🛵 EVgo Inc. | EVGO stock price prediction 2025 and beyond

👉 30 Seconds Summary 👈

EVgo Inc. (Nasdaq : EVGO) is a leading player in the EV charging infrastructure market, with strong potential for long-term growth. For EVGO stock price prediction, our analyst analyzed its fundamentals and also read its technical charts along with sector analysis. On the basis of that our analysts suggested that EVgo stock could reach $5.13 in 2025, $35.52 by 2030, climb to $61.03 by 2035, rise to $93.47 by 2040, and potentially hit $142.61 by 2050. While growth may not be rapid, the company’s established position and its focus on innovation, including 100% renewable energy-powered charging stations, provide a strong foundation for sustainable expansion.

As most of the people are shifting toward electric vehicles (EVs) due to rising prices of Crude Oil, companies like EVgo Inc. (Nasdaq : EVGO) are playing a critical role in building the charging infrastructure which is needed to support the growing demand. If you’re an investor or EV enthusiast, you must be curious about where EVGO stock might be headed as a biggest public fast-charging network company. With the rise of green energy policies and increased EV adoption, many are investing in EVgo’s potential. In this article, we’ll explore expert forecasts for EVGO stock in 2025 and beyond, considering market trends, company growth, and industry challenges to give you a better understanding of what could drive EVgo’s future performance.

EVgo operates one of the largest public fast-charging networks in the U.S., working as a key player in the future of sustainable infrastructure development. In our article “EVGO stock price prediction 2025 and beyond” we will discuss that are the future prospects for this stock and how much it can grow in near and far future.

About EVgo Inc. (NASDAQ : EVGO)

| Company Name | EVgo Inc. |

| Stock Exchange | NASDAQ |

| Ticker Symbol | EVGO |

| Sector | Electric Vehicle Infrastructure |

| Headquarter | Los Angeles, California |

| Founded in | 2010 |

| Major Shareholder | Vanguard Group Inc (9.43%) |

| Market Cap. | $ 2.26 billion usd |

| Revenue(2023) | $ 161 million usd |

| Total Assets | $ 0.81 billion usd |

| All-time high closing price | $ 24.34 usd (Jan 26, 2021) |

| 52-week low | $ 1.65 usd (Apr 25, 2024) |

| 52-week high | $ 9.07 usd (Oct 25, 2024) |

| Peer Companies | Monro Inc. (MNRO), Arko Corp. (ARKO), America’s Car-Mart Inc. (CRMT), Diversified Royalty Corp. (BEVFF) |

EVgo is a leading provider of electric vehicle (EV) fast charging stations in the US. It was established with a focus on sustainable charging points. EVgo owns and operates more than 850 fast-charging stations across 30 states, which makes it easy for EV users to charge their vehicles on the go. The company is expanding its network to support the growing demand for electric vehicles.

Whats special in EVgo is it uses 100% renewable energy to power its charging stations, making it the first EV charging network in the U.S. to achieve this. The company partners with automobile manufacturers, rideshare operators, businesses, and government agencies to ensure convenient access to charging stations. With a strong focus on customer experience and support, EVgo offers reliable fast-charging solution that helps in reducing anxiety for EV drivers about availability of charging stations. Now lets discuss the historical prices of EVgo Inc.

EVgo Inc. (Nasdaq : EVGO) | Past, Present & Future

EVgo Inc. | Historical price data analysis

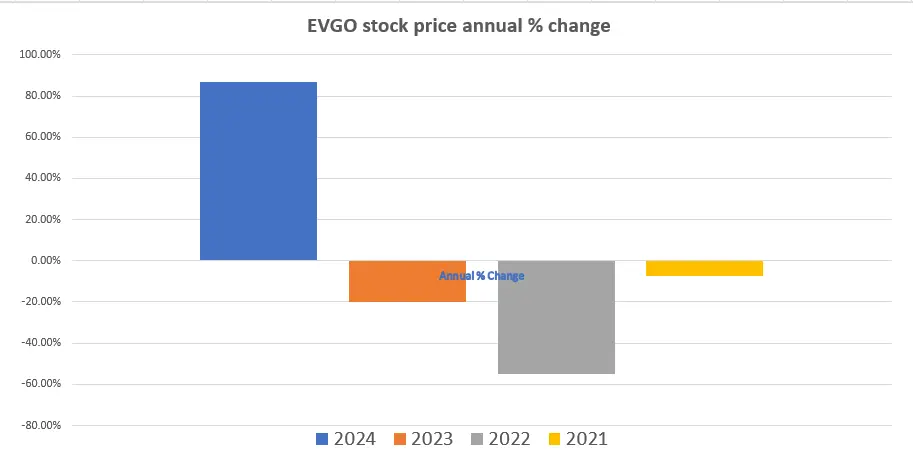

Here in the above annual percentage change chart, we can observe that EVGO share gave a positive result to the investors recently. In the previous years, from 2021 to 2023, it gave a negative return of -7.19%, -55.03% and -19.91% during 2021, 2022 & 2023 respectively. Since, the demand of EVs starting boosting during 2023 and going up in 2024, EVGO stock price started giving potential returns to its investors.

Also Read : Vistra Corp. (VST) stock forecast for 2025 and more…

One year chart analysis for EVGO stock price prediction 2025

Here in EVGO stock’s one year chart, we can see that from January 2024, the stock was trending downwards. The Bearishness was not very steep but gradual. On April 25 2024, EVGO stock price hit its 52-week low of $1.65. From this low, it traded in a narrow range till July. In the start of July, EVGO stock price broke the range and started moving upward. EVGO’s stock price reached $4.70 and started trading in range between $4.70 – 3.30. Recently in Oct, 2024, the stock broke its range with a huge volume and started trading at 52-week high.

EVGO Stock Live Chart

We suggest you to have a look on the above live chart. Look at the patterns it is creating, then you will have better understanding about the predictions we have given below.

Also Read : Boeing stock forecast 2025 and beyond | Fly or Crash?

Time-Frame analysis of EVgo Inc. : Hourly, Daily & Weekly

Since EVGO operates in the evolving EV industry, it’s also important to think about how new advancements in EV technology might shape its future growth. As by a technical chart analysis of Simple Moving Averages (SMAs) we can observe the following –

Time Frame | Observation |

|---|---|

(Every candle represents Nasdaq : EVGO share’s trading session of one Daily. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular daily) | On the Daily time-frame EVGO stock is trading BELOW 50 Days, 100 Days, 200 Days SMAs while ABOVE 21 Days SMA. This indicates that EVGO stock has a Sideways to Negative sentiment in medium term.. |

(Every candle represents Nasdaq : EVGO share’s trading session of one Week. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular week) | On Weekly time-frame, we can observe that EVGO stock is trading BELOW 21 Weeks SMA, 50 Weeks & 100 Weeks SMA. This is the sign of Sideways to Bearishness in Long term. |

(Every candle represents Nasdaq : EVGO stock’s trading session of one Month. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular Month) | On Monthly time-frame, we can observe that EVGO stock is trading BELOW 21 Month SMAs. This indicates that the EVGO stock is in slight Downtrend for Very Long term. The major support can be seen at the levels between $3.10 – $1.60. |

Getting advice from a trusted financial adviser or stockbroker about EV industry can help you deepen your understanding of the market and create a strong investment strategy.

Dow Jones, NASDAQ & EVgo Inc. : A comparative Analysis

Check out the comparative year on year returns of Dow Jones, Nasdaq and EVGO. Here, we are showing the returns by comparing them on closing basis –

| Year | Dow Jones | Nasdaq | EVGO |

|---|---|---|---|

| 2024 | +12.88% | +28.64% | +13.13% |

| 2023 | +13.70% | +43.42% | -19.91% |

| 2022 | -8.78% | -33.10% | -55.03% |

| 2021 | +18.73% | +21.39% | -7.19% |

| 2020 | +7.25% | +43.64% | +9.84% |

Also Read : CrowdStrike | CRWD Stock Price Prediction 2025, 2030, 2040, 2050

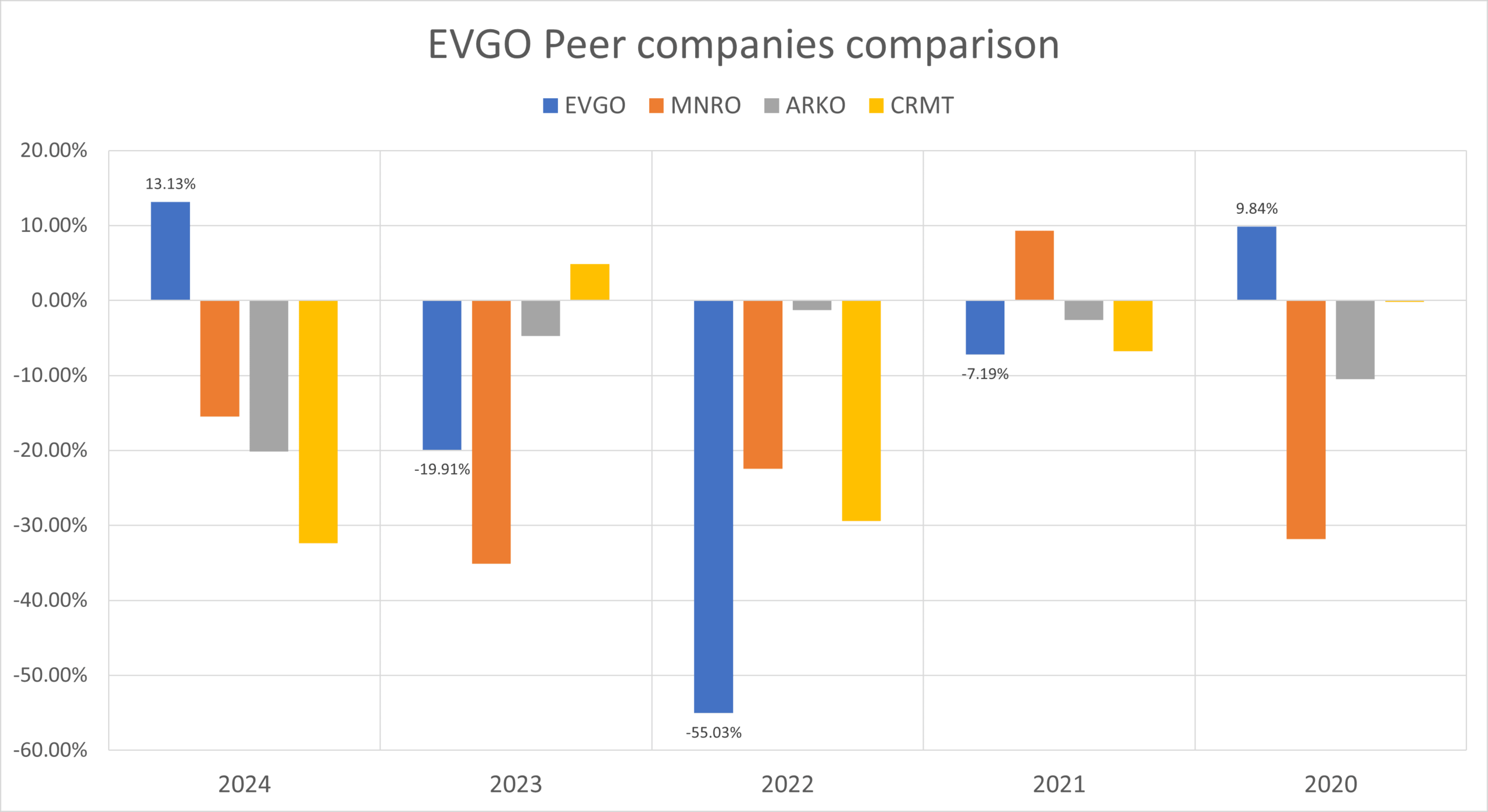

EVGO Peer Comparison / Competitors Analysis

We will compare EVgo Inc. (Nasdaq : EVGO) to its top competitors. We will see how its peer companies performed year-on-year . Below is the comparative table of Monro Inc. (MNRO), Arko Corp. (ARKO), America’s Car-Mart Inc. (CRMT), Diversified Royalty Corp. (BEVFF)’s returns from 2020 to 2024 based on CLOSING Prices.

| Year | EVGO | MNRO | ARKO | CRMT |

|---|---|---|---|---|

| 2024 | +13.13% | -15.47% | -20.12% | -32.36% |

| 2023 | -19.91% | -35.09% | -4.73% | +4.86% |

| 2022 | -55.03% | -22.43% | -1.25% | -29.43% |

| 2021 | -7.19% | +9.32% | -2.56% | -6.77% |

| 2020 | +9.84% | -31.84% | -10.46% | –0.16% |

| Average Returns | -11.83% | -19.10% | -7.82% | -12.77% |

EVGO Stock Price Prediction : Short & Long Term

EVGO Stock Forecast 2025, 2026, 2027, 2028, 2029

| Year | Stock Price Target |

|---|---|

| EVGO stock forecast for 2025 | $ 5.13 |

| EVGO stock forecast for 2026 | $ 9.46 |

| EVGO stock forecast for 2027 | $ 15.78 |

| EVGO stock forecast for 2028 | $ 22.04 |

| EVGO stock forecast for 2029 | $ 31.96 |

Here are the percentage gains for EVGO’s stock price based on the above predictions ;

- 2025: Expected stock price of $5.13, representing a 92.86% increase from the current price of $2.66 (as of March 31, 2025).

- 2026: Estimated stock price of $9.46, reflecting a 255.64% rise from today’s price.

- 2027: Forecasted stock price of $15.78, showing a 493.23% gain.

- 2028: Anticipated stock price of $22.04, marking a 728.57% increase from its current price.

- 2029: Expected stock price of $31.96, maintaining a 1,101.50% surge compared to the current price of $2.66.

EVGO Stock Forecast 2030, 2035, 2040, 2050

| Year | Stock Price Target |

|---|---|

| EVGO stock forecast for 2030 | $ 35.52 |

| EVGO stock forecast for 2035 | $ 61.03 |

| EVGO stock forecast for 2040 | $ 93.47 |

| EVGO stock forecast for 2050 | $ 142.61 |

Looking ahead, EVGO’s stock is expected to experience significant growth over the next few decades, offering attractive returns for long-term investors. Here are the percentage gains for EVGO stock price based on the above predictions:

- By 2030: We expect EVGO’s stock price to reach $35.52, representing a 1,235.34% increase from its current price of $2.66 (as of March 31, 2025).

- By 2035: The stock could rise to $61.03, reflecting a 2,194.36% return.

- By 2040: We expect the stock to climb to $93.47, marking a 3,413.91% gain.

- By 2050: EVGO’s stock price could hit $142.61, indicating an impressive 5,261.28% increase from today’s price.

These projections highlight EVGO’s strong long-term potential, driven by rising demand for electric vehicles and ongoing advancements in EV technology. However, as with all investments, these forecasts come with risks, and future market conditions may influence actual performance.

EVGO Stock Price Prediction 2025 (month-wise)

| Month | Stock Price Target |

|---|---|

| EVGO stock price prediction for March 2025 | $2.86 |

| EVGO stock price prediction for April 2025 | $3.17 |

| EVGO stock price prediction for May 2025 | $3.36 |

| EVGO stock price prediction for June 2025 | $3.64 |

| EVGO stock price prediction for July 2025 | $3.89 |

| EVGO stock price prediction for August 2025 | $4.58 |

| EVGO stock price prediction for September 2025 | $4.83 |

| EVGO stock price prediction for October 2025 | $5.13 |

| EVGO stock price prediction for November 2025 | $5.02 |

| EVGO stock price prediction for December 2025 | $4.85 |

As per our analysis of EVGO stock price, we are expecting that the prices may rise up to $5.13, offering an approximate 92.86% return on its current price of $2.66 as of March 31, 2025. This represents a commendable return for investors. Starting in early 2025, we anticipate a slow but steady rise in EVGO stock price but as the demand of EV increase in coming months, we will see its stock touching its peak in its third quarter. However, by October to November 2025, we might see the stock to hit its peak of $5.13 for 2025, which aligns with patterns observed in previous charts. After touching its peak point, we can see some decline in prices.

Conclusion

We hope, this article “EVGO stock price prediction 2025 and beyond” have provided you some insights. Below are the videos which can also help you in taking more informed decision. Also go through our FAQs section, where we answer some commonly asked questions which came in the minds of an investor before taking any decision.

EVgo Inc. (EVGO), founded in 2010, has established itself as a key player in the EV charging sector, with a market cap of $2.26 billion USD. The company has experienced significant growth, though its stock has seen fluctuations over time. With the increasing adoption of electric vehicles and expanding charging infrastructure, EVGO’s long-term potential looks promising. While short-term movements may be volatile, forecasts suggest strong upside potential in the coming decades. Investors looking for exposure to the EV charging industry may find EVgo an interesting stock to watch for the future.

Frequently Asked Questions (FAQs)

1) Is EVGO a good buy, hold or sell?

It is a MODERATE BUY as per today’s market condition. We are recommending it as a Moderate buy because there are many other options available which are much more profitable in short term. If you are already holding some shares in your portfolio, then you should keep them in your portfolio and see where this stock can reach. As per our analysis, we do not recommend anyone to SELL this stock as of now.

2) What is EVGO stock price prediction for 2030?

As per our analysis, $35.52 is the EVGO stock price target for 2030.

3) Is EVGO a good investment for long term?

Yes, due to rise in demand of EVs, we are predicting a rise in EVgo Inc. stocks also. It might take time to grow your investments in EVGO, but it is a good stock for long term.

4) Who is the largest shareholder of EVGO?

The top three largest shareholders of EVGO stocks are Vanguard Group, BlackRock Inc. and VTSMX.

5) Is EVGO a big company?

EVgo Inc. is one of the largest charging network which serves more than 35 states . It has more than 800 charging stations.

6) Will EVGO pay dividend?

EVgo Inc. (NASDAQ: EVGO) did not paid any dividend till date. Although, payment of dividend or investing profits for company’s benefit are the decisions of Board of Director and they are changeable.

7) Is EVGO a good company to invest in?

Yes, any company which is providing EV charging solution is a good company to invest in. Due to uncertain Crude Oil prices, government is also supporting alternatives. Since, EVgo Inc. is one of the largest player in EV charging infrastructure builder, it is a good company to be in you portfolio or in watchlist.

8) How high will EVGO stock price can go?

As our analysts suggest, EVGO can touch a high of $35.52 in 2030, $93.47 in 2040 and $142.61 in 2050.

9) What is EVGO stock price prediction for 2050?

As per our analysis, the EVGO stock price could reach $142.61 during 2050. Although if it gets favorable market conditions and compete with other players, it can reach that target earlier.

Disclaimer : Not an Investment Advice

The content shared in the above article “EVGO stock price prediction 2025 and beyond” is for general information only. It’s not intended as financial, investment, or professional advice. Always consult a qualified professional—whether legal, financial, or tax-related—before making any investment decisions.

What i do not realize is actually how you’re now not actually much more smartly-preferred than you might be now. You’re very intelligent. You understand thus considerably in terms of this topic, made me for my part consider it from numerous varied angles. Its like men and women don’t seem to be interested unless it’s something to accomplish with Lady gaga! Your personal stuffs great. All the time care for it up!

Thanks for an explanation. All ingenious is simple.

Hi there, I found your site via Google while looking for a related topic, your site came up, it looks great. I have bookmarked it in my google bookmarks.

There is noticeably a bundle to learn about this. I assume you made sure good factors in features also.

Good article and straight to the point. I don’t know if this is really the best place to ask but do you people have any ideea where to hire some professional writers? Thx 🙂