📳 MicroStrategy Incorp. | MSTR Stock Forecast 2025 to 2050

👉 30 Seconds Summary 👈

MicroStrategy Incorporated (Nasdaq : MSTR) is a strong entity in the tech sector, offering promising growth potential for long-term investors. Our analysis of its fundamentals, technical trends, and the broader market outlook suggests that MSTR’s stock price could reach around $390.74 by 2025, $942.47 by 2030, $1,417.34 by 2035, $2,074.17 by 2040, and possibly $3,577.62 by 2050.

Looking to explore the future of MicroStrategy Inc.? This “MSTR stock forecast for 2025 to 2050” article provides insights into where this technology and cryptocurrency-driven company might be headed. It is well known for its substantial Bitcoin (BTC) holdings and pioneering data analytics solutions.

Due to this, MicroStrategy has caught the attention of investors worldwide. In this article, we’ll also analyze the MSTR stock forecast, considering key factors such as Bitcoin’s market performance, the company’s financial health, and trends in the tech industry.

Whether you’re a seasoned investor or new to the stock market, understanding these forecasts can help you make informed decisions about adding MSTR to your portfolio. Read on to discover what could shape MicroStrategy’s future and what the stock might look like by 2050.

About MicroStrategy Incorporated (Nasdaq : MSTR)

| Company Name | MicroStrategy Incorporated |

| Stock Exchange | NASDAQ |

| Ticker Symbol | MSTR |

| Sector | Technology |

| Headquarter | Virginia, U.S. |

| Founded in | 1989 |

| Major Shareholder | Saylor Michael J (~10.94%) |

| Market Cap. | $ 54.82 billion usd |

| Revenue(2023) | $ 496.02 million usd |

| Total Assets | $ 4.75 billion usd |

| All-time high | $ 543.00 usd (Nov 21, 2024) |

| 52-week high | $ 543.00 usd (Nov 21, 2024) |

| 52-week low | $ 101.00 usd (May 01, 2024) |

| Peer Companies | AppLovin Corporation (APP), Cadence Design Systems Inc. (CDNS), Synopsys Inc. (SNPS), Workday Inc. (WDAY) |

MicroStrategy Incorporated (Nasdaq : MSTR) is a prominent player in the technology sector, known for its focus on business intelligence, data analytics, and, more recently, substantial investments in Bitcoin (BTC). It is headquartered in Virginia, U.S., the company was founded in 1989 and has since become an influential name in tech. Michael Saylor, the company’s co-founder, remains its largest shareholder, holding approximately 10.94% of shares. As of 2024, MicroStrategy has a market capitalization of $54.82 billion USD, with annual revenue reaching $496.02 million USD. The company’s total assets stand at $4.75 billion USD.

Over the past year, MSTR stock hit an All-time high of $543.00 on November 21, 2024, with a 52-week range between $543.00 and a low of $43.87 on January 23, 2024. These fluctuations highlight the stock’s volatility, partly driven by the company’s significant Bitcoin holdings.

MicroStrategy Inc. (MSTR) | Past, Present & Future

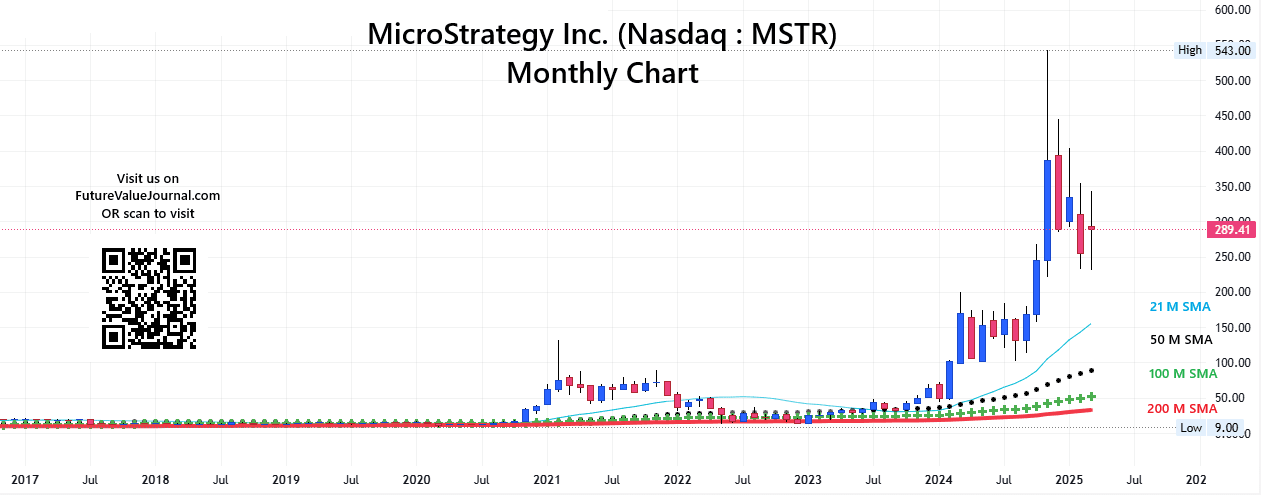

MicroStrategy Inc. | Historical price data analysis

Here in the above 15 Year annual percentage change chart, we can observe that MSTR share price gave mostly positive returns to the investors. In 2020, it’s price got incremented by +172.41%. But again in 2022 it gave a negative return of -74%. In 2023, MSTR stock price gained its value by +346.15% when compared to previous year.

Since, the current trend of the MSTR stock is highly positive but it is trading really far from all the averages when analyzed in short time-frame, which is a sign of temporary volatility. So, as per our analysis, it would be better if you take some time before investing into it. We have provided more detailed analysis below which can help you better understand about your investment decision regarding MicroStrategy stock.

Also Read : 🛍️ Etsy Inc | ETSY stock forecast 2025, 2030 and beyond

MSTR Stock’s One year chart analysis

Above is the MicroStrategy Incorporated stock’s live chart (with 10-for-1 split of August 2024) for you. Have a look and observe the patterns which MSTR stock created in the past. Below are the future value prediction for the stock, compare them with the above chart to get a clear idea about your investment decision.

In one year MSTR stock price chart (without considering 10-for-1 split), we can observe that after hitting its 52-week low of $43.87 on January 23, 2024 the stock began to rise with slight uptrend till Feb 2024.But from February, MSTR stock began to trade in a clear uptrend which is continuing till April 2024 and touched a high of $191.92.

From April, 2024, we have seen a range bound trend in MSTR stock where it traded between $191.92 to $101 till September end. But on October 04, 2024, MSTR broke this range and after testing the breakout, it rallied to its new high of $543.00 on November 21, 2024.

By this, we can anticipate that, the MSTR stock might trade in sideways to up trend for some time. From all these analysis, we formulated the month-wise MSTR stock price prediction for 2025 below.

Also Read : [🛩️] Spirit Airlines Inc | SAVE stock forecast 2025, 2030 to 2050

Time-Frame analysis of MicroStrategy Inc. : Hourly, Daily & Weekly

Relying on just one prediction method may not give a complete picture. By combining various approaches and expert opinions, you can get a better sense of MSTR’s potential, whether you’re looking for short-term opportunities or long-term growth. As by a simple technical chart analysis we can observe the following –

| Time Frame | Observation |

|---|---|

View Daily Chart (Every candle represents Nasdaq : MSTR share’s trading session of one Daily. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular daily) | On the Daily time-frame MSTR stock is trading BELOW 50 Days & 100 Days & ABOVE 21 Days & 200 Days SMAs. This indicates that MSTR stock has a Sideways sentiment in medium term.. |

View Weekly Chart (Every candle represents Nasdaq : MSTR share’s trading session of one Week. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular week) | On Weekly time-frame, we can observe that MSTR stock is trading BELOW 21 Weeks SMA BUT ABOVE 50 Weeks, 100 Weeks & 200 Weeks SMA. This is the sign of Sideways to Bullishness in Long term. |

View Monthly Chart (Every candle represents Nasdaq : MSTR stock’s trading session of one Monthly. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular Monthly) | On Monthly time-frame, we can observe that MSTR stock is trading ABOVE 21 Month, 50 Month, 100 Month as well as 200 Month SMAs. This indicates that the MSTR stock is in clear Up trend for Very Long term. |

Getting advice from a trusted financial adviser or stockbroker can help you deepen your understanding of the market and create a strong investment strategy. Staying informed about the latest news in the e-commerce industry can also provide helpful insights to guide your investment decisions for MicroStrategy Inc.

Dow Jones, NASDAQ & MicroStrategy Inc. : A comparative Analysis

Check out the comparative year on year returns of Dow Jones, Nasdaq and MSTR. Here, we are showing the returns by comparing them on closing basis –

| Year | Dow Jones | Nasdaq | MSTR |

|---|---|---|---|

| 2024 | +12.88% | +28.64% | +358.54% |

| 2023 | +13.70% | +43.42% | +346.15% |

| 2022 | -8.78% | -33.10% | -74.00% |

| 2021 | +18.73% | +21.39% | +40.13% |

| 2020 | +7.25% | +43.64% | +172.42% |

Also Read : CrowdStrike | CRWD Stock Price Prediction 2025, 2030, 2040, 2050

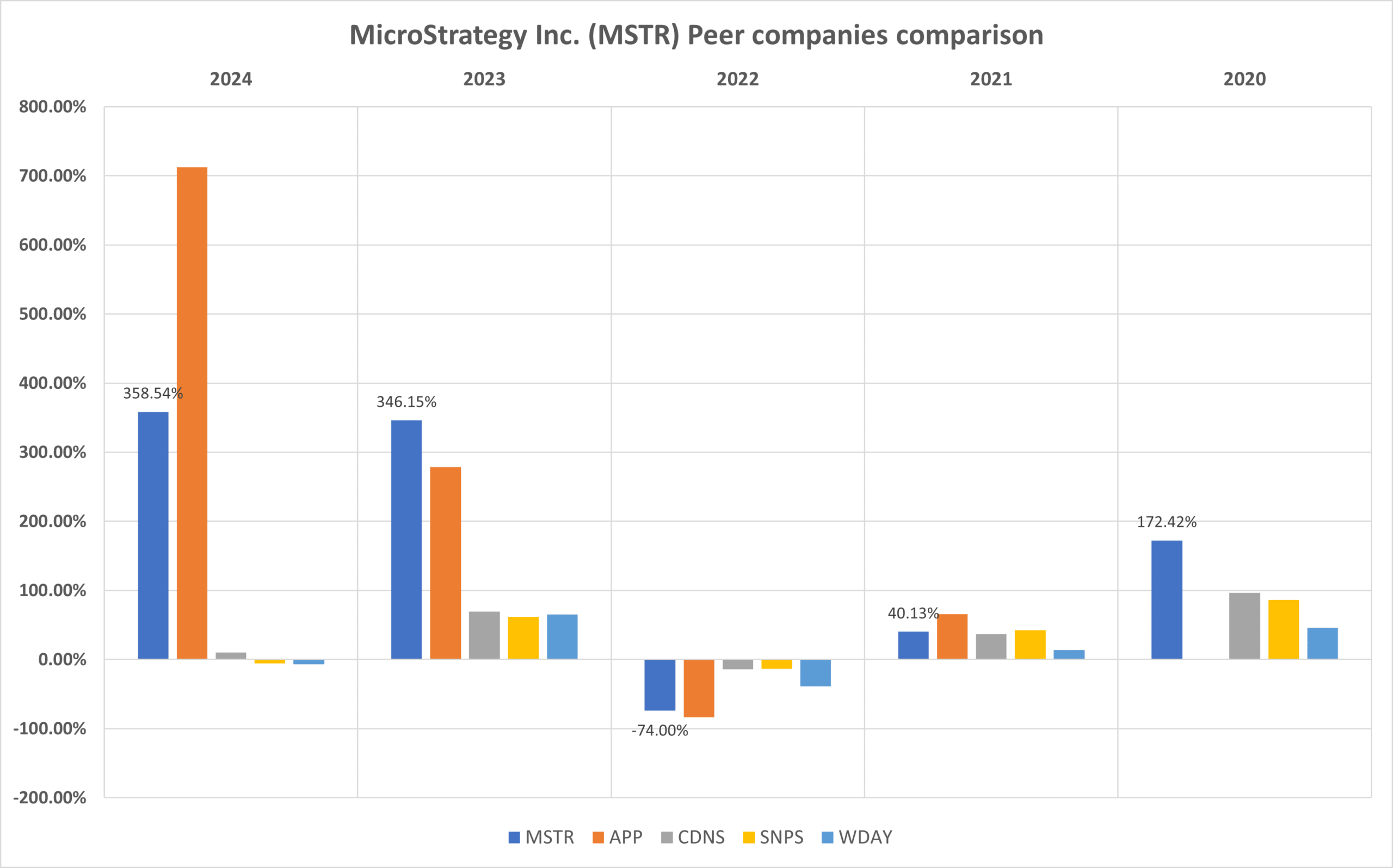

MSTR Peer Comparison / Competitors Analysis

We will compare MicroStrategy Inc. (Nasdaq : MSTR) to its top competitors. We will see how its peer companies performed year-on-year . Below is the comparative table of AppLovin Corporation (APP), Cadence Design Systems Inc. (CDNS), Synopsys Inc. (SNPS), Workday Inc. (WDAY’s returns from 2020 to 2024 based on CLOSING Prices.

| Year | MSTR | APP | CDNS | SNPS | WDAY |

|---|---|---|---|---|---|

| 2024 | +358.54% | +712.62% | +10.31% | -5.74% | -6.53% |

| 2023 | +346.15% | +278.44% | +69.55% | +61.27% | +64.98% |

| 2022 | -74.00% | -83.73% | -13.80% | -13.35% | -38.75% |

| 2021 | +40.13% | +65.84% | +36.59% | +42.15% | +14.01% |

| 2020 | +172.42% | – | +96.70% | +86.24% | +45.70% |

| Average Returns | +167.77% | +243.29% | +39.87% | +34.11% | +15.88% |

Here we can observe that MSTR stocks’ performance is MIND-BLOWING when compared to its peer companies if we look at the 5-year average returns. We considered 4 YEAR average returns for APP, since it got listed in 2021.

MSTR Stock Forecast : Short & Long Term

MSTR Stock Forecast 2025, 2026, 2027, 2028, 2029

| Year | MSTR Price Target |

|---|---|

| MSTR stock price prediction for 2025 | $ 390.74 |

| MSTR stock price prediction for 2026 | $ 470.39 |

| MSTR stock price prediction for 2027 | $ 540.87 |

| MSTR stock price prediction for 2028 | $ 617.55 |

| MSTR stock price prediction for 2029 | $ 794.85 |

Based on these predictions, MicroStrategy Incorporated (Nasdaq: MSTR) stock could see significant growth in the coming years. Starting from its current price of $289.41 (as of March 28, 2025), here’s a breakdown of the expected price and percentage increase each year through 2029:

- 2025: The stock price is projected to reach $390.74, reflecting a 35.01% increase from today’s price of $289.41.

- 2026: The estimated price is $470.39, marking a 62.53% rise from today’s price.

- 2027: The forecasted price is $540.87, showing an 86.89% gain from today’s price.

- 2028: The anticipated price is $617.55, indicating a 113.38% increase from today’s price.

- 2029: The stock is expected to hit $794.85, representing a massive 174.64% surge compared to today’s price of $289.41.

These predictions suggest a strong upward trend for MSTR stock, which could be encouraging for long-term investors.

MicroStrategy Price Target for 2030, 2035, 2040, 2050

| Year | MSTR Price Target |

|---|---|

| MSTR stock forecast for 2030 | $ 942.47 |

| MSTR stock forecast for 2035 | $ 1417.34 |

| MSTR stock forecast for 2040 | $ 2074.17 |

| MSTR stock forecast for 2050 | $ 3577.62 |

Looking at MSTR’s long-term growth potential, it could provide solid returns for investors planning to hold for the future. Based on the current stock price of $289.41 (as of March 28, 2025), here are some possible projections:

- By 2030: The stock price might reach $942.47, representing a 225.65% increase from today’s price of $289.41.

- By 2035: It could climb to $1,417.34, marking a 389.73% return from today’s level.

- By 2040: The stock is projected to reach $2,074.17, showing an impressive 616.69% gain.

- By 2050: MSTR’s stock price could soar to $3,577.62, indicating a remarkable 1,136.18% increase over the current price of $289.41.

These projections highlight MSTR’s long-term growth potential, though it’s essential to remember that all forecasts carry risks due to possible changes in market and industry trends.

MSTR Stock Forecast 2025 (month-wise)

| Month | MSTR Price Target |

|---|---|

| MSTR stock forecast for January 2025 | 240.42 |

| MSTR stock forecast for February 2025 | 254.02 |

| MSTR stock forecast for March 2025 | 267.75 |

| MSTR stock forecast for April 2025 | 283.49 |

| MSTR stock forecast for May 2025 | 294.97 |

| MSTR stock forecast for June 2025 | 307.74 |

| MSTR stock forecast for July 2025 | 324.85 |

| MSTR stock forecast for August 2025 | 337.08 |

| MSTR stock forecast for September 2025 | 349.51 |

| MSTR stock forecast for October 2025 | 390.74 |

| MSTR stock forecast for November 2025 | 377.18 |

| MSTR stock forecast for December 2025 | 361.48 |

Based on our analysis, MSTR stock price could rise to around $390.74 by 2025, offering an estimated 35.01% return on the current price of $289.41 (as of March 28, 2025). This would provide a solid return for long-term investors. Want to know more about the company? Keep reading, we also have glimpse of our analysis that explains about how we get these forecasts.

Also Read : [💻] ACM Research Inc. | ACMR stock forecast 2025, 2030, 2040, 2050

Conclusion

MicroStrategy Inc. (MSTR) has established itself as a strong player in the market, with a market cap of $54.82 billion USD. The stock reached its all-time high of $543.00 in November 2024 and has delivered an outstanding five-year average return of 167.77%. Looking ahead, projections suggest that MSTR could reach $3,577.62 per share by 2050, highlighting its long-term growth potential. As the company continues to expand its presence in business intelligence and digital assets, MicroStrategy remains an intriguing investment choice for those seeking high returns in the years ahead.

For investors with a long-term focus, MicroStrategy (Nasdaq: MSTR) may be a solid option for steady growth. We hope this article, “MicroStrategy Incorp. | MSTR Stock Forecast 2025 to 2050,” has provided valuable insights. Be sure to check out our videos and FAQs section for more detailed information and guidance!

Handpicked for you (MUST WATCH)

Frequently Asked Questions (FAQs)

1) How high will MSTR stock go?

MSTR can go up to $3500+ per share till 2050 if we consider it as a super Long-term investment.

2) What is the price target for MSTR in 12 month?

The price target for MSTR stock can be $390 per share in next 12 months as per our analysis.

3) Is MSTR a good stock to buy?

Yes. As per our analysis, MSTR is a STRONG BUY. It looks good in charts as well as in fundamental analysis too. Although because of its substantial holdings in BTC, it looks a little risky considering the volatility of cryptocurrencies.

4) What is the MSTR stock price prediction for 2030 ?

In 2030, as per our analysis, we can see MSTR stock to reach $1662.07 per share.

5) What is the MSTR stock price prediction for 2050 ?

For 2050, we are expecting MSTR stock to reach around $942.47 per share.

6) What is the price target for MSTR stock in 2025 ?

For 2025, we are expecting MSTR stock to reach around $390.74 per share. As this company has a considerable high holdings of BTC, it can go further also.

7) What is the MSTR stock prediction for 2040 ?

In 2040, we can see MSTR stock price to reach around $2074.17 per share.

8) Does MSTR pay dividends?

No. MSTR didn’t paid any dividends till date. Although, this is the matter of decision related to the Board of Members, we can hope that it may change and the company may start paying dividends to the investors.

Disclaimer : Not an Investment Advice

The content shared in the above article “MicroStrategy Incorp. | MSTR Stock Forecast 2025 to 2050” is for general information only. It’s not intended as financial, investment, or professional advice. Always consult a qualified professional—whether legal, financial, or tax-related—before making any investment decision.