💰 Nvidia Stock Price Forecast 2025, 2030, 2040 & 2050

👉 30 Seconds Summary 👈

Nvidia Corporation (Nasdaq : NVDA) remains a top player in the tech industry with strong long-term growth potential. Our projections suggest NVDA’s stock could reach $169.34 in 2025, $846.14 by 2030, and $2,503.14 by 2035. Looking further ahead, it may rise to $4,072.35 by 2040 and $7,500.46 by 2050. These forecasts highlight Nvidia’s dominance and potential for substantial returns in the years to come.

In this digital age, Nvidia (NVDA) is one of the major player in the tech industry, known for leading the way in several areas. The company designs cutting-edge graphics processing units (GPUs), gaming software, and professional visualization tools. You can find Nvidia’s stock listed on NASDAQ. This article aims to provide investors with valuable insights and a detailed outlook on Nvidia stock price forecast 2025, 2030, 2040, and 2050.

Nvidia’s GPUs have long been known for delivering top-tier performance in gaming, giving players stunning visuals and an immersive experience. This early success paved the way for Nvidia to branch out into areas like artificial intelligence, data centers, and autonomous vehicles. It also develops system-on-chip units for mobile devices and the automotive market, with a strong focus on advancements in Artificial Intelligence, Machine Learning, network solutions, and cloud computing. Nvidia plays a crucial role as a key supplier of media and communication processors that power AI technologies.

Now, Nvidia is a major force in the tech world, with a market cap that highlights its influence and growth potential. In this ‘Nvidia Stock Price Forecast‘ article, we’ll take a look at how Nvidia’s stock price could evolve in the months, years, and even decades ahead.

About Nvidia Corporation (NVDA) | Company Information

| Company Name | Nvidia Corporation |

| Stock Exchange | Nasdaq |

| Ticker Symbol | NVDA |

| Sector | Technology |

| Headquarter | Santa Clara, California |

| Founded in | April 1993 |

| Founder | Jensen Haung, Chris Malachowsky, Curtis Priem |

| Market Cap. (June 2024) | $3.35 trillion |

| Revenue (2024) | $60.93 billion |

| Total assets (2024) | $65.74 billion |

| Peer Companies | Broadcom Inc. (AVGO), Qualcomm Inc. (QCOM), Arm Holdings PLC (ARM), Taiwan Semiconductor Manufacturing Company Ltd. (TSM), Advanced Micro Devices Inc. (AMD) |

Nvidia Corporation was established in April 1993. In just 30 years, it has now became a 3.34 trillion USD company. That’s really a whooping growth for a company. Focusing on graphics and gaming equipment sector, Nvidia generated a revenue of $60.93 Billion USD in 2024. As gaming is not only for kids anymore, many adults look towards gaming as a career option, we are expecting more growth for the company. Nvidia also started working towards Virtual Reality and metaverse.

Nvidia Corporation (NVDA) Analysis | Past, Present & Future

We’ll look at both charts and key financial data to help you understand what could impact NVDA’s stock price in the short and long term. If you’re wondering about Nvidia’s growth potential, keep reading to see where this stock might be headed.

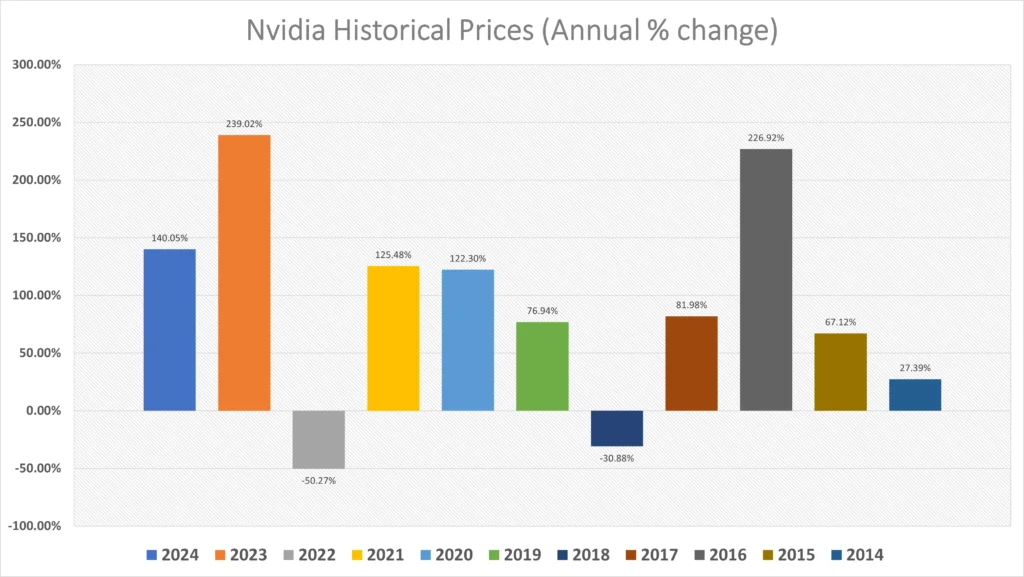

Nvidia Stock Price Historical Data [2001-2024]

From the above table, it is clear that NVDA’s share is trading near it’s All-Time High of $158.71 per share. While doing NVDA share price prediction, we took only last 5 year data into account because in IT sector, most drastic changes were experienced only in last 5 years. So, in the period of 2020-2024, NVDA’s share dropped at the low of $3.17. For a company, which traded at just $3.17 in last 5 year and now its trading on 158.71 (as on 28.06.2025), it looks like a massive success.

Analysis with live chart for Nvidia stock forecast for 1 year from now

As we can clearly see that Nvidia share price has shown a tremendous growth over the last year. In January 2024, it was trading near to $40 but along with its uptrend and after experiencing some corrections, now it is trading at $158.71 as on June 28, 2025 which is four times the value before 2024. Here as per its yearly growth of almost 300%, we are now expecting a steady growth in Nvidia stock price.

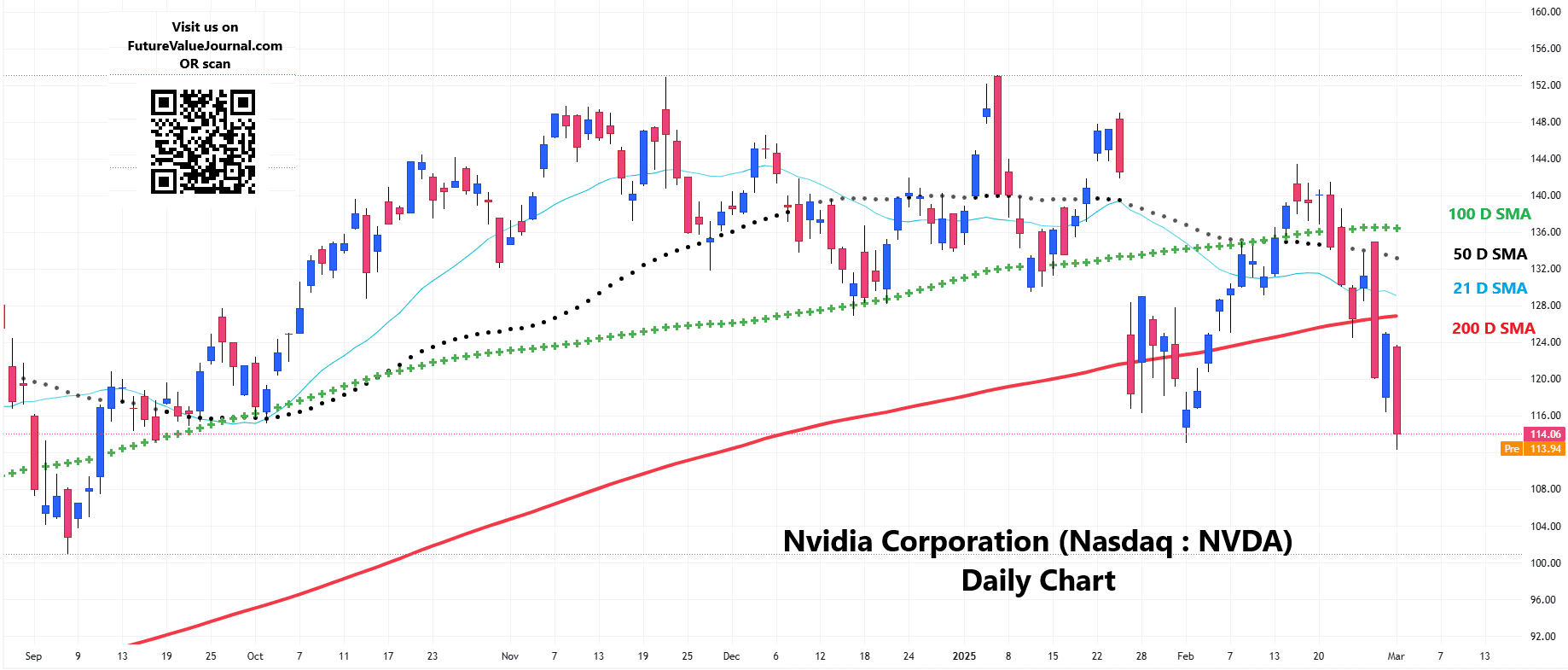

Time-Frame analysis of Nvidia : Hourly, Daily & Weekly

By analyzing a Nvidia stock price through a timeframe chart, we can gather some key insights that will assist us in determining the final NVDA stock predictions : –

| Time Frame | Observation |

|---|---|

View Hourly Chart (Every candle represents Nasdaq : NVDA share’s trading session of one hour. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular hour) | On hourly time-frame, we can observe that NVDA stock is trading below the 21 hour, 50 hour, 100 hour and 200 hour SMA. This indicates that the Nvidia stock is in Sideways to Downtrend for short term. |

View Daily Chart (Every candle represents Nasdaq : NVDA share’s trading session of one day. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular day) | On daily time-frame, we can observe that NVDA stock is trading BELOW 21 Day SMA, 50 Day, 100 Day & 200 Day SMA. This is the sign of Bearishness in medium term. |

View Weekly Chart (Every candle represents Nasdaq : NVDA stock’s trading session of one week. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular week) | On the weekly time-frame NVDA stock is trading below 21 weeks but Above 50 weeks, 100 weeks & 200 weeks SMA. This indicates that NVDA stock has a clear BULLISH sentiment, if we look at it from a long term perspective. |

View Monthly Chart (Every candle represents Nasdaq : NVDA stock’s trading session of one Monthly. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular week) | On the Monthly time-frame NVDA stock is trading Above all 21 Months , 50 Months, 100 Months & 200 Months SMA. This indicates that NVDA stock has a clear BULLISH sentiment, if we look at it from a very long term perspective. |

Since there is a BULLISH perspective shown by SMAs in Weekly time-frame while a SIDEWAYS to NEGATIVE perspective in Hourly & Daily time-frames. This can be a confusing scenario for a trader. By observing the directions of the SMAs, we can find that NVDA’s direction is always POSITIVE in Weekly time-frame while NEGATIVE in Hourly & Daily Timeframe.

Dow Jones, NASDAQ & Nvidia : A comparative Analysis

Check out the comparative year on year returns of Dow Jones, Nasdaq and NVDA. Here, we are showing the returns by comparing them on closing basis –

| Year | Dow Jones | Nasdaq | Nvidia |

|---|---|---|---|

| 2024 | +12.88% | +28.64% | +171.17% |

| 2023 | +13.70% | +43.42% | +238.87% |

| 2022 | -8.78% | -33.10% | -50.31% |

| 2021 | +18.73% | +21.39% | +125.29% |

| 2020 | +7.25% | +43.64% | +121.93% |

Also Read : Tempus AI Inc. | TEM Stock Price Forecast 2025-2050 with complete analysis

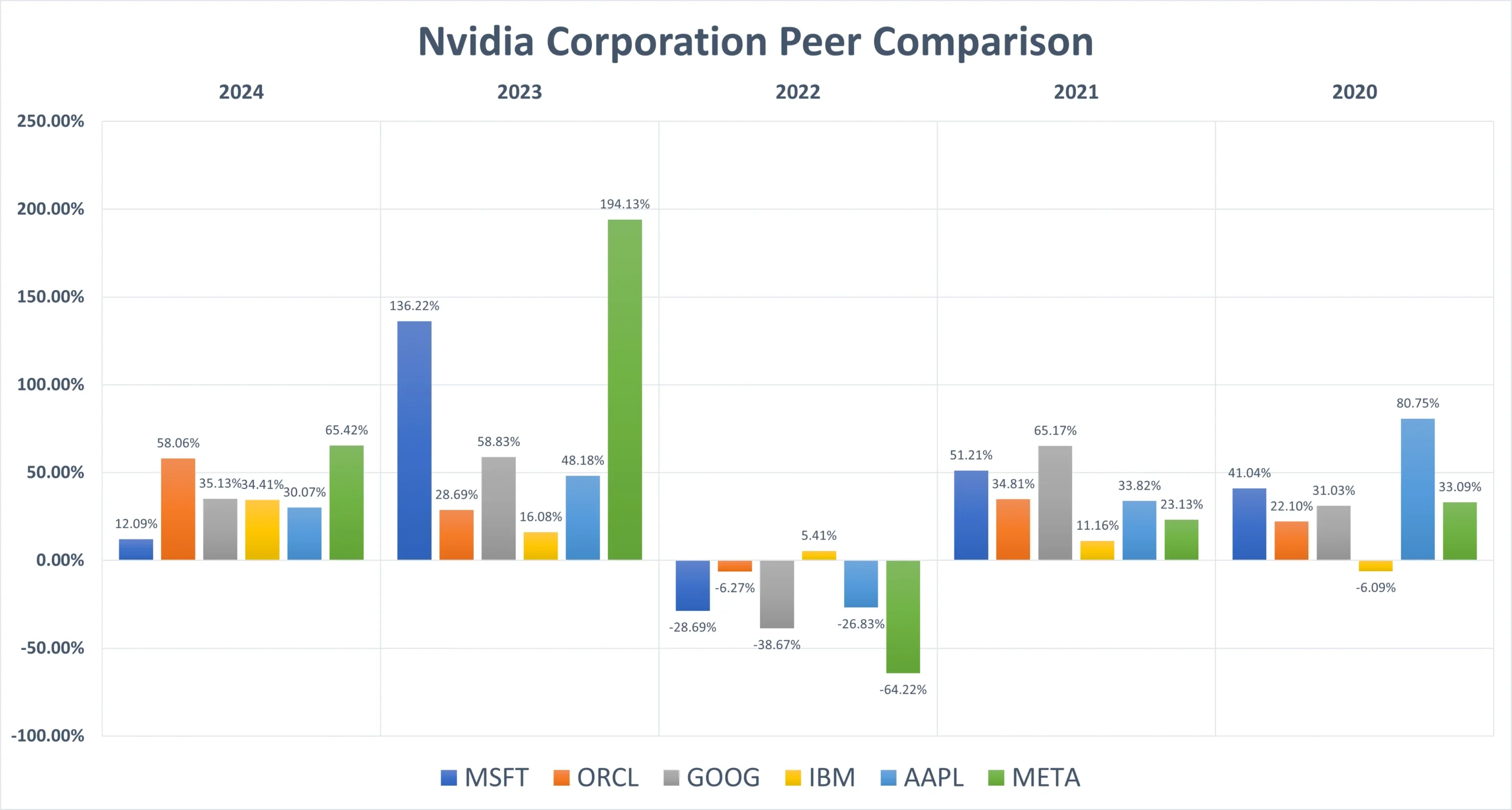

Nvidia Peer Comparison / Competitors Analysis

We will compare Nvidia Corporation (Nasdaq : NVDA) to its top competitors. We will see how its peer companies performed year-on-year . Below is the comparative table of Broadcom Inc. (AVGO), Qualcomm Inc. (QCOM), Arm Holdings PLC (ARM), Taiwan Semiconductor Manufacturing Company Ltd. (TSM), Advanced Micro Devices Inc. (AMD)‘s returns from 2020 to 2024 based on CLOSING Prices.

| Year | NVDA | AVGO | QCOM | TSM | AMD |

|---|---|---|---|---|---|

| 2024 | +171.17% | +107.70% | +6.22% | +89.89% | -18.06% |

| 2023 | +238.87% | +99.64% | +31.55% | +39.62% | +127.59% |

| 2022 | -50.31% | -15.97% | -39.88% | -38.08% | -54.99% |

| 2021 | +125.29% | +51.97% | +20.04% | +10.34% | +56.91% |

| 2020 | +121.93% | +38.55% | +72.66% | +87.68% | +99.98% |

| Average Returns | +121.39% | +56.37% | +18.12% | +37.89% | +42.28% |

Here we can observe that Nvidia’s performance is really commendable when compared to its peer companies if we look at the 5-year average returns. Arm Holdings PLC (ARM) got listed in 2023, so we are not considering it for this comparison.

Approach to Nvidia stock price prediction

Nvidia share price prediction involved various methods, including technical analysis, fundamental analysis, and expert opinions. When looking at any price prediction, it’s important to consider factors like current market conditions, company performance, and the overall economy. While analyzing a tech company, we also have to consider the possibilities of future technology changes and look forward to upcoming innovations.

Relying on just one factor is rarely effective for predicting stock movements or building a solid investment plan. However, using a combination of analytical tools and expert advice can give investors a clearer picture of a stock’s potential in both the short and long term. Consulting a trusted stockbroker can also improve your understanding of the market and help create a successful investment strategy.

Also Read : DJT Share Price Prediction for 2025, 2030, 2040, 2050

Nvidia Stock Price Forecast : Short & Long Term

Nvidia Stock Price Forecast 2025, 2026, 2027, 2028, 2029

| Year | NVDA Stock Price Target |

|---|---|

| Nvidia stock price prediction for 2025 | $169.34 |

| Nvidia stock price prediction for 2026 | $210.61 |

| Nvidia stock price prediction for 2027 | $327.18 |

| Nvidia stock price prediction for 2028 | $465.49 |

| Nvidia stock price prediction for 2029 | $674.72 |

- 2025: Estimated stock price of $169.34, reflecting a 26.06% increase from 2024’s closing price of $134.29.

- 2026: Projected stock price of $210.61, representing an 56.81% gain.

- 2027: Expected stock price of $327.18, showing a 143.61% surge.

- 2028: Forecasted stock price of $465.49, marking a 246.66% increase.

- 2029: Anticipated stock price of $674.72, indicating a 402.24% rise from its 2024’s closing price.

Nvidia Stock Price Forecast 2030, 2035, 2040, 2050

| Year | NVDA Stock Price Target |

|---|---|

| Nvidia stock price prediction for 2030 | $846.14 |

| Nvidia stock price prediction for 2035 | $2503.14 |

| Nvidia stock price prediction for 2040 | $4072.35 |

| Nvidia stock price prediction for 2050 | $7500.46 |

By 2030, NVIDIA’s market value could soar to new heights, with analysts predicting it might reach a market capital of staggering $10 trillion. This growth would be fueled by NVIDIA’s strong product line and leadership in the AI industry, signaling ongoing investor confidence and high demand for its products. NVIDIA’s financial outlook also looks solid through 2030. The company has consistently shown strong revenue and earnings per share (EPS) growth, highlighting its efficiency and profitability. .

- NVIDIA’s stock price could hit around $850 by the end of 2030, a significant jump from its current levels

- Looking ahead to 2035, we estimate Nvidia’s stock price could reach $2,503.14, a 1763.88% increase from 2024’s closing price of $136.29.

- By 2040, we expect the stock to rise to $4,072.35, reflecting a 2933.40% gain.

- Looking even further to 2050, we predict Nvidia’s stock will climb to $7,500.46, an impressive 5486.51% surge from its 2024 closing price of $136.29.

Nvidia stock price forecast 2025 (month-wise)

| Month | Nvidia Stock Price Target |

|---|---|

| January 2025 | $130.70 |

| February 2025 | $139.38 |

| March 2025 | $143.43 |

| April 2025 | $149.75 |

| May 2025 | $152.36 |

| June 2025 | $157.39 |

| July 2025 | $161.63 |

| August 2025 | $163.13 |

| September 2025 | $169.76 |

| October 2025 | $167.06 |

| November 2025 | $161.43 |

| December 2025 | $158.34 |

These predictions are based on NVIDIA’s strong financial performance and leading role in the AI sector. Growth during this period is expected to come from ongoing innovation and the successful execution of strategic plans. Investor confidence in NVIDIA has grown, with the company’s earnings per share (EPS) forecasts for fiscal 2025 increasing. This rise in EPS reflects steady profitability and operational efficiency, which are key factors in driving the stock’s performance.

The stock’s performance in the first half of 2025 will also be influenced by broader economic factors, such as economic growth and market sentiment. A strong economic environment and positive market outlook could push the stock even higher, while a slowdown or negative market conditions could weigh on its performance.

Also Read : MSFT Stock Prediction 2025 to 2050 : Should You Worry?

Virtual Reality & Metaverse – Nvidia

NVIDIA stretched his realm beyond just computing and AI, with the company set to play a major role in the future of the metaverse and virtual reality (VR). These rapidly growing areas offer big opportunities for NVIDIA and could influence its stock performance and overall market value over the long term.

Nvidia’s Metaverse

At the heart of NVIDIA’s metaverse strategy is the Omniverse platform, a real-time 3D design and simulation tool. This platform leverages NVIDIA’s strength in graphics processing and AI to build immersive virtual worlds. The Omniverse is being used in various fields, from architecture and engineering to entertainment, making NVIDIA a key player in developing the infrastructure for the metaverse.

Nvidia’s Virtual Reality

In the VR space, NVIDIA’s GPUs are critical for creating high-quality virtual experiences. As VR technology continues to improve, the need for more powerful graphics processors will likely increase, boosting sales of NVIDIA’s high-end GPUs. The RTX series, known for its real-time ray tracing, is particularly suited for creating lifelike VR environments.

What could we expect as an investor ?

The potential market for metaverse and VR technologies is huge. Some analysts predict the metaverse could be an $800 billion market by 2024 and could grow to $30 trillion by 2030. NVIDIA’s strong presence in this space could play a significant role in its future growth. That said, the metaverse and VR industries are still in their early stages, and how they develop remains uncertain. Factors like user adoption, content creation, and technological hurdles could affect growth. NVIDIA also faces competition from other tech giants that are heavily investing in these areas.

Despite these challenges, NVIDIA’s technological leadership and strategic position in the metaverse and VR could provide significant growth in the long run. As these markets evolve, NVIDIA’s contributions to building metaverse infrastructure and enhancing VR capabilities may become key drivers of its stock performance. For investors like us looking at NVIDIA’s long-term potential, it’s essential to keep an eye on developments in the metaverse and VR. While these sectors are filled with opportunity, their ever-changing nature also brings a degree of uncertainty. NVIDIA’s ability to seize these opportunities could shape its future market standing and stock value.

Conclusion

Let’s conclude now what we have discussed in this article “Nvidia Stock Price Forecast for 2025, 2030, 2040, 2050” so far. We are not expecting Nvidia to rise much in 2025. As we have discussed in its historical analysis, this stock experienced a multi-bagger growth in its last 5 year term.

So, in 2025, it may rise to ~ $170 which looks quite normal for a company with this kind of potential. But after 2025, when metaverse will get more light and people’s attention, it may again turn to a multi-bagger for you as we speak of 2035, 2040, 2050 and beyond.

Please Go through the FAQs for more clarity about this investment decision and share your thoughts/queries on this in our comments section. We will be more than happy to interact with you…

Frequently Asked Questions (FAQs)

1) Who is the largest shareholder of Nvidia stocks ?

The Vanguard Group Inc., holds 8.1% of the company’s outstanding shares.

2) How much will Nvidia stock prediction prices for 2025 ?

Analysts anticipate that Nvidia stock prices may reach a value of $165–$185 per share in 2025.

3) Is Nvidia a buy or sell right now ?

Nvidia is one of the largest player in major upcoming future technologies like metaverse & VR. So, our analyst are having a bullish outlook on Nvidia stock

4) What is the 12 month target for Nvidia stock prediction prices ?

The 12-month Nvidia stock price prediction could be around $170 which is an increase of ~26% from the 2024 closing price of $134.29.

5) Could Nvidia stock prediction prices top $1000 a share in 2026 ?

As per our analysis, it looks like an over-estimated value. But this 10-fold growth might be possible if Nvidia could capture the market early in upcoming technologies.

6) Is Nvidia good for investment ?

Yes, currently it looks like a wise investment. In April 2024, the company had $31.4 billion in cash and investments, compared to $9.7 billion in short- and long-term debt. Semiconductor companies often keep large cash reserves to help them manage the ups and downs of the chip industry.

7) Is Nvidia a long term buy ?

Nvidia (NVDA) remains a strong long-term investment despite the recent noise. As a leader in artificial intelligence (AI) and the third most valuable stock globally, Nvidia saw a significant drop in market value after its Q2 earnings report in late August. However, its long-term potential remains solid.

8) What will the Nvidia stock prediction prices for 2040?

Here are three possible scenarios for Nvidia stock prediction prices :

Conservative Growth (5% annually): Nvidia’s stock could reach about $2,038 by 2040 and $3,319 by 2050.

Moderate Growth (S&P 500 historical return of 11.13%): Nvidia’s stock could rise to $5,346 by 2040 and $15,358 by 2050.

Our Analysis: Nvidia’s stock could rise to $4,000 by 2040 and $7,500 by 2050.

9) What can be the Nvidia stock forecast for 1 year from now?

$170 per share could be the Nvidia stock forecast for 1 year from now.

Disclaimer : Not an investment advice

The content shared in the above article “💰 Nvidia Stock Price Forecast 2025, 2030, 2040 & 2050” is for general information only. It’s not intended as financial, investment, or professional advice. Always consult a qualified professional—whether legal, financial, or tax-related—before making any investment decisions.

Thank you, I have recently been searching for information approximately this topic for a long time and yours is the greatest I’ve came upon till now. However, what in regards to the bottom line? Are you certain concerning the source?

Thank you for your kind words! I’m glad you found the information helpful. Regarding the bottom line, it ultimately depends on various factors like market trends, company performance, and economic conditions. I always strive to provide well-researched and data-backed insights, referencing reliable sources. If you have any specific concerns or would like more details on any aspect, feel free to ask. I’d be happy to discuss further!”

You made some nice points there. I looked on the internet for the issue and found most guys will approve with your blog.

I’m so in love with this. You did a great job!!

Thank you so much! 😊 I’m really glad you liked it. Your kind words mean a lot! Let me know if there’s anything else you’d like to see.

There’s so much noise online, but your blog always manages to cut through with authenticity and intelligence.

you are in reality a good webmaster. The website loading pace is amazing.

It sort of feels that you’re doing any distinctive trick. Furthermore, The contents are

masterwork. you’ve done a magnificent activity on this topic!

Wow, fantastic blog layout! How long have you been blogging for?

you made blogging look easy. The overall look of your site is magnificent, as well as the content!

It’s a shame you don’t have a donate button! I’d without a doubt donate to this excellent blog!

I suppose for now i’ll settle for book-marking and adding your RSS feed to

my Google account. I look forward to new updates

and will share this website with my Facebook group. Chat soon!

Hello very nice website!! Guy .. Beautiful .. Superb .. I’ll bookmark your web

site and take the feeds additionally? I am satisfied to seek out so

many useful info here in the post, we want develop extra strategies on this regard,

thank you for sharing. . . . . .

Fantastic goods from you, man. I’ve understand your stuff previous to and

you are just extremely magnificent. I actually like what you have acquired here, really

like what you are saying and the way in which you say it.

You make it enjoyable and you still take care of to keep it smart.

I can’t wait to read much more from you. This is actually a

terrific site.

Thankfulness to my father who told me regarding this webpage,

this webpage is really amazing.

I am regular reader, how are you everybody?

This piece of writing posted at this web page is actually nice.

Very nice post. I just stumbled upon your weblog and wished to say that I have truly enjoyed surfing around your blog

posts. In any case I’ll be subscribing to your rss feed and I

hope you write again very soon!

Since the admin of this web site is working, no hesitation very soon it will

be renowned, due to its quality contents.

Hi there! Do you use Twitter? I’d like to follow you if that would be ok.

I’m definitely enjoying your blog and look forward to new posts.

Great post.

Very nice post. I just stumbled upon your blog and wanted

to say that I have truly enjoyed surfing around your blog posts.

After all I will be subscribing to your rss feed

and I hope you write again soon!

Nice weblog right here! Additionally your site lots up fast!

What host are you the usage of? Can I get your affiliate link

on your host? I desire my website loaded up as quickly as yours lol

It’s in point of fact a nice and helpful piece of information.

I am satisfied that you simply shared this helpful information with us.

Please stay us up to date like this. Thank you for sharing.

This is my first time visit at here and i am truly impressed to read everthing at alone place.

I think the admin of this website is in fact working hard in support of his website, as here every stuff is quality based stuff.

Wonderful beat ! I would like to apprentice while you amend your site, how could i subscribe for a blog site? The account aided me a acceptable deal. I had been tiny bit acquainted of this your broadcast provided bright clear concept

Hey! Do you use Twitter? I’d like to follow you if that would be ok.

I’m absolutely enjoying your blog and look forward to new posts.

Thanks , I’ve just been looking for information approximately this topic for a while and yours is the greatest I’ve found out so far. But, what about the conclusion? Are you certain about the supply? http://www.kayswell.com

I am regular reader, how are you everybody? This article posted at this

site is truly nice.

Greate article. Keep posting such kind of info on your site. Im really impressed by your site. Hi there, You have done an excellent job. I’ll definitely digg it and individually suggest to my friends. I am sure they will be benefited from this web site.

Thanks , I’ve just been looking for information approximately this topic for a while and yours is the greatest I’ve found out so far. But, what about the conclusion? Are you certain about the supply?

Pretty nice post. I just stumbled upon your weblog and wanted to say that I’ve truly enjoyed surfing around your blog posts. In any case I will be subscribing to your feed and I hope you write again soon!

I like the balance between theory and practice. Very thought-provoking content here. This is exactly what I needed today.

The topic was well explained. Your explanation cleared up my confusion..

I am genuinely thankful to the owner of this web page who has shared this fantastic post at here.

Loved how you broke things down. Even beginners can follow this easily..

Very informative read…. Clear and concise guidance..

Appreciate the clarity of explanation. This post exceeded my expectations.

Clear and easy to follow!… This made my day a little easier.

Helpful and concise writing. Great mix of information and simplicity.

This really helped me understand things better…. Keep up the great work!…

Impressed by the level of detail. Keep up the great work!

Learned something new today! You should write more often.

Amazing write-up!! Thanks for sharing your knowledge.

Impressed by the level of detail. Could improve the layout slightly, but nice job.

Pretty solid content here. Really appreciate the effort you put into this. 馃檪

Informative and clear…. Could use a bit more detail, but overall solid..

Impressed by the level of detail.. Hope to see a follow-up soon….

Very informative read. Looking forward to your next post!

Hello, just wanted to mention, I liked this blog post.

It was practical. Keep on posting!

Have you ever considered about adding a little bit more than

just your articles? I mean, what you say is valuable and everything.

But think of if you added some great graphics

or video clips to give your posts more, “pop”! Your content is excellent but with images and video

clips, this website could undeniably be one of the very best in its field.

Fantastic blog!

I can tell you put a lot of energy into writing this. It shows in the way the content flows and how complete the information feels.