📈 Laser Photonics | LASE stock forecast 2025 to 2050 with Analysis

➡️ 30 Seconds Summary ⬅️

Laser Photonics (LASE) is a company that creates advanced laser technology used in various industries, like aerospace, automotive, defense, and healthcare. They specialize in laser systems for cleaning, cutting, and engraving, offering solutions that are both affordable and environmentally friendly.

In this article “LASE stock forecast” we are going to analyze LASE stock price past performance and on the basis of which we will estimate its future prices. Their products help businesses work faster, more precisely, and more efficiently. Laser Photonics is known for its innovation and continues to develop new ways for companies to reduce costs and improve productivity through the use of laser technology.

About Laser Photonics Corporation (LASE)

| Company Name | Laser Photonics Corporation |

| Stock Exchange | Nasdaq |

| Ticker Symbol | LASE |

| Sector | Miscellaneous (Industrial Machinery) |

| Headquarter | Orlando, Florida |

| Founded in | 1981 |

| Major Shareholder | Geode Capital Management, LLC |

| Market Cap. | $ 0.21 billion usd |

| Revenue(2023) | $ 3.39 million usd |

| Total Assets | $ 10.29 million usd |

| All-time high closing price | $ 19.80 usd (Sept 23, 2024) |

| 52-week low | $ 0.67 usd (Nov. 20, 2023) |

| 52-week high | $ 19.80 usd |

| Peer Companies | Realbotix Corp. (XBOTF), Greenland Technologies Holding Corp. (GTEC), Nephros Inc. (NEPH), LiqTech International Inc. (LIQT), Markforged Holding Corp. (MKFG) |

Laser Photonics Corporation is a leading U.S.-based manufacturer specialized in industrial laser systems. It is founded in 1981. The company is known for its innovative solutions in laser cleaning, cutting, and marking technologies. Its products are widely used in industries such as aerospace, automotive, defense, and manufacturing, where precision and efficiency are very important. Laser Photonics focuses on providing environmentally friendly, cost-effective alternatives to traditional industrial processes, like chemical cleaning and abrasive blasting. The company’s laser cleaning technology, in particular, has gained attention for its ability to remove rust, paint, and other contaminations from surfaces without damaging the original material or producing harmful waste.

Laser Photonics continues to expand its product portfolio and global presence. It is listed on the NASDAQ under the ticker symbol “LASE”. The company aims to capitalize on the growing demand for laser-based technologies across various sectors, positioning itself for long-term growth in the industrial laser market.

Laser Photonics (Nasdaq : LASE) | Past, Present & Future

Laser Photonics (LASE) | Historical price analysis

| Year | Open | High | Low | Close | % Change |

|---|---|---|---|---|---|

| 2024 | 1.19 | 19.80 | 0.98 | 5.78 | +398.83% |

| 2023 | 2.05 | 7.23 | 0.67 | 1.18 | -42.16% |

| 2022 | 5.00 | 5.50 | 1.50 | 2.04 | -59.02% |

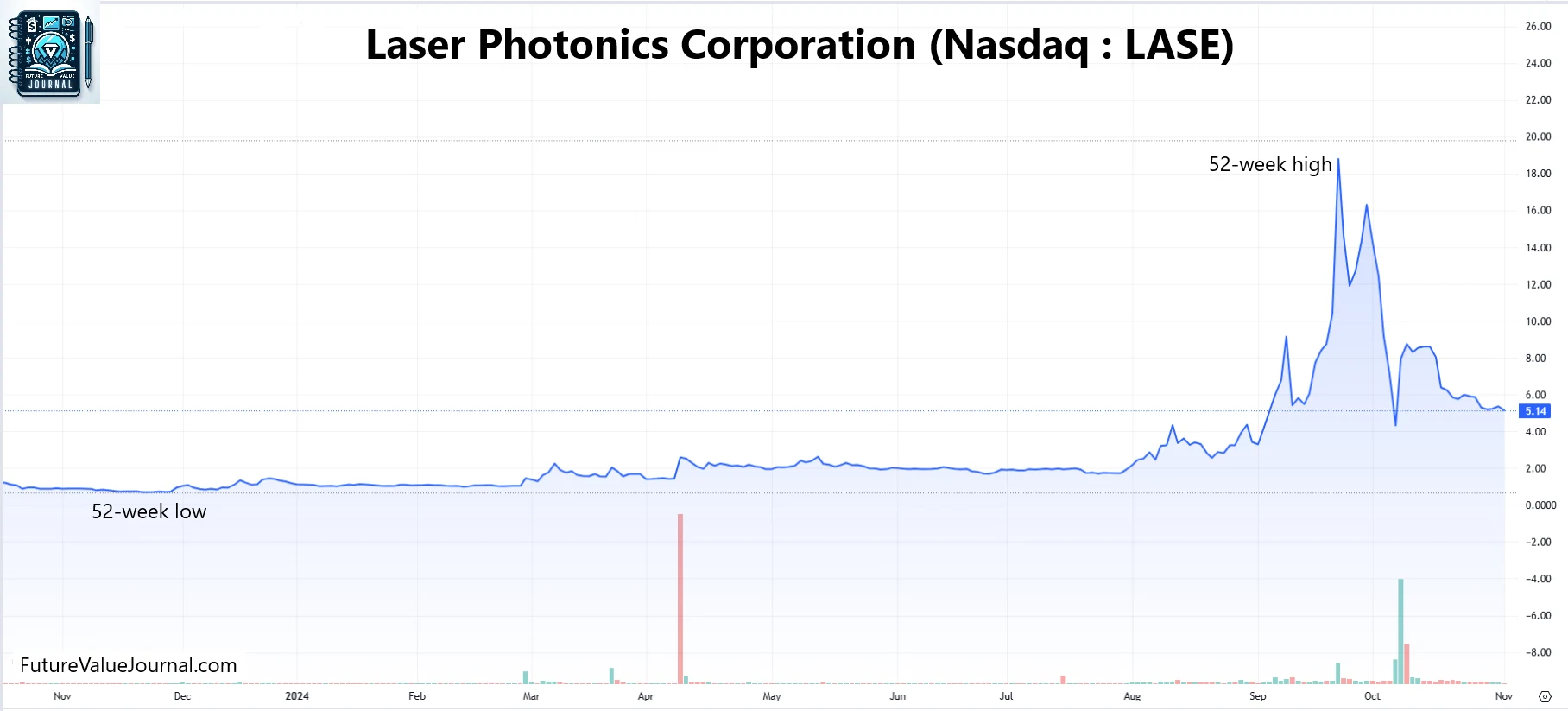

In the above graph, we can clearly see that LASE stock price gave little positive but more negative results to its investors if we analyze it on monthly basis. Although, the recent breakout tell a totally different story. LASE stock price hit its all-time high of $19.80 recently. Let’s see where this new breakout takes the stock.

Also Read : Lucid (LCID) stock forecast for 2025 to 2050 : You should know

One year chart analysis for LASE stock forecast 2025

Here, in LASE’s one year chart, we can interpret that the stock remained hibernated for whole time and suddenly started booming at rocket speed in September 2024. LASE stock price broke its range in August 2024, but dropped a little for a correction. Then in Sept., the stock price hit its All Time High of $19.80. On the basis of that, we prepared monthly LASE stock forecast for 2025.

LASE Stock Live Chart

Before we start looking at the future values of LASE Stock Prices, have a close look at the current chart so we can understand where it is heading in future.

Time-Frame analysis of LASE : Hourly, Daily & Weekly

By a technical chart analysis of Simple Moving Averages (SMAs) on different timeframes, we can observe the following –

Time Frame | Observation |

|---|---|

(Every candle represents Nasdaq : LASE share’s trading session of one Daily. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular daily) | On the Daily time-frame LASE stock is trading BELOW 21 Days , 50 Days, 100 Days, 200 Days SMAs. This indicates that LASE stock has a Sideways to Negative sentiment in medium term. |

(Every candle represents Nasdaq : LASE share’s trading session of one Week. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular week) | On Weekly time-frame, we can observe that LASE stock is trading BELOW 21 Weeks & 50 Weeks SMAs. This is the sign of Sideways to Bearishness in Long term. |

(Every candle represents Nasdaq : LASE stock’s trading session of one Month. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular Month) | On Monthly time-frame, we can observe that LASE stock is trading at 21 Month SMAs. This indicates that the LASE stock is in Sideways for Very Long term. |

The major support can be seen at the levels between $3.20 – $0.70. Getting advice from a trusted financial adviser or stockbroker about EV industry can help you deepen your understanding of the market and create a strong investment strategy.

Dow Jones, NASDAQ & LASE : A comparative Analysis

Check out the comparative year on year returns of Dow Jones, Nasdaq and Laser Photonics Corporation. Here, we are showing the returns by comparing them on closing basis –

| Year | Dow Jones | Nasdaq | LASE |

|---|---|---|---|

| 2024 | +12.88% | +28.64% | +398.83% |

| 2023 | +13.70% | +43.42% | -42.16% |

| 2022 | -8.78% | -33.10% | -59.02% |

| 2021 | +18.73% | +21.39% | – |

| 2020 | +7.25% | +43.64% | – |

Also Read : CrowdStrike | CRWD Stock Price Prediction 2025, 2030, 2040, 2050

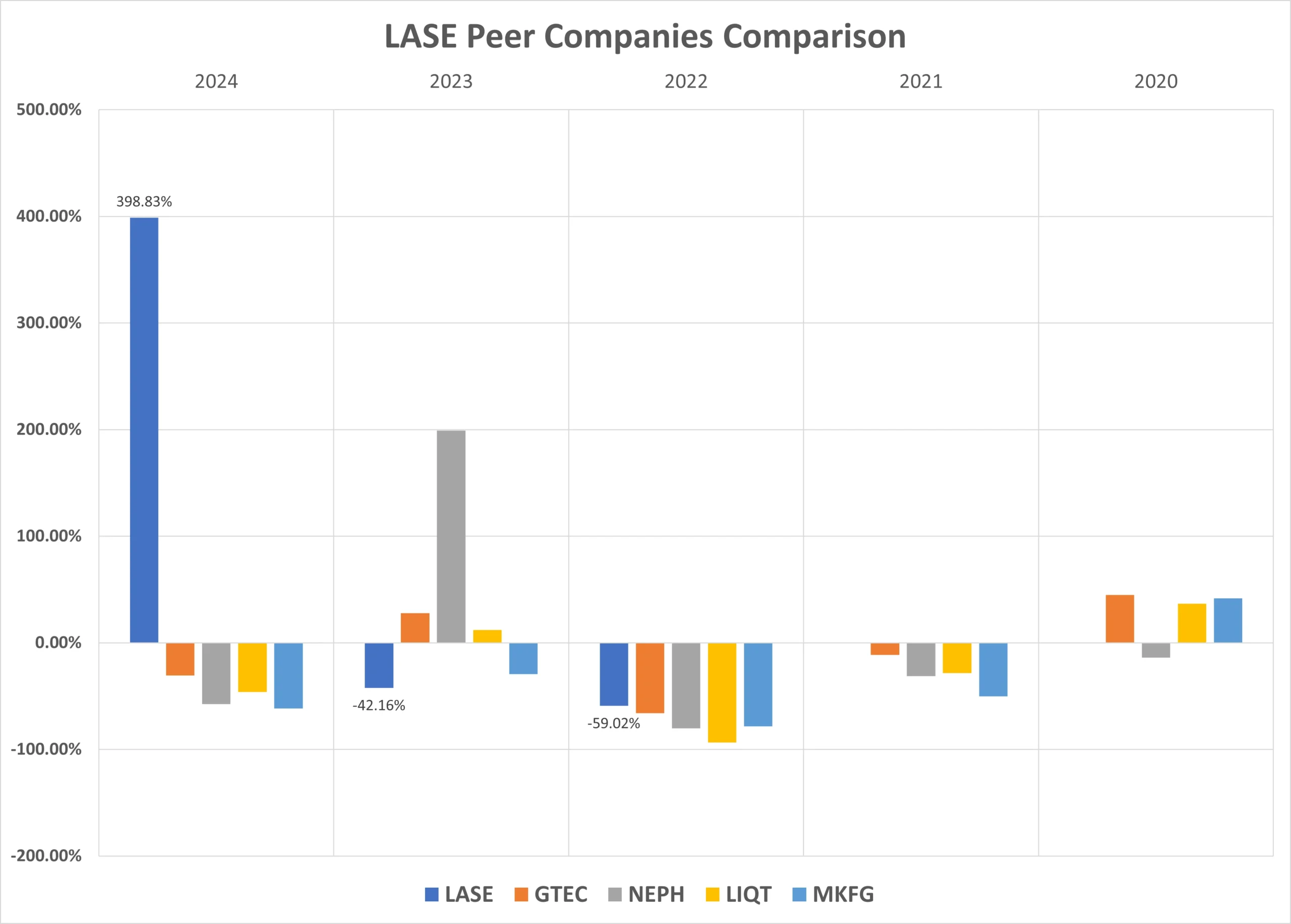

LASE Peer Comparison / Competitors Analysis

We will compare Laser Photonics Corporation (Nasdaq : LASE) to its top competitors. We will see how its peer companies performed year-on-year . Below is the comparative table of Greenland Technologies Holding Corp. (GTEC), Nephros Inc. (NEPH), LiqTech International Inc. (LIQT), Markforged Holding Corp. (MKFG)’s returns from 2020 to 2024 based on CLOSING Prices.

| Year | LASE | GTEC | NEPH | LIQT | MKFG |

|---|---|---|---|---|---|

| 2024 | +398.83% | -30.47% | -57.51% | -45.96% | -61.71% |

| 2023 | -42.16% | +27.98% | +199.00% | +12.17% | -29.31% |

| 2022 | -59.02% | -66.10% | -80.39% | -93.36% | -78.40% |

| 2021 | – | -11.19% | -31.24% | -28.50% | -50.14% |

| 2020 | – | +44.80% | –13.77% | +36.75% | +41.66% |

| Average Returns | +99.21% | -6.99% | +3.22% | -23.78% | -35.58% |

LASE Stock Forecast : Short & Long Term

LASE Stock Forecast 2025, 2026, 2027, 2028, 2029

| Year | Stock Price Target |

|---|---|

| LASE stock forecast for 2025 | $ 5.33 |

| LASE stock forecast for 2026 | $ 8.67 |

| LASE stock forecast for 2027 | $ 15.74 |

| LASE stock forecast for 2028 | $ 24.14 |

| LASE stock forecast for 2029 | $ 32.13 |

- By 2025, we expect the LASE stock price to reach around $5.33, representing a 70.8% increase from its current price of $3.12 (as of April 01, 2025).

- Looking ahead to 2026, we predict that LASE could rise to $8.67, a 178% gain, showing further growth.

- By 2027, we expect the stock to climb to $15.74, marking an impressive 404.5% increase.

- Moving forward to 2028, we anticipate the stock could reach $24.14, reflecting a 674% gain.

- Finally, by 2029, LASE could hit $32.13, representing a substantial 929.8% increase from today’s price of $3.12.

LASE Stock Forecast 2030, 2035, 2040, 2050

| Year | Stock Price Target |

|---|---|

| LASE stock forecast for 2030 | $ 37.78 |

| LASE stock forecast for 2035 | $ 43.14 |

| LASE stock forecast for 2040 | $ 52.11 |

| LASE stock forecast for 2050 | $ 78.37 |

- By 2030, our long-term analysis forecasts LASE stock price reaching $37.78, which would represent a significant 1,110.9% increase from today’s price of $3.12 as on April 01, 2025.

- Looking ahead to 2035, we estimate LASE stock price could reach $43.14, which would represent a remarkable 1,282.7% return.

- By 2040, we expect the stock to rise to $52.11, reflecting a substantial 1,570.2% gain from the current price.

- Further into the future, in 2050, we anticipate LASE stock price could hit $78.37, indicating an impressive 2,411.9% increase from its current price.

LASE Stock Price Prediction 2025 (month-wise)

| Month | Stock Price Target |

|---|---|

| LASE stock price prediction for March 2025 | $3.65 |

| LASE stock price prediction for April 2025 | $3.79 |

| LASE stock price prediction for May 2025 | $3.85 |

| LASE stock price prediction for June 2025 | $4.02 |

| LASE stock price prediction for July 2025 | $4.19 |

| LASE stock price prediction for August 2025 | $4.33 |

| LASE stock price prediction for September 2025 | $4.76 |

| LASE stock price prediction for October 2025 | $5.33 |

| LASE stock price prediction for November 2025 | $5.01 |

| LASE stock price prediction for December 2025 | $4.62 |

As per our analysis of LASE stock price, we are expecting that the prices may rise up to $5.33, offering an approximate 70.80% return on its current price of $3.12 as of April 01, 2025. This represents a whooping return (ROI) for investors. Starting in early 2025, we anticipate a gradual and steady fall in LASE’s stock price. Around mid-2025, this upward trend could pick up pace. However, by October to November 2025, we might see the stock dip again, which aligns with patterns observed in previous charts.

Also Read : CrowdStrike | CRWD Stock Price Prediction 2025 – 2050

Conclusion

Laser Photonics (Nasdaq : LASE), founded in 1981, has demonstrated remarkable growth in the stock market. After reaching an all-time high of $19.80, the stock delivered an impressive +398.83% return in 2024, significantly outperforming many of its peer companies. While LASE is currently trading sideways when analyzed across multiple timeframes, its long-term potential remains strong. Given its historical performance and future growth projections, our analysts predict that LASE could reach $78 by 2050, offering fantastic returns for long-term investors.

Frequently Asked Questions (FAQs)

1) Will LASE stock price reach $100?

As per our current analysis, it will be really hard for LASE stock price to reach $100 in coming years. But if market conditions become favorable or Laser photonics innovate some groundbreaking tech, we can expect this price also.

2) Is LASE a good stock to buy, sell or hold?

In our opinion, it doesn’t look like a Buy or Hold. If you want to hold this stock for longer period, you can sell half of your holdings in profits and hold rest of it to see what this new breakout have for you.

3) What is the LASE stock forecast for 2030?

In 2030, we are expecting LASE stock price to reach around $36.

4) What is the LASE stock forecast for 2050?

During 2050, we can see LASE stock price to hit $78. Although it can worth way more than that if it continues to innovate new tech in Industrial machinery.

5) Is Laser Photonics Corp. a long term investment?

Its neither Yes nor No. Because LASE stock prices gave breakout recently, every other guy is thinking about investing in it to get rich quick. But in our opinion, if you are thinking for longer term, their are many more better options available.

6) Is Laser Photonics stock public?

Yes, many people are unaware of this, but Laser Photonics is a publicly traded corporation.

7) What is the LASE stock price prediction for 2025?

As per current market conditions, LASE stock price could reach up to $5.33 per share in 2025.

Disclaimer : Not an Investment Advice

The content shared here in “📈 Laser Photonics | LASE stock forecast 2025 to 2050 with Analysis” is for general information only. It’s not intended as financial, investment, or professional advice. Always consult a qualified professional—whether legal, financial, or tax-related—before making any investment decisions.

6 Comments