💲SoFi Technologies | SOFI Stock Price Prediction 2025 to 2050

👉 30 Seconds Summary 👈

SoFi Technologies Inc. is a strong player in the fintech industry, offering a one-stop solution for people’s financial needs. After looking at the company’s fundamentals, technical trends, and the broader market outlook, SoFi’s stock price is projected to reach $13.84 by 2025, $31.56 by 2030, $45.18 by 2035, $62.07 by 2040, and possibly rise to $85.34 by 2050.

When it comes to investing in financial technology, SoFi Technologies Inc. (NASDAQ : SOFI) has captured the attention of many investors, especially those who are looking for growth opportunities in this evolving world of digital finance. SoFi is known for its innovative approach to banking, lending money, and investment services. It is reshaping the way how people manage money. But what does the future hold for SOFI stock?

In this article “SOFI stock price prediction 2025, 2030, 2040 & 2050“, we’ll explore SOFI’s growth potential, analyze the stock for forecasts and market trends to give you an insightful look at where SOFI stock price might reach by 2025, 2030, 2040 and 2050. Whether you’re a short term trader or a long term investor who is considering SOFI to your portfolio, this guide will provide the key insights which you need for better investment decision.

About SoFi Technologies Inc. (NASDAQ : SOFI)

| Company Name | SoFi Technologies, Inc. |

| Stock Exchange | NASDAQ |

| Ticker Symbol | SOFI |

| Sector | Finance & Banking Services |

| Headquarter | San Francisco, US |

| Founded in | 2011 |

| Major Shareholder | Vanguard Group Inc. (~8.19%) |

| Market Cap. | $ 11.72 billion usd |

| Revenue( June, 2024) | $ 586.98 million usd |

| Total Assets | $ 32.65 billion usd |

| All-time high | $ 28.26 usd (Feb 01, 2021) |

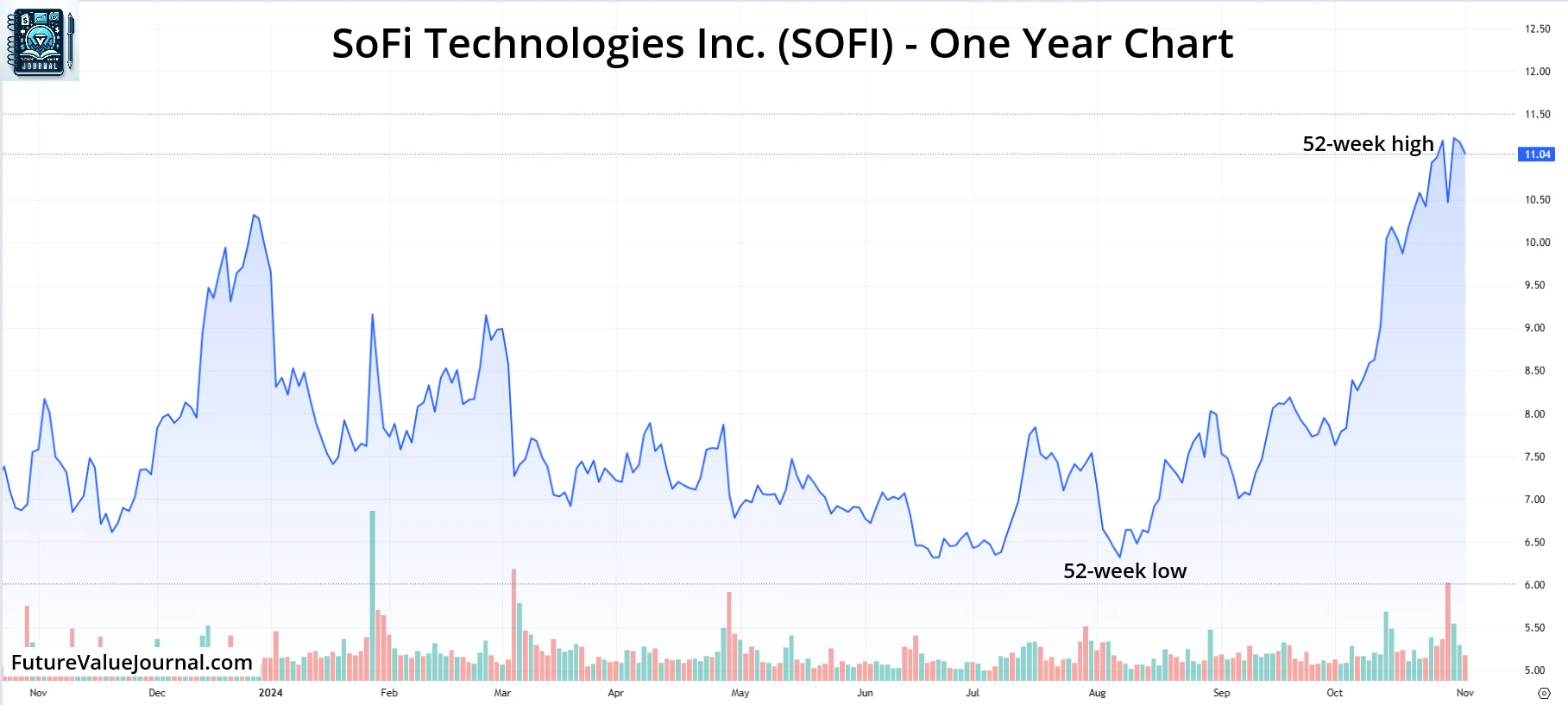

| 52-week high | $ 12.46 usd (Nov 08, 2024) |

| 52-week low | $ 6.32 usd (Aug 05, 2024) |

| Peer Companies | Ally Financial Inc. (ALLY), Qifu Technology Inc. (QFIN), Joint Stock company Kaspi.kz (KSPI), SLM Corporation (SLM), American Express Company or AMEX (AXP) |

SoFi Technologies Inc. (NASDAQ : SOFI) is a financial services company that’s on a mission to make money management simple and accessible. It was founded in 2011. SoFi initially focused on helping students to refinance their loans but it quickly expanded to cover a wide range of financial needs. Today, SoFi offers many services including banking, investing, lending, and personal finance tools in its one platform, aiming to bring all aspects of finance under one roof. What sets SoFi Technologies apart is its innovative tech-driven approach which provides a seamless experience to users and sets a new standard in digital finance. From high-interest savings accounts to unique credit offerings, SoFi aims to empower people to reach their financial goals faster and easier.

SoFi Technologies Inc. (SOFI) | Past, Present & Future

Historical data analysis of SoFi stock price

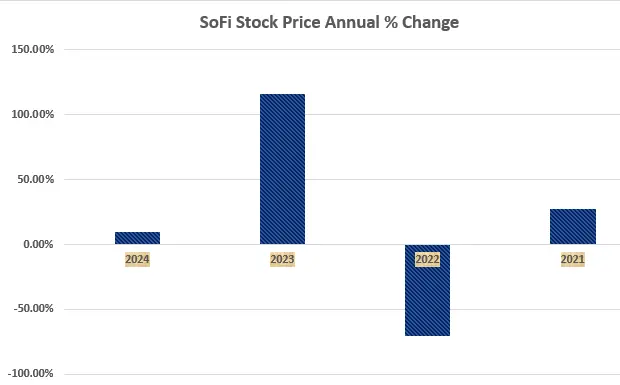

Here in the above annual percentage change chart, we can observe that SoFi share price gave mixed positive as well as negative returns to the investors. In 2021, SoFi stock provided a decent +27% returns. But in 2022, the stock price fell -70.84%. In 2023, the stock price was increased by +115.84%. Although, the overall growth of SoFi stock price is negative after the fall of 2021. It never touched the 2021’s high of $28.26. If we calculate it from the initial value, it is in the overall loss of -20%.

Since, the current trend of the SoFi stock is highly positive but it is trading really far from all the averages which is a sign of temporary volatility in the stock price. So, as per our analysis, it would be good if you wait for some time before investing into it. We have provided more detailed analysis below which can help you better your investment decision regarding SoFi Technologies Inc.

Also Read : Nvidia Share Price Prediction 2025 and beyond | Will omniverse & VR succeed ?

One year chart analysis for SoFi stock price prediction 2025

In one year SoFi stock price chart, we can observe that after hitting its 52-week high of $10.49 on December 22, 2023 the stock was in a slight downtrend till July 2024.But from July, there, it is trying to trade in sideways to up trend. From Aug, 2024, we have seen a little recovery with high volumes. As on Aug 29, 2024 the stock tried to break the range with huge volumes but came back due to lack of support from bulls. But now in Oct 2024, SoFi stock price broke its range and started moving up. It created a new high of $12.46 on Nov 08, 2024.

By this, we can anticipate that, the SoFi stock might trade in sideways direction for some time and then again in up trend if it can stabilize in its current range for some days. From all these analysis, we formulated the month-wise SoFi stock price prediction for 2025 below.

SoFi Stock Live Chart

After the sudden fall in early 2024, we observed a slow but steady downtrend in SoFi stock price till . However, the stock tried to rise many times, but it came down to a new low every time. Now in the end of 2024, it is trying to change its trend, with volumes, which can be good sign. In November 2024, we saw a sudden spike in the many technology and IT sector stock prices, which effected SoFi Technologies also. Want to know more about the company? Keep reading, we also have glimpse of our analysis that explains about how we get these forecasts.

Time-Frame analysis of SoFi Technologies Inc. : Hourly, Daily & Weekly

Since SoFi operates in the evolving fintech space, it’s also important to think about how new advancements in technology might shape its future growth. As by a technical chart analysis of Simple Moving Averages (SMAs) we can observe the following –

Time Frame | Observation |

|---|---|

(Every candle represents Nasdaq : SOFI share’s trading session of one Daily. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular daily) | On the Daily time-frame SOFI stock is trading BELOW 21 Days, 50 Days & 100 Days & ABOVE 200 Days SMAs. This indicates that SOFI stock has a Sideways to Negative sentiment in medium term. |

(Every candle represents Nasdaq : SOFI share’s trading session of one Week. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular week) | On Weekly time-frame, we can observe that SOFI stock is trading BELOW 21 Weeks SMA BUT ABOVE 50 Weeks & 100 Weeks SMA. This is the sign of Sideways to Bullishness in Long term. |

(Every candle represents Nasdaq : SOFI stock’s trading session of one Monthly. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular Monthly) | On Monthly time-frame, we can observe that SOFI stock is trading ABOVE 21 Month SMAs. This indicates that the SOFI stock is in slight Up trend for Very Long term. |

Keeping up with the latest news in the fintech world can also give you valuable insights to make smart choices when investing in SoFi Technologies Inc. Getting advice from a trusted financial adviser or stockbroker also can help you deepen your understanding of the market and create a strong investment strategy.

Dow Jones, NASDAQ & SoFi Technologies Inc. : A comparative Analysis

Check out the comparative year on year returns of Dow Jones, Nasdaq and SOFI. Here, we are showing the returns by comparing them on closing basis –

| Year | Dow Jones | Nasdaq | SOFI |

|---|---|---|---|

| 2024 | +12.88% | +28.64% | +54.77% |

| 2023 | +13.70% | +43.42% | +115.84% |

| 2022 | -8.78% | -33.10% | -70.84% |

| 2021 | +18.73% | +21.39% | +27.09% |

| 2020 | +7.25% | +43.64% | +26.72% |

Also Read : CrowdStrike | CRWD Stock Price Prediction 2025, 2030, 2040, 2050

SOFI Peer Comparison / Competitors Analysis

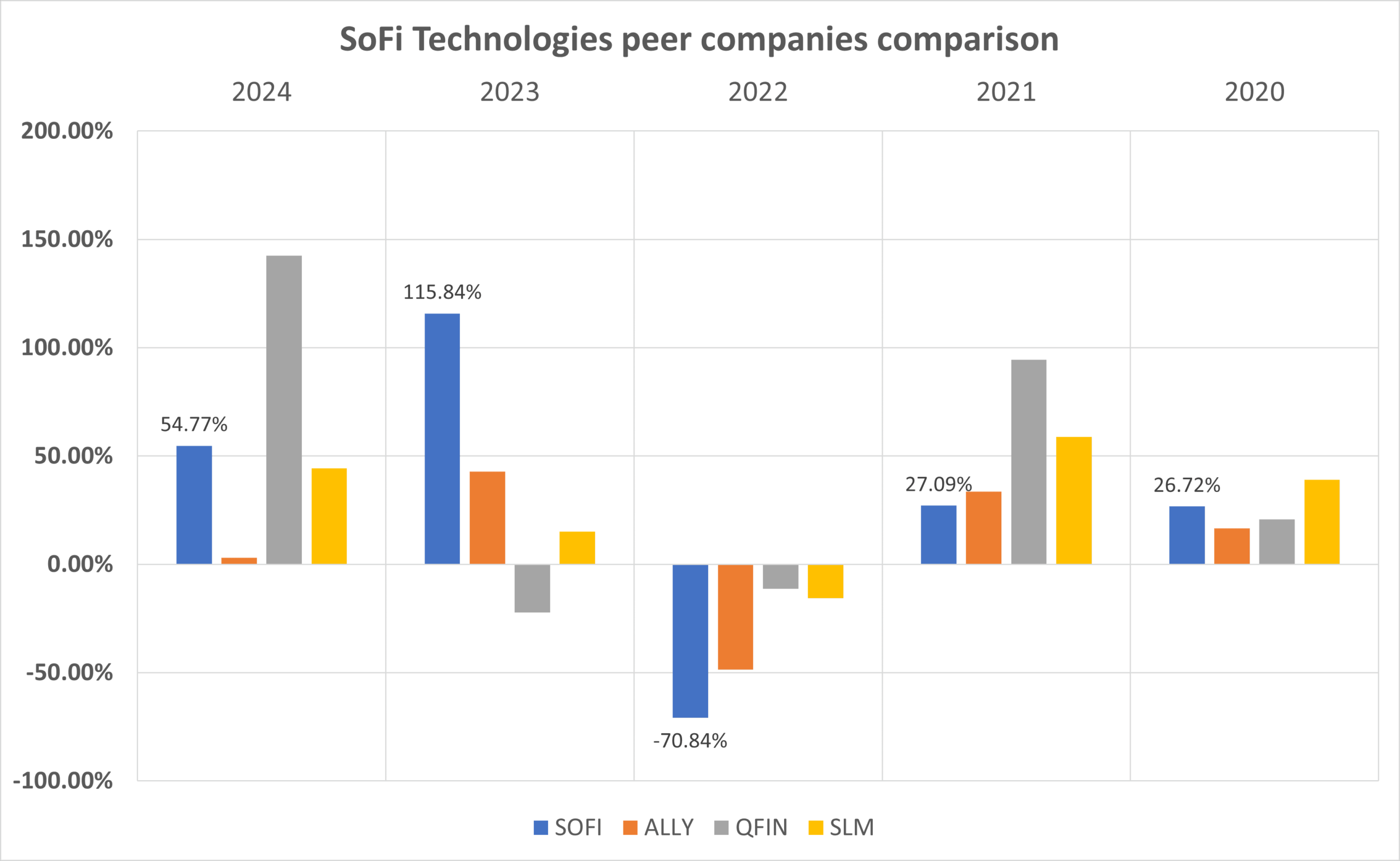

We will compare SoFi Technologies Inc. (Nasdaq : SOFI) to its top competitors. We will see how its peer companies performed year-on-year . Below is the comparative table of Ally Financial Inc. (ALLY), Qifu Technology Inc. (QFIN), SLM Corporation (SLM)’s returns from 2020 to 2024 based on CLOSING Prices.

| Year | SOFI | ALLY | QFIN | SLM |

|---|---|---|---|---|

| 2024 | +54.77% | +3.12% | +142.60% | +44.25% |

| 2023 | +115.84% | +42.82% | -22.30% | +15.18% |

| 2022 | -70.84% | -48.65% | -11.21% | -15.61% |

| 2021 | +27.09% | +33.51% | +94.49% | +58.76% |

| 2020 | +26.72% | +16.69% | +20.68% | +39.06% |

| Average Returns | +30.72% | +9.49% | +44.85% | +28.32% |

Here we can observe that SOFI stocks’ performance is at par when compared to its peer companies if we look at the 5-year average returns. We didn’t considered Joint Stock company Kaspi.kz (KSPI) for this comparison since it got listed in 2024.

SoFi Stock Price Prediction : Short & Long Term

SoFi Stock Price Forecast 2025, 2026, 2027, 2028, 2029

| Year | Stock Price Target |

|---|---|

| SoFi stock price forecast for 2025 | $ 13.84 |

| SoFi stock price forecast for 2026 | $ 16.07 |

| SoFi stock price forecast for 2027 | $ 19.94 |

| SoFi stock price forecast for 2028 | $ 23.38 |

| SoFi stock price forecast for 2029 | $ 26.72 |

Based on the above predictions, SoFi Technologies Inc. (NASDAQ: SOFI) stock could see decent but volatile growth in the coming years. Starting from its current price of $11.90 (as of March 28, 2025), here’s a breakdown of the expected percentage increases for SoFi stock price each year leading up to 2029:

- 2025: The stock price is expected to reach $13.84, reflecting a 16.30% increase.

- 2026: The estimated price is $16.07, marking a 35.04% rise.

- 2027: The forecasted price is $19.94, showing an 67.56% gain.

- 2028: The anticipated price is $23.38, indicating a 96.47% increase.

- 2029: The stock is expected to hit $26.72, representing a massive 124.52% surge compared to today’s price of $11.90.

SoFi Stock Price Prediction 2030, 2035, 2040, 2050

| Year | Stock Price Target |

|---|---|

| SoFi Stock Price Prediction for 2030 | $ 31.56 |

| SoFi Stock Price Prediction for 2035 | $ 45.18 |

| SoFi Stock Price Prediction for 2040 | $ 62.07 |

| SoFi Stock Price Prediction for 2050 | $ 85.34 |

As we look towards the long term growth, SoFi stock may provide a steady growth and good returns for long-term investors. Based on the current price of $11.90 (as of March 28, 2025), here are the projected percentage gains for SoFi stock price:

- By 2030: The stock price could reach $31.56, marking a 165.21% increase.

- By 2035: It could rise to $45.18, reflecting a 279.66% return.

- By 2040: The stock is expected to climb to $62.07, showing a 421.59% gain.

- By 2050: SoFi’s stock price could hit $85.34, indicating an impressive 617.14% increase from today’s price of $11.90.

These projections highlight SoFi’s long-term growth potential, but these forecast come with associated risks. Future market conditions and industry developments in finance as well as IT sector will play a crucial role in shaping the actual performance of the stock.

Also Read : MSFT Stock Prediction 2025 to 2050 : Should You Worry?

SoFi Stock Price Prediction 2025 (month-wise)

| Month | Price Target |

|---|---|

| SoFi stock price prediction for January 2025 | 10.92 |

| SoFi stock price prediction for February 2025 | 10.53 |

| SoFi stock price prediction for March 2025 | 10.86 |

| SoFi stock price prediction for April 2025 | 11.43 |

| SoFi stock price prediction for May 2025 | 11.89 |

| SoFi stock price prediction for June 2025 | 12.28 |

| SoFi stock price prediction for July 2025 | 11.67 |

| SoFi stock price prediction for August 2025 | 12.53 |

| SoFi stock price prediction for September 2025 | 13.17 |

| SoFi stock price prediction for October 2025 | 13.84 |

| SoFi stock price prediction for November 2025 | 12.43 |

| SoFi stock price prediction for December 2025 | 13.29 |

As per our analysis of SoFi stock price, we are expecting that the prices may rise up to $13.84 during 2025, offering an approximate 16.30% return on its current price of $11.90 (as of March 28, 2025). This represents a DECENT return for long term investors.

Conclusion

SoFi Technologies (SOFI) has shown steady growth in the fintech sector, with a market cap of $11.72 billion USD. The stock reached its all-time high of $28.26 in February 2021, but its overall trend remains sideways.

For long-term investors, SoFi Technologies Inc. (NASDAQ: SOFI) holds promising potential as a choice for steady, future growth. We hope this article, “SOFI stock price prediction 2025, 2030, 2040 & 2050” has given you valuable insights. Be sure to check out the videos and FAQs section for more detailed information and guidance.

Despite short-term fluctuations, long-term forecasts suggest that SOFI could reach $85.34 per share by 2050, indicating strong potential for future growth. As the company continues to expand its digital banking and lending services, it remains an interesting stock to watch for long-term investors.

Also Read : EVGO stock price prediction 2025 and beyond | The FUTURE of EVs

Frequently Asked Questions (FAQs)

1) Who is the biggest shareholder in SoFi stock?

The top three largest shareholders of SoFi Technologies Inc stock are Vanguard Group (8.19%), Blackrock Finance Inc (4.10%) and Silver Lake Management Co. (2.93%).

2) What will SoFi stock be worth in 2025?

In 2025, SoFi stock price could reach near to $14 per share.

3) Is SoFi a good stock to buy?

Yes, as per our analysis, SoFi Technologies is a good stock to buy. Since, they are working in Fintech sector and we have seen multifold increase in the demand of such services, it can even become a multi-bagger in coming decades.

4) What is the price target for SoFi in 5 years?

In the next 5 years, we can see SOFI stock to reach around $27 to $32 per share.

5) What is the SoFi stock forecast for 2030?

By 2030, the stock price could reach $31.56, which is a 165.21% increase on today’s price of $11.90.

6) Will SoFi Technologies stock reach $100?

As per our analysis, It can reach around $85 till 2050 but if SoFi technologies get favorable market conditions, it may touch $100 per share mark in coming decades.

7) What is the SoFi stock forecast for 2050?

By 2050, SoFi’s stock price could hit $85.34, indicating an impressive 617.14% increase from today’s price of $11.90 (March 28, 2025).

Disclaimer : Not an Investment Advice

The content shared in the above article “SoFi Technologies | SOFI Stock Price Prediction 2025 to 2050” is for general information only. It’s not intended as financial, investment, or professional advice. Always consult a qualified professional—whether legal, financial, or tax-related—before making any investment decision.

4 Comments