✈️ Joby Aviation | JOBY stock forecast 2025, 2030 and more

👉 30 Seconds Summary 👈

Joby Aviation is a key player in the air taxi industry with strong long-term growth potential. Our analysts have reviewed the company’s fundamentals, technical charts, and the overall sector outlook to forecast that JOBY stock could reach $8.37 in 2025, $15.48 by 2030, rise to $18.76 by 2035, climb to $23.09 by 2040, and potentially hit $31.96 by 2050. While growth may be steady rather than fast, Joby’s established position and focus on 100% renewable energy-powered air taxis provide a solid foundation for future expansion.

As the future of transportation is shifting towards the sky, Joby Aviation (NYSE : JOBY) is one of the crucial player to keep an eye on as an emerging air taxi industry. It is well known for its electric vertical takeoff and landing (eVTOL) aircraft. In our article “JOBY stock forecast 2025, 2030 and more” we will explore what will be the future for JOBY stock and whether it can live up to its potential. Joby Aviation is working on the development of urban air mobility solutions that aim to reduce traffic on the roads and cut down the overall carbon emissions.

We will also explore the key factors that could influence the company’s growth. From regulatory approvals to advances in battery technology and infrastructure development, we’ll break down the opportunities and challenges that may shape Joby Aviation’s future. As the company continues to develop its air taxi services, these forecasts will provide a better understanding of its potential for long-term growth.

About Joby Aviation (NYSE : JOBY)

| Company Name | Joby Aviation |

| Stock Exchange | NYSE |

| Ticker Symbol | JOBY |

| Sector | Aviation |

| Headquarter | Santa Cruz, California |

| Founded in | 2009 |

| Major Shareholder | JoeBen Bevirt (8.67%) |

| Market Cap. | $ 3.89 billion usd |

| Revenue(2023) | $ 1.03 million usd |

| Total Assets | $ 1.29 billion usd |

| All-time high closing price | $ 17.00 usd (Feb 16, 2021) |

| 52-week low | $ 4.50 usd (Apr 22, 2024) |

| 52-week high | $ 7.69 usd (July 16, 2024) |

| Peer Companies | Copa Holdings, S.A. (CPA), SkyWest Inc (SKYW), Air Canada (ACDVF), Alaska Air Group Inc, (ALK), Air France-KLM SA (AFLYY) |

Joby Aviation (NYSE : JOBY) is a futuristic company which focuses on city air transportation with its innovative electric vertical takeoff and landing (eVTOL) aircraft . It was founded in 2009 by JoeBen Bevirt. The company is working to create an air taxi service that could change the way people travel inside the cities. Joby’s eVTOL aircraft are designed to be silent, environment friendly, and capable of flying up to 150 miles in a single charge. This innovative technology could help reduce traffic congestion and provide a faster way to travel.

Joby has already made significant progress in its mission, including partnerships with Uber and Toyota, and by getting approval from the Federal Aviation Administration (FAA) to begin test flights. With the growing focus on sustainable transportation and urban mobility solutions, Joby Aviation is ready to play a leading role in shaping the future of city travel. Investors and tech enthusiasts are watching closely as the company continues to develop its groundbreaking technology and push the boundaries of what’s possible in aviation.

Joby Aviation (NYSE : JOBY) | Past, Present & Future

Joby Aviation | Historical price data analysis

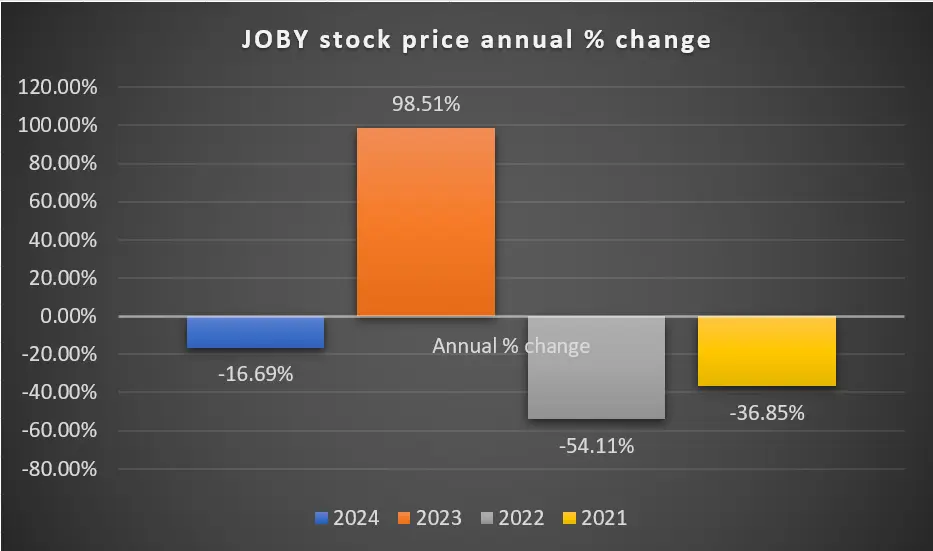

| Year | Year High | Year Low | Year Close | Annual % change |

|---|---|---|---|---|

| 2024 | 7.46 | 4.50 | 5.54 | -16.69% |

| 2023 | 10.69 | 3.31 | 6.65 | 98.51% |

| 2022 | 7.48 | 3.18 | 3.35 | -54.11% |

| 2021 | 17.00 | 6.37 | 7.30 | -36.85% |

Here in the above annual percentage change chart, we can observe that Joby Aviation’s share gave a negative return as compared to previous year to the investors. In the previous years also, it gave a negative return of -36.86% and -54.11% during 2021 & 2022 respectively. But in 2023, it gave a whooping return of 98.51% to its investors. Since, the demand of Air taxis may rise in upcoming years, JOBY stock price may start and upward trend and provide potential returns to its investors.

Also Read : Nvidia Share Price Prediction 2025 and beyond | Will omniverse & VR succeed ?

One year chart analysis for JOBY stock forecast 2025

Here in one year JOBY stock price chart, we can see that from January 2024, the stock was trending downwards. The Bearishness was not steep but gradual. On April 22 2024, JOBY stock price hit its 52-week low of $4.50. From this low, it traded in a narrow range till July. In the start of July, JOBY stock price broke the range and started moving upward. JOBY stock price reached the 52-week high of $7.69 and started to come down sharply to the previous range low $4.60. Currently on March 11, 2025 it is trading on $5.42.

JOBY Stock Live Chart

Look at the latest Joby Aviation stock chart above and take some time to analyze it. Have a close look at the patterns it is creating right now. Below are the future value predictions for JOBY stock based on such deep analysis.

Time-Frame analysis of Joby Aviation Inc. : Hourly, Daily & Weekly

Since Joby operates in the evolving aviation industry, it’s also important to think about how new advancements in technology might shape its future growth. As by a technical chart analysis of Simple Moving Averages (SMAs) we can observe the following –

Time Frame | Observation |

|---|---|

(Every candle represents NYSE : JOBY share’s trading session of one Daily. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular daily) | On the Daily time-frame JOBY stock is trading BELOW 21 Days, 50 Days, 100 Days, 200 Days SMAs. This indicates that JOBY stock has a Sideways to Negative sentiment in medium term. |

(Every candle represents NYSE : JOBY share’s trading session of one Week. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular week) | On Weekly time-frame, we can observe that JOBY stock is trading BELOW 21 Weeks SMA BUT ABOVE 50 Weeks & 100 Weeks SMA. This is the sign of Sideways to Bullishness in Long term. |

(Every candle represents NYSE : JOBY stock’s trading session of one Monthly. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular Monthly) | On Monthly time-frame, we can observe that JOBY stock is trading ABOVE 21 Month SMAs. This indicates that the JOBY stock is in slight Up trend for Very Long term. The major support can be seen at the levels between $5.79 – $5.90. |

Getting advice from a trusted financial adviser or stockbroker about aviation industry can help you deepen your understanding of the market and create a strong investment strategy.

Dow Jones, NASDAQ & Joby Aviation : A comparative Analysis

Check out the comparative year on year returns of Dow Jones, Nasdaq and JOBY. Here, we are showing the returns by comparing them on closing basis –

| Year | Dow Jones | Nasdaq | JOBY |

|---|---|---|---|

| 2024 | +12.88% | +28.64% | +22.26% |

| 2023 | +13.70% | +43.42% | +98.51% |

| 2022 | -8.78% | -33.10% | -54.11% |

| 2021 | +18.73% | +21.39% | -36.85% |

| 2020 | +7.25% | +43.64% | +12.56% |

Also Read : CrowdStrike | CRWD Stock Price Prediction 2025, 2030, 2040, 2050

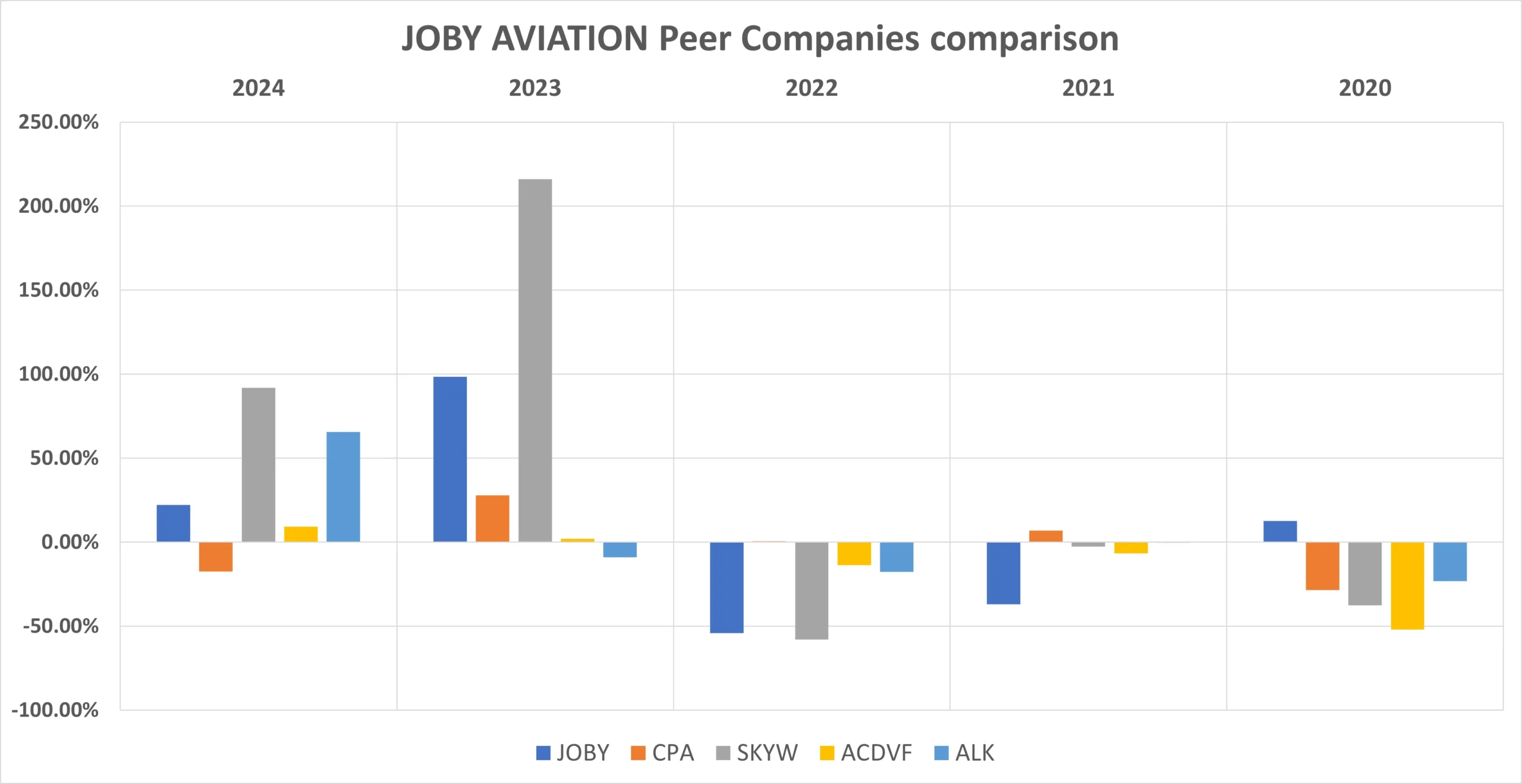

JOBY Peer Comparison / Competitors Analysis

We will compare Joby Aviation Inc. (NYSE : JOBY) to its top competitors. We will see how its peer companies performed year-on-year . Below is the comparative table of Copa Holdings, S.A. (CPA), SkyWest Inc (SKYW), Air Canada (ACDVF), Alaska Air Group Inc, (ALK)’s returns from 2020 to 2024 based on CLOSING Prices.

| Year | JOBY | CPA | SKYW | ACDVF | ALK |

|---|---|---|---|---|---|

| 2024 | +22.26% | -17.34% | +91.82% | +9.35% | +65.73% |

| 2023 | +98.51% | +27.82% | +216.17% | +2.08% | -9.01% |

| 2022 | -54.11% | +0.62% | -57.99% | -13.70% | -17.58% |

| 2021 | -36.85% | +7.03% | -2.51% | -6.65% | -0.19% |

| 2020 | +12.56% | -28.54% | -37.63% | –52.07% | -23.25% |

| Average Returns | +8.47% | -2.08% | +41.97% | -12.19% | +3.14% |

Here we can observe that JOBY stocks’ performance is at par when compared to its peer companies if we look at the 5-year average returns.

JOBY Stock Forecast : Short & Long Term

JOBY Stock Forecast 2025, 2026, 2027, 2028, 2029

| Year | Stock Price Target |

|---|---|

| JOBY stock forecast for 2025 | $ 8.37 |

| JOBY stock forecast for 2026 | $ 10.78 |

| JOBY stock forecast for 2027 | $ 11.65 |

| JOBY stock forecast for 2028 | $ 13.40 |

| JOBY stock forecast for 2029 | $ 14.19 |

Here are the percentage gains for JOBY stock price based on the above predictions ;

- 2025: Expected stock price of $8.37, representing a 54.43% increase from the current price of $5.42 (as of March 11, 2025).

- 2026: Estimated stock price of $10.78, reflecting a 98.89% rise from today’s price.

- 2027: Forecasted stock price of $11.65, showing a 114.94% gain.

- 2028: Anticipated stock price of $13.40, marking a 147.23% increase from its current price.

- 2029: Expected stock price of $14.19, maintaining a 161.81% surge compared to today’s price of $5.42.

JOBY Stock Price Prediction 2030, 2035, 2040, 2050

| Year | Stock Price Target |

|---|---|

| JOBY Stock Price Prediction for 2030 | $ 15.48 |

| JOBY Stock Price Prediction for 2035 | $ 18.76 |

| JOBY Stock Price Prediction for 2040 | $ 23.09 |

| JOBY Stock Price Prediction for 2050 | $ 31.96 |

Looking ahead, JOBY stock price is expected to experience a slow but steady growth over the next few decades, offering decent returns for a long-term investor. Here are the percentage gains for JOBY stock price based on the above predictions:

- By 2030: We expect JOBY stock price to reach $15.48, representing a 185.61% increase from its current price of $5.42 (as of March 11, 2025).

- By 2035: The stock could rise to $18.76, reflecting a 246.13% returns.

- By 2040: We expect the stock to climb to $23.09, marking a 326.01% gains.

- By 2050: JOBY stock price could hit $31.96, indicating an impressive 489.67% increase from today’s price.

These projections highlight JOBY’s long-term potential, driven by future demand for Air Taxis and ongoing advancements in EV Air travel technology. However, as with all investments, these forecasts come with risks, and future market conditions may influence actual performance.

JOBY Stock Forecast 2025 (month-wise)

| Month | Stock Price Target |

|---|---|

| JOBY stock forecast for January 2025 | 5.94 |

| JOBY stock forecast for February 2025 | 6.14 |

| JOBY stock forecast for March 2025 | 6.34 |

| JOBY stock forecast for April 2025 | 7.07 |

| JOBY stock forecast for May 2025 | 7.31 |

| JOBY stock forecast for June 2025 | 7.96 |

| JOBY stock forecast for July 2025 | 8.37 |

| JOBY stock forecast for August 2025 | 8.32 |

| JOBY stock forecast for September 2025 | 8.11 |

| JOBY stock forecast for October 2025 | 7.89 |

| JOBY stock forecast for November 2025 | 8.17 |

| JOBY stock forecast for December 2025 | 8.09 |

As per our analysis of JOBY stock price, we are expecting that the prices may rise up to $8.37 during 2025, offering an approximate 54.43% return on its current price of $5.42 as of March 11, 2025. This represents a decent return for investors. Starting in early 2025, we anticipated a very slow but steady gain in JOBY stock price but as the demand of Air Taxis come in light, we will see its stock touching its peak in mid-year. However, by October to December 2025, we might see the stock to come a little lower from its peak prices, which aligns with patterns observed in previous year charts.

Also Read : Boeing stock forecast 2025 and beyond | Fly or Crash?

Conclusion

Joby’s commitment to innovation and ability to adapt to market changes make it a solid option for investors looking for long-term, stable returns. The company’s cutting-edge eVTOL aircraft and its strategic vision position Joby well for growth in the coming decades.

For those with a long-term investment outlook, Joby Aviation presents a promising opportunity. Its focus on technological advancements and commitment to the future of air mobility suggest a positive outlook for investors seeking gradual, substantial returns. We hope this article on the “JOBY stock forecast 2025, 2030, and beyond” has given you useful insights. Be sure to check out the videos and our FAQ section for more guidance.

Also Read : Serve robotics | SERV stock forecast 2025, 2030, 2040, 2050

Frequently Asked Questions (FAQs)

1) Who is the largest institutional investor in JOBY?

The top three institutional investors in JOBY are Baillie Gifford and Company, Capricorn Investment Group and Vanguard Group Inc.

2) Is JOBY a good long-term stock?

As per our analysis, YES. Joby Aviation (NYSE : JOBY) is a potential stock if we think as a very long term investment. It may have performed badly in past but it is a company of futuristic technology, Air Taxis will get attention soon in near future, which will benefit this company and its investors.

3) What is the stock price prediction for JOBY in 2025?

According to our analysts, JOBY stock price may reach to $8.37 per share in 2025.

4) Can I invest in Joby Aviation?

Yes, if you believe in investing futuristic technology companies and if you are patient enough to hold this stock for a very long term, you can invest in Joby Aviation. This is not an investment advice, it is what we are anticipating for this stock.

5) Does JOBY pay dividends?

Joby Aviation (JOBY) didn’t paid any dividend till date. Although, payment of dividend or investing profits for company’s benefit are the decisions of Board of Director and they are changeable.

6) Is JOBY worth buying?

Joby Aviation (NYSE : JOBY) is a MODERATE BUY as per today’s market condition. We are recommending it as a Moderate buy because there are many other options available which are much more profitable in short term. If you are already holding some shares in your portfolio, then you should keep them in your portfolio and see where this stock can reach.

7) Who owns the most JOBY stock?

JoeBen Bevirt owns most of the shares of Joby Aviation (JOBY).

8) What is the stock price prediction for JOBY in 2030?

According to our analysis, we are expecting JOBY share to trade around $15.48, which is 185.61% return for the investors.

9) What is the JOBY stock forecast for 2050?

For 2050, Joby Aviation’s stock forecast is $31.96 (+489.67%) as calculated on current stock price.

Disclaimer : Not an Investment Advice

The content shared in the above article “JOBY stock forecast 2025 and longer term” is for general information only. It’s not intended as financial, investment, or professional advice. Always consult a qualified professional—whether legal, financial, or tax-related—before making any investment decisions.

What i do not realize is in truth how you are no longer actually much more neatly-favored than you may be now. You are very intelligent. You already know therefore significantly on the subject of this topic, produced me personally imagine it from so many numerous angles. Its like women and men aren’t involved except it is something to do with Lady gaga! Your own stuffs excellent. All the time handle it up!

At this time it seems like Expression Engine is the top blogging platform available right now. (from what I’ve read) Is that what you’re using on your blog?

Good website! I really love how it is easy on my eyes and the data are well written. I am wondering how I might be notified when a new post has been made. I have subscribed to your RSS which must do the trick! Have a nice day!

Excellent post. I was checking continuously this blog and I’m impressed! Very useful info specially the last part 🙂 I care for such info much. I was seeking this certain info for a very long time. Thank you and best of luck.