JPMorgan Chase & Co. – JPM stock forecast 2025-2050 with detailed analysis

➡️ 30 Seconds Summary ⬅️

JPMorgan Chase & Co. (NYSE: JPM) is one of the largest and most influential financial institutions in the world, renowned for its performance and deep-rooted legacy in banking. With a market cap surpassing hundreds of billions and a diverse global footprint, JPMorgan remains a favorite among long-term investors. We will compare JPMorgan Chase’s performance with major indices as well as with its major competitors. We will also analyze JPMorgan Chase stock on multiple timeframe and based on this analysis, we will estimate its future prices. In this blog post “JPM stock forecast 2025-2050 with detailed Analysis”, we dive deep into the future of JPM stock, analyzing potential price targets from 2025 to 2050. Whether you’re a seasoned investor or just starting out, this detailed forecast offers valuable insights into the bank’s long-term growth trajectory.

About JPMorgan Chase & Co. (NYSE : JPM)

| Company Name | JPMorgan Chase & Co. |

| Stock Exchange | NYSE |

| Ticker Symbol | JPM |

| Sector | Financial Services |

| Headquarter | New York City, US |

| Founded in | 2000 |

| Major Shareholder | Vanguard Group (~9.7%) |

| Market Cap. | $ 672.77 billion USD |

| Revenue(2024) | $ 177.7 billion USD |

| Total Assets | $ 4.00 trillion USD |

| All-time HIGH price | $ 280.25 USD (Feb 19, 2025) |

| All-time LOW price (since 2015) | $ 50.07 USD (Aug 24, 2015) |

| Peer Companies | Bank of America Corp. (BAC), Wells Fargo & Company (WFC), HSBC Holdings plc (HSBC), Commonwealth Bank of Australia (CMWAY), HDFC Bank Limited (HDB) |

Founded in the year 2000, JPMorgan Chase & Co. has grown to become one of the largest and most respected financial institutions in the world. With a massive market capitalization of $672.77 billion USD and total assets exceeding $4 trillion USD, the bank plays a critical role in global finance. Headquartered in New York, JPMorgan Chase offers a wide range of services, including investment banking, asset management, commercial banking, and wealth management. The company recently reached an all-time high stock price of $280.25 USD on February 19, 2025, reflecting strong investor confidence and consistent performance across various market cycles.

JPMorgan Chase & Co. (NYSE : JPM) | Past, Present & Future

JPMorgan Chase (JPM) | Historical price analysis

| Year | Open | High | Low | Close | % Change |

|---|---|---|---|---|---|

| 2024 | 169.09 | 254.31 | 164.30 | 239.71 | +40.92% |

| 2023 | 135.24 | 170.69 | 123.11 | 170.10 | +26.85% |

| 2022 | 159.86 | 169.81 | 101.28 | 134.10 | -15.31% |

| 2021 | 127.50 | 172.96 | 123.77 | 158.35 | +24.62% |

| 2020 | 139.79 | 141.10 | 76.91 | 127.07 | -8.85% |

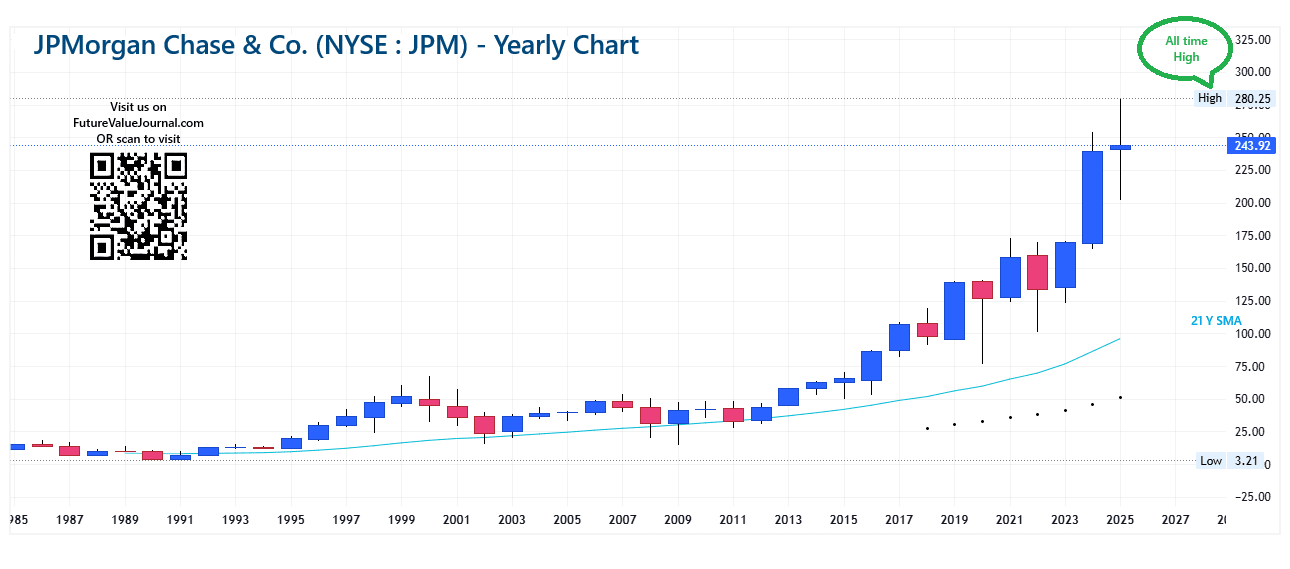

In the above table, we can clearly see that JPMorgan Chase stock price gave mostly positive results to its investors. JPMorgan Chase stock price hit its all-time high of $280.25 on Feb 19, 2025.

Also Read : AXP | American Express Stock Forecast 2025-2050 with Complete Analysis 🚨

Live chart analysis for JPM Stock Forecast

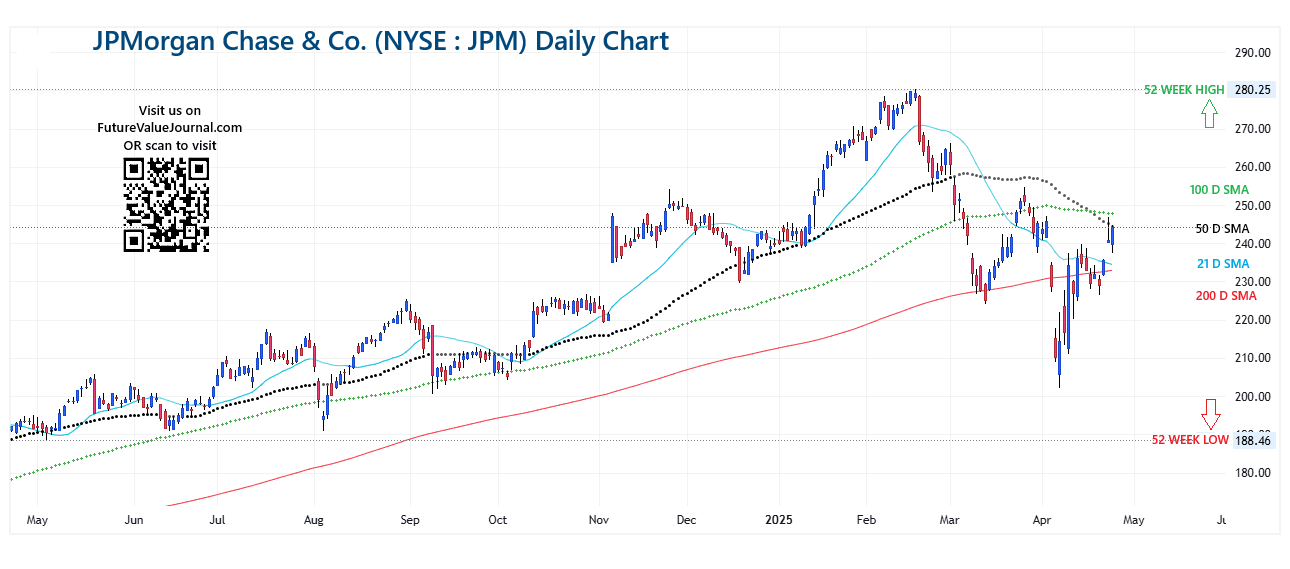

Before we start looking at the future values of JPMorgan Chase Stock, have a look at its current chart so we can understand where it is heading in future. Here, in JPMorgan Chase’s chart, we can observe that, JPMorgan Chase started its up trend since November 2022. JPMorgan Chase started its upside journey after hitting a low of $101.28 in October2022. From Nov. 2022 to Dec 2023, the uptrend was slow but when JPM broke its previous high, investors became confident about its Bullish trend. During 2024, JPM was in clear Up trend. On Feb 19, 2025 JPM created its all time high of $280.25 BUT after hitting that high, we can see a steep fall in the stock price. It might be due to profit booking but due to two consecutive gap down openings in April 2025, investors might be rethinking about fresh investments in JPM.

Time-Frame analysis of JPMorgan Chase : Daily, Weekly, Monthly, Yearly

By a technical chart analysis of Simple Moving Averages (SMAs) on different timeframes, we can observe the following –

| Time Frame | Observation |

|---|---|

View Daily Chart (Every candle represents NYSE : JPM share’s trading session of one day. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular day) | On the Daily time-frame JPMorgan Chase stock is trading ABOVE 21 Days & 200 Days SMA while BELOW 50 Days & 100 Days SMAs. This indicates that JPM stock is trying to change its trend from bearish to bullish in medium term. |

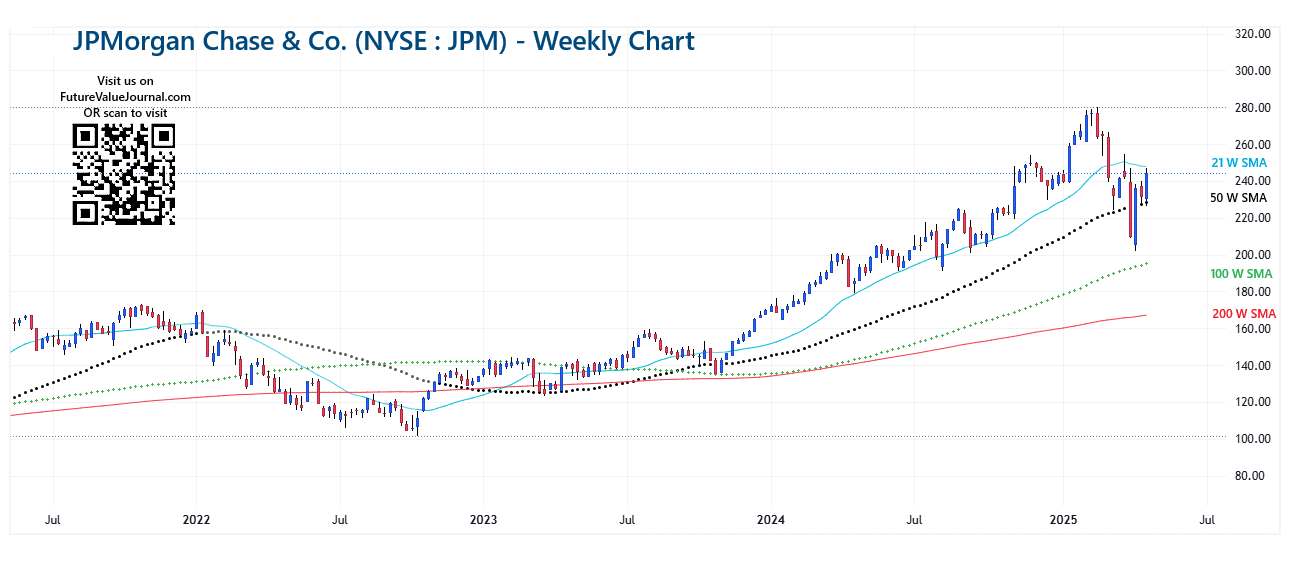

View Weekly Chart (Every candle represents NYSE : JPM share’s trading session of one week. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular week) | On Weekly time-frame, we can observe that JPMorgan Chase stock is trading Above all the 50 Weeks, 100 Weeks SMA & 200 Weeks SMAs but BELOW 21 Weeks SMA. This is the clear sign of Bullish trend in Long term. |

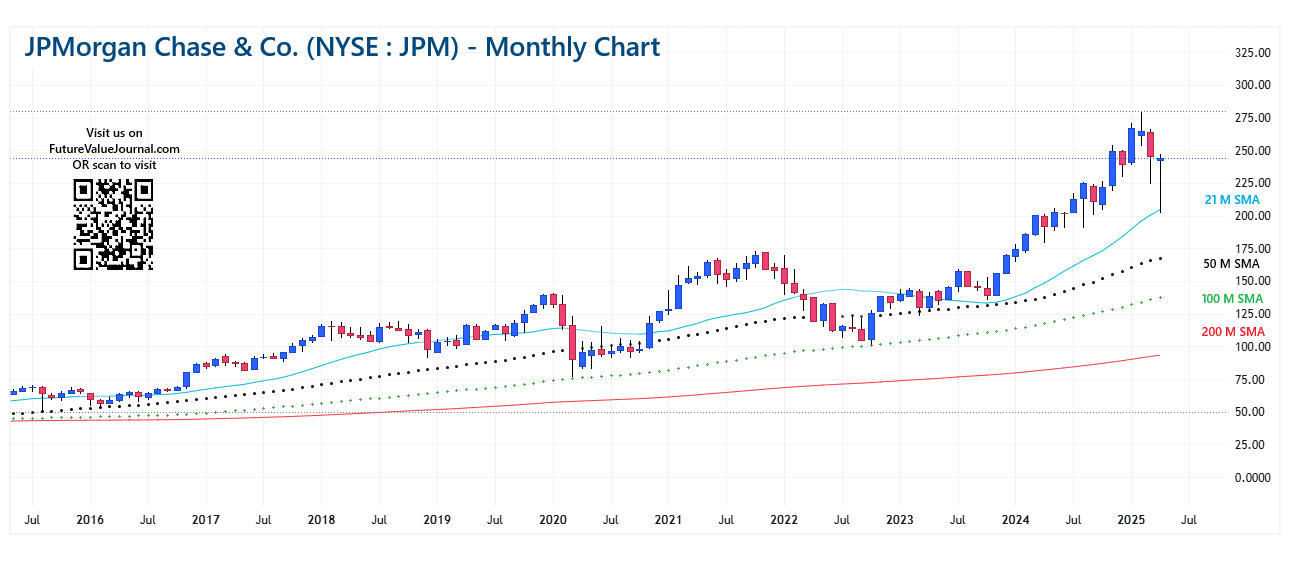

View Monthly Chart (Every candle represents NYSE : JPM stock’s trading session of one month. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular month) | On Monthly time-frame, we can observe that JPMorgan Chase stock is trading Above all the 21 Months, 50 Months, 100 Months & 200 Months SMAs. This indicates that the JPM stock is in Bullish trend for Very Long term. |

View Yearly Chart (Every candle represents NYSE : JPM stock’s trading session of one year. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular year) | In the yearly chart also, we can clearly see that JPMorgan Chase has given positive returns to its long term investor continuously since 2016. |

The major support can be seen at the levels around $200. If we go for the directional analysis of the SMAs, we can see a clear Bullish trend in SMAs directions in multiple timeframes.

Dow Jones, NASDAQ & JPMorgan Chase : A comparative Analysis

Check out the comparative year on year returns of Dow Jones, NASDAQ and JPM. Here, we are showing the returns by comparing them on closing basis –

| Year | Dow Jones | NASDAQ | JPM |

|---|---|---|---|

| 2024 | +12.88% | +28.64% | +40.92% |

| 2023 | +13.70% | +43.42% | +26.85% |

| 2022 | -8.78% | -33.10% | -15.31% |

| 2021 | +18.73% | +21.39% | +24.62% |

| 2020 | +7.25% | +43.64% | -8.85% |

Here in the above table, we can clearly see that their is a correlation between Dow, Nasdaq & JPMorgan Chase stock. So, before taking medium to long term trade you should consider overall market conditions also.

Also Read : SoFi Technologies | SOFI Stock Price Prediction 2025 to 2050 🚨

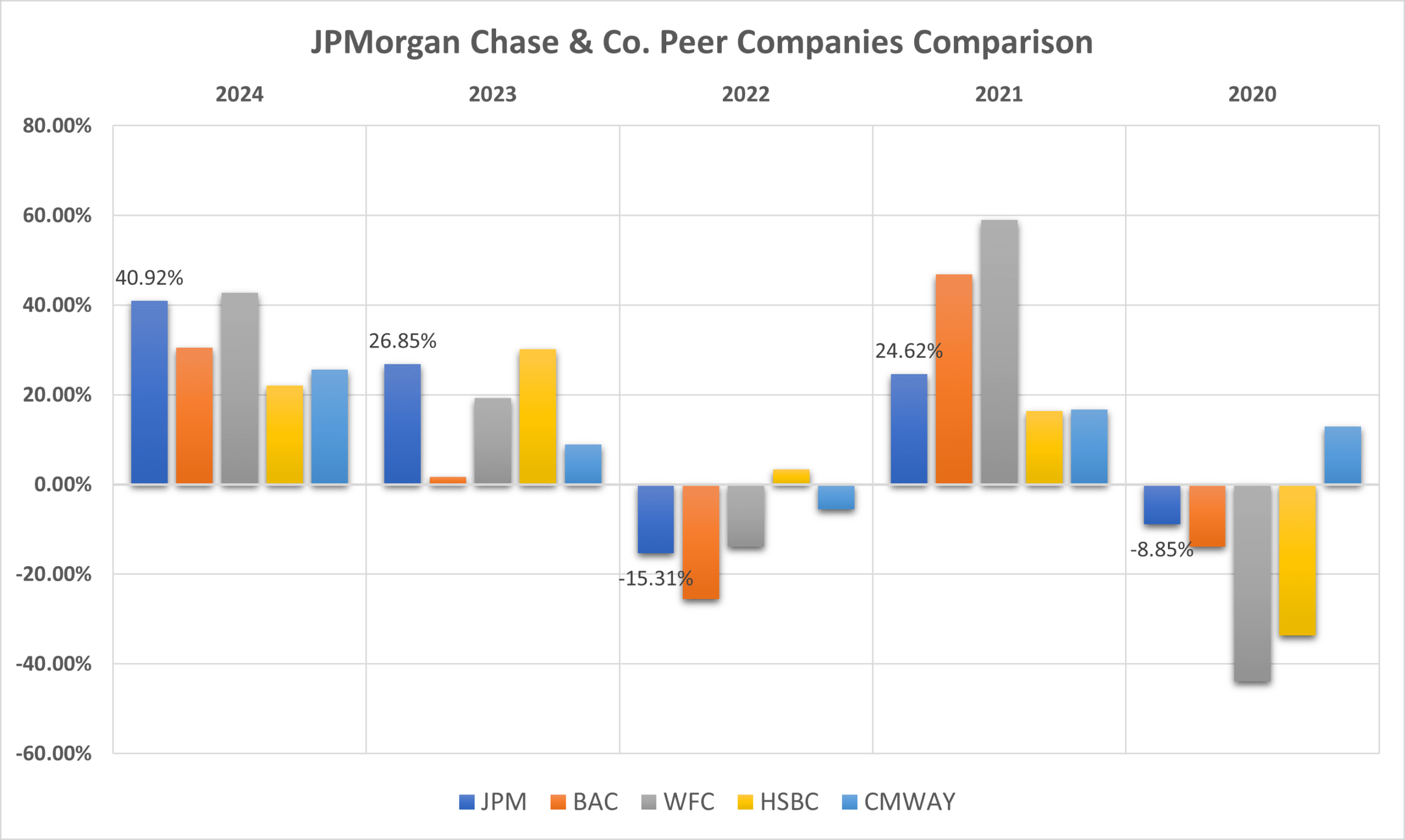

JPMorgan Chase Peer Comparison / Competitors Analysis

We will compare JPMorgan Chase & Co. (NYSE : JPM) to its peer companies. We will see how its top competitors performed year-on-year . Below is the comparative table of Bank of America Corp. (BAC), Wells Fargo & Company (WFC), HSBC Holdings plc (HSBC), Commonwealth Bank of Australia (CMWAY)’s returns from 2020 to 2024 based on CLOSING Prices.

| Year | JPM | BAC | WFC | HSBC | CMWAY |

|---|---|---|---|---|---|

| 2024 | +40.92% | +30.53% | +42.71% | +22.00% | +25.55% |

| 2023 | +26.85% | +1.66% | +19.21% | +30.10% | +8.95% |

| 2022 | -15.31% | -25.56% | -13.94% | +3.35% | -5.51% |

| 2021 | +24.62% | +46.78% | +58.98% | +16.36% | +16.68% |

| 2020 | -8.85% | -13.94% | -43.90% | -33.72% | +12.86% |

| Average Returns | +13.64% | +7.88% | +12.61% | +7.61% | +11.70% |

JPMorgan Chase has given a positive returns of +13.64% to its long-term investors if we look at the 5 years average returns. Since all the peer companies gave similar returns to their investors, it looks like an industry standard.

JPM Stock Forecast : Short & Long Term

JPM Stock Forecast 2025, 2026, 2027, 2028, 2029

| Year | Stock Price Target |

|---|---|

| JPM stock forecast for 2025 | $ 270.87 |

| JPM stock forecast for 2026 | $ 306.08 |

| JPM stock forecast for 2027 | $ 345.86 |

| JPM stock forecast for 2028 | $ 390.84 |

| JPM stock forecast for 2029 | $ 441.65 |

- In 2025, we project JPMorgan Chase & Co. (NYSE: JPM) stock could reach around $270.87, which would represent a 13.00% increase from its 2024 closing price of $239.71.

- Looking ahead to 2026, JPMorgan Chase might rise to $306.08, showing a 27.65% gain.

- By 2027, the stock may climb to $345.86, marking a strong 44.26% increase.

- Moving into 2028, we anticipate JPMorgan Chase could reach $390.84, reflecting a 63.10% gain.

- Finally, by 2029, the stock could hit $441.65, representing a 84.20% surge from its 2024 closing price.

JPM Stock Price Forecast 2030, 2035, 2040, 2050

| Year | Stock Price Target |

|---|---|

| JPM stock forecast for 2030 | $ 499.06 |

| JPM stock forecast for 2035 | $ 919.49 |

| JPM stock forecast for 2040 | $ 1694.10 |

| JPM stock forecast for 2045 | $ 2762.19 |

| JPM stock forecast for 2050 | $ 5750.76 |

- By 2030, our long-term analysis forecasts JPMorgan Chase’s stock price could reach $499.06, which would represent a 108.20% increase from its 2024 closing price of $239.71.

- Looking ahead to 2035, we estimate JPMorgan Chase stock could rise to $919.49, showing a remarkable 283.54% return.

- By 2040, the stock is expected to surge to $1,694.10, reflecting a substantial 606.40% gain.

- By 2045, JPMorgan Chase could climb to $2,762.19, marking an outstanding 1052.17% increase.

- Further into the future, by 2050, we forecast JPMorgan Chase stock could hit $5,750.76, indicating an impressive 2298.92% rise from its 2024 closing price.

JPM Stock Price Prediction 2025 (month-wise)

| Month | Stock Price Target |

|---|---|

| JPM stock price prediction for March 2025 | $255.09 |

| JPM stock price prediction for April 2025 | $259.53 |

| JPM stock price prediction for May 2025 | $261.08 |

| JPM stock price prediction for June 2025 | $263.92 |

| JPM stock price prediction for July 2025 | $265.19 |

| JPM stock price prediction for August 2025 | $267.65 |

| JPM stock price prediction for September 2025 | $269.41 |

| JPM stock price prediction for October 2025 | $270.87 |

| JPM stock price prediction for November 2025 | $268.33 |

| JPM stock price prediction for December 2025 | $264.14 |

As per our analysis of JPMorgan Chase stock price, we are expecting that the prices may rise up to $270.87, offering an approximate 13.00% return on its 2024 closing price of $239.71. This represents a DECENT return (ROI) for investors.

Also Read : 💻Palantir Technologies | PLTR Stock Price Forecast 2025-2050 with Complete Analysis

Conclusion

JPMorgan Chase & Co. (NYSE: JPM), founded in 2000, stands as a pillar in the global financial sector. With a robust market capitalization of $672.77 billion and Vanguard Group holding approximately 9.7% of its shares, JPM shows strong institutional backing and long-term confidence. The stock continues to align with major market indices and delivers performance in line with industrial averages.

Technical analysis across multiple timeframes suggests a bullish trend, making it a reliable pick for patient investors. Based on our long-term forecast, JPM stock has the potential to reach around $5,750 per share by 2050, offering significant growth for those looking at long-term wealth creation.

Frequently Asked Questions (FAQs)

1) Will JPMorgan Chase stock price reach $500?

As per our current analysis, we can expect the $500 per share price of JPMorgan Chase during 2030-2031.

2) Is JPMorgan Chase a good stock to buy, sell or hold?

In our opinion, currently JPMorgan Chase is a good stock to HOLD as well as some new Buy. Since it is a ‘Too Big To Fail’ company, it can give some decent returns to its investors in the long run.

3) What is the JPM stock forecast for 2030?

In 2030, we are expecting JPMorgan Chase stock price to reach around $499.06.

4) What is the JPM stock forecast for 2050?

During 2050, we might see JPMorgan Chase stock price to hit $5,750.76.

5) What is the JPM stock forecast for 2025?

As per current market conditions, JPMorgan Chase stock price could reach up to $270.87 per share in 2025.

6) What is the JPM stock price prediction for 2026?

In 2026, we are expecting JPMorgan Chase stock price to reach around $306.08.

7) What is the JPM stock forecast for 2027?

In 2027, we are expecting JPMorgan Chase stock price to reach around $345.86.

8) What is the JPM stock price prediction for 2028?

In 2028, we are expecting JPMorgan Chase stock price to reach around $390.84.

9) What is the JPM stock forecast for 2029?

In 2029, we are expecting JPMorgan Chase stock price to reach around $441.65.

Disclaimer : Not an Investment Advice

The content shared here in “JPMorgan Chase & Co. – JPM stock forecast 2025-2050 with detailed analysis” is for general information only. The stock price forecasts provided here are based on current market conditions which are subject to change with respect to change in market scenario. It’s not intended as financial, investment, or professional advice. Always consult a qualified professional—whether legal, financial, or tax-related—before making any investment decisions.

Definitely imagine that which you stated. Your favourite justification seemed to be at the net the simplest thing to consider of. I say to you, I definitely get annoyed while people think about issues that they plainly do not realize about. You controlled to hit the nail upon the top as smartly as outlined out the entire thing without having side effect , other people can take a signal. Will probably be again to get more. Thank you

What i do not realize is actually how you are not really much more well-liked than you might be now. You’re so intelligent. You realize thus significantly relating to this subject, made me personally consider it from so many varied angles. Its like men and women aren’t fascinated unless it is one thing to do with Lady gaga! Your own stuffs outstanding. Always maintain it up!

Excellent post. I was checking constantly this blog and I am inspired! Extremely useful information specially the closing section 🙂 I maintain such info a lot. I was seeking this particular information for a long time. Thank you and best of luck.