🛡️ Serve robotics | SERV stock forecast 2025, 2030, 2040, 2050

Serve Robotics Inc. is a U.S.-based company that’s changing the way deliveries are made. Specializing in autonomous sidewalk delivery robots, Serve is focused on creating sustainable, efficient, and affordable last-mile delivery solutions. This article “SERV stock forecast 2025, 2030, 2040, 2050” will give you some insights of current as well as future aspects of the company and their investments.

Originally a spin-off from Postmates, the company has quickly made a name for itself with robots designed to navigate city streets and deliver goods straight to people’s doors. As e-commerce and the demand for fast, contactless deliveries grow, Serve Robotics is emerging as a key player in shaping the future of urban deliveries and automated logistics.

Serve Robotics Stock Live Chart (OTCMKTS : SBOT)

SERV Stock Forecast for 2025, 2026, 2027, 2028, 2029

| Year | Stock Price Target |

|---|---|

| SERV stock forecast for 2025 | 17.43 |

| SERV stock forecast for 2026 | 22.34 |

| SERV stock forecast for 2027 | 34.63 |

| SERV stock forecast for 2028 | 49.71 |

| SERV stock forecast for 2029 | 62.54 |

In 2026, our analysis of SERV stock forecast projects the price to rise to $22.34, offering an approximate 127.96% return on its current price of $9.80 as of October 7, 2024. This represents a solid return for investors in the stock.

In 2027, it may rise to $34.63, delivering a 253.37% return on the current price. In 2028, the stock is expected to reach $49.71, offering a 407.24% return, and by 2029, it could rise to $62.54, providing an impressive 538.16% return from its current price.

Given the anticipated changes in the robotics industry in the near future, our analysts expect slow but steady growth for SERV stock price. While market fluctuations may occur, the long-term outlook for Serve Robotics remains positive as it continues to innovate and adapt to industry changes.

SERV Stock Forecast for 2030, 2035, 2040, 2050

| Year | Stock Price Target |

|---|---|

| SERV stock forecast for 2030 | 77.14 |

| SERV stock forecast for 2035 | 98.31 |

| SERV stock forecast for 2040 | 133.18 |

| SERV stock forecast for 2050 | 255.84 |

Our long-term analysis forecasts SERV stock reaching $77.14 by 2030, representing a significant 687.35% increase from today’s price of $9.80. Looking further ahead to 2035, we estimate the stock could climb to $98.31, marking an impressive 902.14% increase from the current price.

By 2040, the stock is projected to rise to $133.18, reflecting a substantial 1,259% gain from its current value. Looking even further into the future, by 2050, we anticipate SERV stock could hit $255.84, indicating an extraordinary 2,510.61% increase from its present price.

While predicting the exact trajectory of SERV’s future growth is challenging, the company shows great potential, especially with the increasing adoption of robotics in everyday life. As Serve Robotics continues to push boundaries in the robotics sector, it stands to benefit from the growing demand for autonomous delivery solutions. Although current data only provides a glimpse of its potential, SERV’s unique position in this emerging market suggests it is well-positioned for long-term growth as the industry evolves.

Also Read : ARM Stock Forecast for 2025 to 2050 : You should know

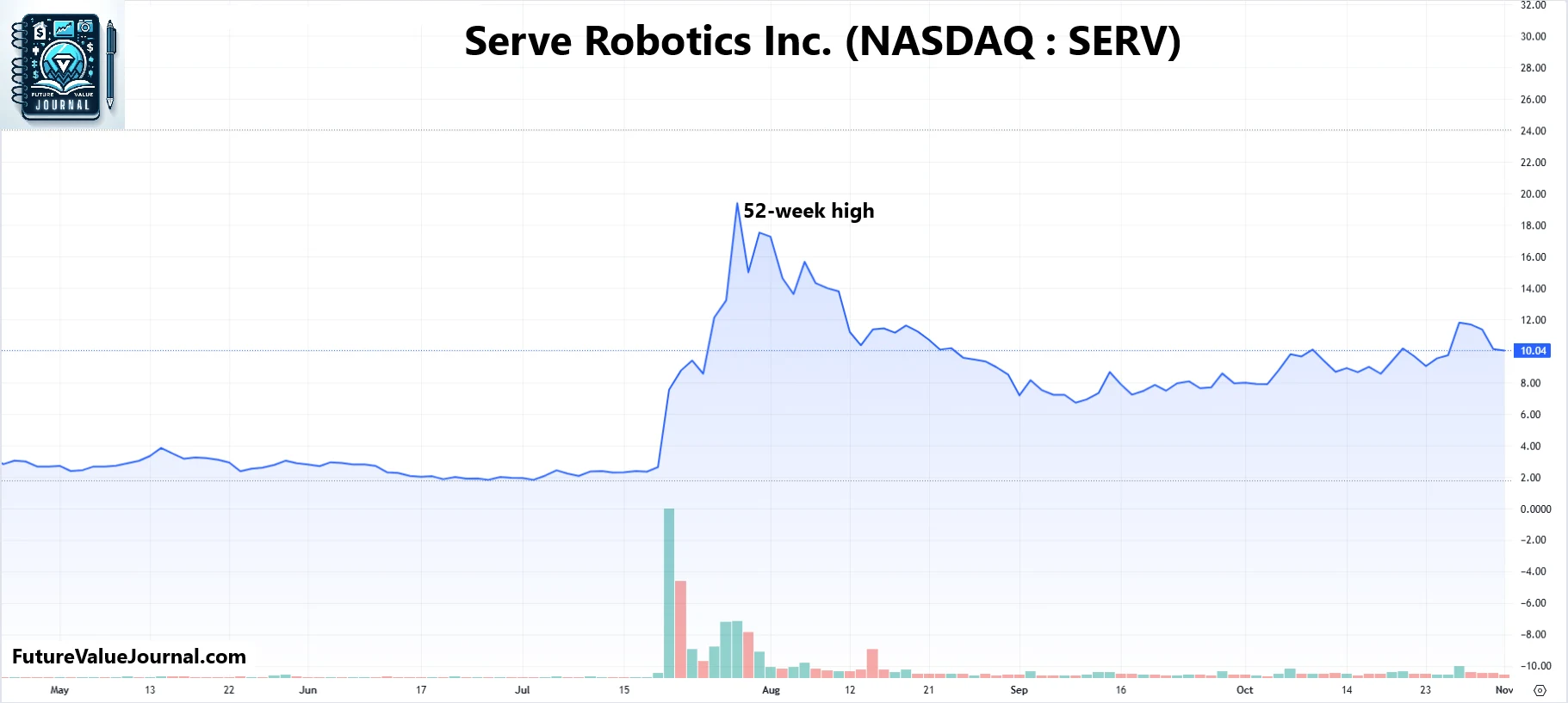

One year chart analysis for SERV stock forecast

Here in this serv stock price chart, we can clearly see the highest tip of this stock is ~ $24 which it touched in mid- July 2024.

Currently, Serve robotics is trying to break a range and moving up. It is now trading on $ 9.80 breaking a range of 6.5-9.0 in which it was staying for months.

Serve Robotics Stock Prediction 2025 (month-wise)

| Month | Stock Price Target |

|---|---|

| Serve robotics stock prediction for January 2025 | 14.42 |

| Serve robotics stock prediction for February 2025 | 14.59 |

| Serve robotics stock prediction for March 2025 | 14.86 |

| Serve robotics stock prediction for April 2025 | 15.04 |

| Serve robotics stock prediction for May 2025 | 15.42 |

| Serve robotics stock prediction for June 2025 | 15.67 |

| Serve robotics stock prediction for July 2025 | 15.82 |

| Serve robotics stock prediction for August 2025 | 16.11 |

| Serve robotics stock prediction for September 2025 | 16.49 |

| Serve robotics stock prediction for October 2025 | 16.74 |

| Serve robotics stock prediction for November 2025 | 17.08 |

| Serve robotics stock prediction for December 2025 | 17.43 |

Our analysis of SERV stock forecasts that the price will rise to $17.43, providing an estimated 77.86% return from its current price of $9.80 as of October 7, 2024, which could represent a strong gain for investors.

Meanwhile, with expected advancements in the robotics industry, our analysts foresee steady growth for SERV stock. While short-term market fluctuations are likely, the long-term outlook remains positive as the company continues to innovate and adjust to industry shifts.

About Serve Robotics Inc. | Company Information

| Company Name | Serve Robotics Inc. |

| Stock Exchange | Nasdaq |

| Ticker Symbol | SERV |

| Sector | Consumer Discretionary |

| Headquarter | Redwood City, California, US |

| Founded in | 2017 (as division), 2021 (as independent company) |

| Founder | Ali Kashani, Dmitry Demeshchuk, MJ Chun |

| Major Shareholder | Uber Technologies Inc, (12.51%), Ali Kashani (7.98%) |

| Market Cap. | $ 368 million usd |

| All-time high closing price | $ 24.09 usd on July 29, 2024 |

| 52-week low | $ 1.77 usd on May 22,2024 |

| 52-week high | $ 24.09.00 usd |

Serve Robotics is an innovative company specializing in autonomous sidewalk delivery robots. Founded in 2021, the company is at the forefront of revolutionizing last-mile delivery through the use of robotics and AI technology. Serve Robotics’ robots are designed to autonomously navigate sidewalks and urban environments, making deliveries more efficient, cost-effective, and environmentally friendly.

With a vision to reshape local deliveries, Serve Robotics is tapping into the growing demand for contactless delivery solutions, especially in densely populated areas. The company’s focus on sustainability is evident in its zero-emission, electric-powered robots, which reduce carbon footprints and congestion in cities.

Backed by significant investors, including Uber, Serve Robotics is well-positioned to grow within the rapidly evolving logistics and delivery market. The company’s innovative approach is drawing attention from both the tech and financial worlds as it aims to scale its operations globally.

Historical SERV stock price data

Shares of Serve Robotics, an AI-powered last-mile robot delivery company, have experienced significant volatility since its started trading publicly on April 18, when it began trading on the Nasdaq Capital Market under the ticker “SERV.“

Since then, SERV shares have risen by an impressive 196.3%. However, following a disappointing second-quarter 2024 report, the stock dropped 9.6% since August 13. In the recent earnings, SERV reported $0.48 million in revenue, a substantial improvement from the $0.06 million reported in the same quarter last year.

However, revenues fell 50% from the previous quarter, which raised concerns among investors. Despite this, the company saw an 80% increase in delivery and branding revenues for Q2, with daily supply hours growing 27% quarter-over-quarter.

This mixed performance has left investors uncertain about SERV’s near-term trajectory.

Conclusion

To summarize, Serve Robotics Inc. is a U.S.-based company specializing in last-mile robotics delivery services. A significant portion of the company is owned by Uber Technologies Inc., providing it with strong financial backing. With this support, Serve Robotics is poised for gradual but steady growth in the stock market over the coming years.

Our long-term analysis forecasts the SERV stock price to reach $77.14 by 2030, $98.31 by 2035, and $133.18 by 2040, eventually climbing to $255.84 by 2050.

Given the rising demand for robotic delivery solutions and Serve Robotics’ innovative approach in the industry, we anticipate positive growth ahead. While fluctuations may occur, the company’s unique position in a rapidly evolving market makes it an attractive option for long-term investors.

Also Read : Microsoft Stock Forecast for Traders & Investors

Handpicked for you (MUST WATCH)

Frequently asked questions (FAQs)

1) What is the price target for Serve Robotics in 2025?

Our analysis of SERV stock predicts that the price could rise to $17.43, offering an estimated 77.86% return from its current price of $9.80 as of October 7, 2024. This growth potential presents a promising opportunity for investors.

2) Did Nvidia buy Serve Robotics stock?

In April, Nvidia made a significant investment in Serve Robotics by purchasing 1.05 million shares at a price of $2.42 per share, totaling to approx. $3.7 million. This stock purchase was linked to a 6.0% convertible debt note that Nvidia held with the company, allowing them to convert the debt into equity. This move highlights Nvidia’s interest in the growing robotics sector, positioning it to benefit from Serve Robotics’ future growth and innovations.

3) What was Serve Robotics IPO price?

The Serve Robotics Inc, debuted on Nasdaq on April 18, 2024 by an initial price of $4 / share.

4) Who is the CEO of Serve Robotics?

Ali Kashani co-founded Serve Robotics in January 2021 and has been the company’s CEO since its inception. Before starting Serve, he was Vice President at Postmates, a popular on-demand food delivery platform. His leadership experience in the tech and delivery industries has been instrumental in guiding Serve’s growth and innovation.

5) Is Serve Robotics a buy or sell?

As per chart analysis, Serve Robotics doesn’t look great BUT as per Business model, we are expecting a huge growth of this company in future. So in our opinion it is a MODERATE BUY. It may not give returns in near future, but if we look at very long term, we can expect company’s multifold growth.

6) What is the price target for Serve Robotics in 2030?

Our long-term analysis predicts that SERV stock could reach $77.14 by 2030, marking a substantial 687.35% increase from its current price of $9.80.

7) What is the price target for Serve Robotics in 2050?

By 2050, we project that SERV stock could reach $255.84, marking an impressive 2,510.61% increase from its current price. This substantial growth reflects the company’s long-term potential as it continues to innovate and expand within the robotics delivery sector.

8) Should I invest in SERV stock?

Investing in stocks requires thorough research of the company, along with a clear understanding of financial goals and risk tolerance. While these predictions provide valuable insights into potential future trends, it’s essential to consider this information as part of a broader strategy. Always consult your financial advisor before making any investment decisions.

Disclaimer : Not an Investment Advice

The content shared here in “🛡️ Serve robotics | SERV stock forecast 2025, 2030, 2040, 2050” is for general information only. It’s not intended as financial, investment, or professional advice. Always consult a qualified professional—whether legal, financial, or tax-related—before making any investment decisions.

Even though this was a long post, it didn’t feel long at all. You kept it engaging from start to finish.