| Total Assets(2024) | $6.67 billion |

| Peer Companies | SentinelOne Inc (NYSE), Microsoft Corp. (MSFT), Fortinet Inc (FTNT), Cisco Systems Inc (CSCO), BlackBerry Ltd. (BB), Broadcom Inc. (AVGO) |

CrowdStrike Holdings, Inc. delivers a wide range of cybersecurity solutions aimed at preventing digital intrusions. Their cloud-based services protect everything from endpoints and cloud workloads to identities and data. They also offer threat intelligence, managed security services, IT operations management, threat hunting, Zero Trust identity protection, and log management, serving customers worldwide. It is founded on November 7, 2011, by George P. Kurtz, Gregg Marston, and Dmitri Alperovitch.

CrowdStrike Holdings Inc. (CRWD ) Analysis | Past, Present & Future

We’ll look at both charts and key financial data to help you understand what could impact CRWD’s stock price in the short and long term. If you’re wondering about CrowdStrike Holdings’ growth potential, keep reading to see where this stock might be headed.

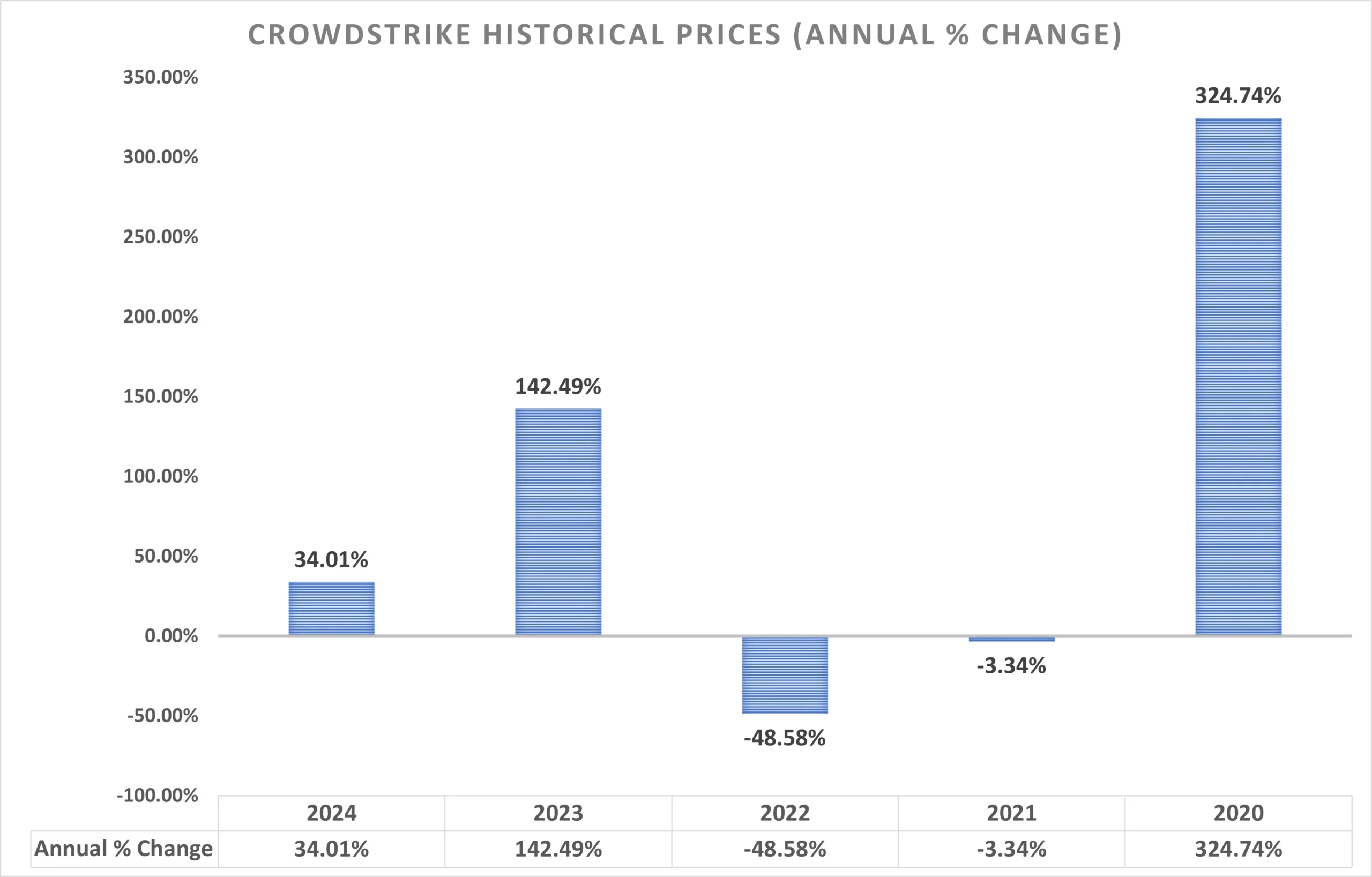

CrowdStrike Historical Price [2020-2024]

Approach to CrowdStrike Stock Price Prediction

Stock price forecasting uses different approaches, including technical and fundamental analysis, along with expert opinions and current market analysis. When evaluating a price prediction, it’s important to understand the sector, the company’s performance, and broader economic trends.

Relying on a single factor usually doesn’t give an accurate picture for predicting stock movements or creating a strong investment plan. But by combining multiple analysis tools with expert insights, investors can get a clearer view of a stock’s short- and long-term potential. Working with a reliable stockbroker can also enhance your market understanding and help shape a successful investment strategy. For CrowdStrike stock price prediction, we used a mixed approach to provide the most accurate targets.

As we can clearly see in the above table, $398.33 is the All-Time High for CrowdStrike share which is also the 52-week high. Since, due to the advancements in various internet based technologies, we are expective more rise in the Crowdstrike’s stock price in the coming years.

Also Read : DJT Share Price Prediction for 2025, 2030, 2040, 2050

CrowdStrike One year chart analysis

In CrowdStrike’s 1 year chart, we can clearly see that it came to the same price of ~$280 as it was in January 2024.

CrowdStrike stock price showed very high volatility from June to August 2024 where it rallied till $400 to come down to ~$220.

Although, due of its strong fundamentals, it came back to $280 as on 01.10.2024. Here as we look closely to the chart, we can se a slight upside trend in Crowdstrike stock.

Time-Frame analysis of CRWD : Hourly, Daily & Weekly

By analyzing a Nvidia stock price through a timeframe chart, we can gather some key insights that will assist us in determining the final CrowdStrike stock price predictions : –

| Time Frame | Observation |

|---|---|

View Hourly Chart (Every candle represents Nasdaq : CRWD share’s trading session of one hour. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular hour) | On hourly time-frame, we can observe that CrowdStrike stock is trading below the 21 hour, 50 hour, 100 hour and 200 hour SMA. This indicates that the CRWD stock is in Sideways to Downtrend for short term. |

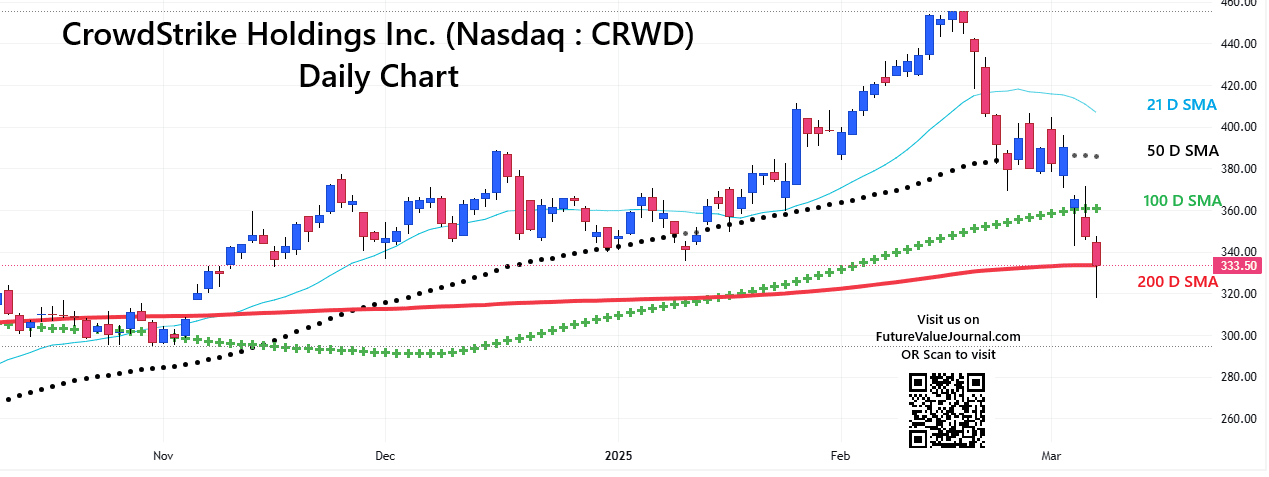

View Daily Chart (Every candle represents Nasdaq : CRWD share’s trading session of one day. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular day) | On daily time-frame, we can observe that CrowdStrike stock is trading BELOW 21 Day SMA, 50 Day, 100 Day & 200 Day SMA. This is the sign of Bearishness in medium term. |

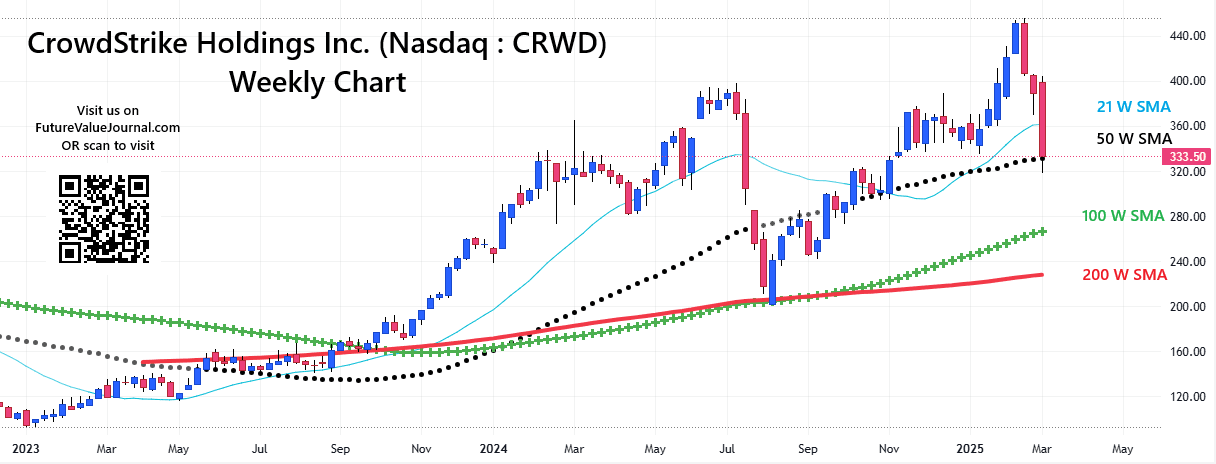

View Weekly Chart (Every candle represents Nasdaq : CRWD stock’s trading session of one week. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular week) | On the weekly time-frame CrowdStrike stock is trading below 21 weeks but Above 50 weeks, 100 weeks & 200 weeks SMA. This indicates that CRWD stock has a clear BULLISH sentiment, if we look at it from a very long term perspective. |

Since there is a BULLISH perspective shown by SMAs in Weekly time-frame while a BEARISH perspective in Hourly & Daily time-frames. By observing the directions of the SMAs, we can find that CRWD’s direction is always POSITIVE in Weekly time-frame while NEGATIVE in Hourly & Daily Timeframe.

Dow Jones, NASDAQ & CrowdStrike Holdings: A comparative Analysis

Check out the comparative year on year returns of Dow Jones, Nasdaq and CRWD. Here, we are showing the returns by comparing them on closing basis –

| Year | Dow Jones | Nasdaq | CRWD |

|---|---|---|---|

| 2024 | +12.88% | +28.64% | +34.01% |

| 2023 | +13.70% | +43.42% | +142.49% |

| 2022 | -8.78% | -33.10% | -48.58% |

| 2021 | +18.73% | +21.39% | -3.34% |

| 2020 | +7.25% | +43.64% | +324.74% |

Also Read : META Stock Price Prediction : what to expect in 2025 ?

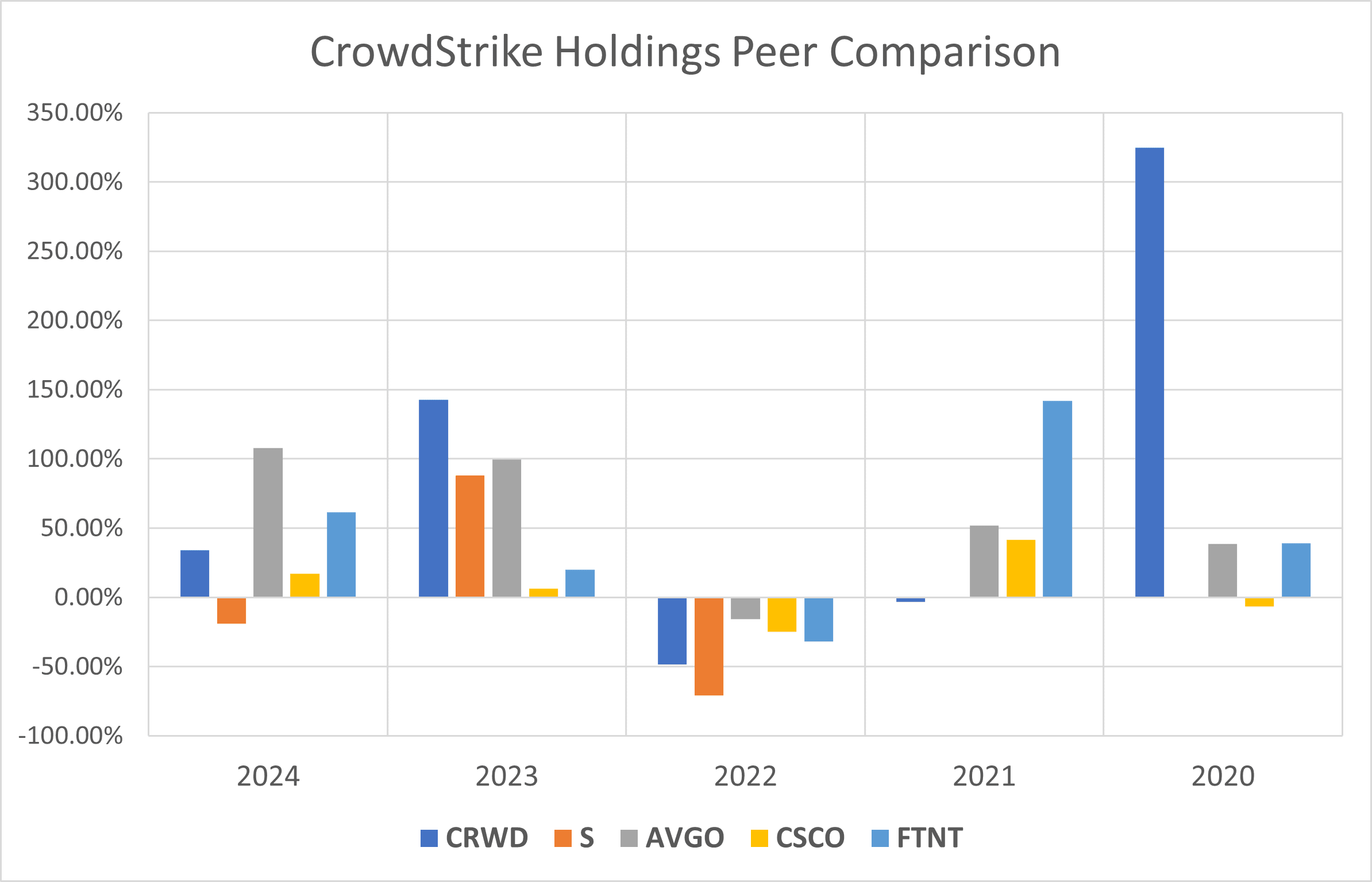

CrowdStrike Holdings Peer Comparison / Competitors Analysis

We will compare CrowdStrike Holdings Inc (Nasdaq : CRWD) to its top competitors. We will see how its peer companies performed year-on-year . Below is the comparative table of SentinelOne Inc (S), Fortinet Inc (FTNT), Cisco Systems Inc (CSCO), Broadcom Inc. (AVGO)s returns from 2020 to 2024 based on CLOSING Prices.

| Year | CRWD | S | AVGO | CSCO | FTNT |

|---|---|---|---|---|---|

| 2024 | +34.01% | -19.10% | +107.70% | +17.18% | +61.42% |

| 2023 | +142.49% | +88.07% | +99.64% | +6.05% | +19.72% |

| 2022 | -48.58% | -71.10% | -15.97% | -24.82% | -31.98% |

| 2021 | -3.34% | Listing year | +51.97% | +41.61% | +141.97% |

| 2020 | +324.74% | – | +38.55% | -6.69% | +39.13% |

| Average Returns | +89.87% | -0.71% | +56.38% | +6.66% | +46.05% |

Here we can observe that CRWD’s performance is really commendable when compared to its peer companies if we look at the 5-year average returns.

CrowdStrike Stock Price Prediction : Short & Long Term

CrowdStrike Stock Price Prediction 2025, 2026, 2027, 2028, 2029

| Year | CRWD Price Target |

| 2025 | $413.88 |

| 2026 | $449.22 |

| 2027 | $476.06 |

| 2028 | $498.73 |

| 2029 | $511.97 |

In 2025, we expect CrowdStrike stock to reach $413.88, a 25.12% increase from the current price of $330.78 as of March 8, 2025. By 2026, the stock could rise to $449.22, representing a 35.80% gain. In 2027, it’s projected to hit $476.06, marking a 43.92% increase.

Further down the line, in 2028, we anticipate CrowdStrike stock could reach $498.73, reflecting a 50.77% gain. Finally, by 2029, we project the stock to climb to $511.97, which would represent a substantial 77.48% surge from today’s price of $330.78.

CrowdStrike Stock Price Prediction 2030, 2035, 2040, 2050

| Year | CRWD Price Target |

|---|---|

| 2030 | $540.78 |

| 2035 | $746.46 |

| 2040 | $969.66 |

| 2050 | $1831.34 |

By 2030, CrowdStrike is projected to experience moderate growth, with its stock potentially reaching $540.78—a 63.48% growth from its current price of $330.78. If this prediction holds, CrowdStrike will cement its position as a dominant force in the cybersecurity industry, possibly even monopolizing certain sectors.

With a subscription-based revenue model, the company ensures a steady and growing cash flow. By 2030, strategic acquisitions or partnerships could further enhance its stock value and market dominance.

In 2035, we expect CrowdStrike stock to reach $746.46, a 125.67% increase from the current price of $330.78 as of March 08, 2025. By 2040, the stock could rise to $969.66, representing a 193.14% gain. In 2050, it’s projected to hit $1,831.34, marking a 453.64% increase.

By 2050, CrowdStrike stock price is expected to grow ~$1830 per share. This optimistic forecast is fueled by CrowdStrike’s aggressive expansion into new geographic regions and industries. As cyber threats become more complex, businesses globally will need advanced cybersecurity solutions, and CrowdStrike is poised to meet this demand.

CrowdStrike Stock Price Prediction 2025 (month-wise)

Looking ahead, 2025 could be a major year for CrowdStrike, with the stock expected to surge to around $413.88 from its current price. This growth is driven by CrowdStrike’s growing leadership in cybersecurity as more companies focus on protecting their digital assets. The company’s high P/E ratio shows that investors are betting on strong future growth, and its average annual revenue growth of 30% backs up those expectations.

Also Read : SERVE Robotics Stock Price Prediction | The future of robotics

Conclusion

You made it to the end, amazing! So, here’s the takeaway on CrowdStrike stock price prediction: By 2025, we can expect steady growth. While it may not be a stock that multiplies your investment overnight, it should provide a decent return. If you’re willing to hold on until 2035, you could see your investment double. But if you’re patient enough to hold until 2050, and the market conditions remain favorable for CrowdStrike, it could very well turn into a multi-bagger, giving you significant returns.

Please Go through the FAQs for more clarity about this investment decision and share your thoughts/queries on this in our comments section. We will be more than happy to interact with you…

Handpicked for you (MUST WATCH)

Frequently asked questions (FAQs)

1) What will CRWD stock be worth in 2025?

As per our analysis, we are expecting CrowdStrike to reach ~$415 per share in 2025 which is almost 25% growth on an investment.

2) How high will CRWD stock go?

CrowdStrike stock prices are projected to reach ~$1830 by 2050. Yes, it doesn’t sound much after such a long wait but it is variable. As CrowdStrike gets favorable situations, the stock can become a multi-bagger in no time.

3) What is the CrowdStrike stock price prediction for 2030?

By 2030, CrowdStrike is expected to see steady growth, with its stock potentially rising to ~$540—an increase of 63+% from its current price of $330.78.

4) Is CrowdStrike a buy or sell?

Honestly, its neither a buy nor a sell. In our point of view, it seems to be a hold. If you are holding some shares of CrowdStrike, you should not sell them in the near future, also you can buy some more as the stock dips.

5) Who competes with CrowdStrike?

Palo Alto Cortex XDR, Trend Micro Vision One, Cybereason Defense Platform, Bitdefender, Sophos and Symantec are the top competitors of CrowdStrike.

6) What affects the price of CrowdStrike stock?

CrowdStrike’s stock price, like any financial asset, is influenced by supply and demand. Events like earnings reports, product launches, mergers, and acquisitions can sway this balance. Broader factors such as market sentiment, the economy, interest rates, inflation, and major political events also play a big role in shaping the stock’s performance.

7) Who is the largest shareholder in CrowdStrike?

Vanguard Group Inc. is the largest shareholder in CrowdStrike.

8) What is CrowdStrike stock price prediction for 2050?

CrowdStrike’s stock price is projected to reach around $1,830 by 2050. While that may not seem like a huge gain after such a long wait, it’s important to remember that stock prices can be unpredictable. If conditions turn favorable, CrowdStrike has the potential to become a multi-bagger much sooner than expected.

9) Will CrowdStrike share price reach $500 in coming years ?

Yes, we are expecting CrowdStrike share price to reach $500 in 2029.

10) Does CrowdStrike pays dividends ?

NO. CrowdStrike is not paying dividends to their investors but they are reinvesting the profits for their expansion which is quite a good thing.

11) Will CrowdStrike stock recover ?

Yes, since Crowdstrike is a profit making firm and as we see more technology advancements in near future there will be an increase in the demand of security services. So, as per our analysis, if currently Crowdstrike stock is falling, it will recover soon.

Disclaimer : Not an Investment Advice

The content shared here in “🛡️ CRWD | CrowdStrike Stock Price Prediction 2025, 2030, 2040, 2050” is for general information only. It’s not intended as financial, investment, or professional advice. Always consult a qualified professional—whether legal, financial, or tax-related—before making any investment decisions.

When someone writes an piece of writing he/she keeps the thought of a user in his/her brain that how a user can know it. So that’s why this paragraph is outstdanding.

Hello there, You’ve done a great job. I will certainly digg it and personally recommend to my friends. I’m sure they will be benefited from this site.

This website contains a lot of engaging and valuable information.

Here, you can discover various materials that broaden your horizons.

Visitors will benefit from the information shared on this site.

Each section is organized clearly, making it simple to use.

The articles are presented professionally.

You can find information on various fields.

Whether your interest is in useful facts, this site has something for everyone.

Overall, this website is a excellent platform for those who love learning.

You should be a part of a contest for one of the finest blogs on the net. I’m going to highly recommend this blog!

I am really impressed with your writing skills as well as with the layout on your blog. Is this a paid theme or did you modify it yourself? Anyway keep up the nice quality writing, it is rare to see a nice blog like this one nowadays.

My partner and I stumbled over here coming from a different page and thought I might check things out. I like what I see so i am just following you. Look forward to finding out about your web page yet again.