💸 Lucid Stock Forecast for 2025 to 2050 [updated]

👉 30 Seconds Summary 👈

Lucid Group Inc (Nasdaq : LCID) is an American EV manufacturing and technology company. They are majorly hold by Saudi Arabia’s Public Investment Fund. With its strong financial support, we are expecting a slow but steady growth of Lucid stock prices. We can expect the stock price to go up to $ 17.50, $ 22.73, $ 43.28, $55.13 in 2030, 2035, 2040, 2050 respectively.

Lucid Group, Inc. is an American electric vehicle (EV) manufacturer and technology company. It is headquartered in Newark, California. It is Known for producing luxury EVs, Lucid started production of its flagship model, the Lucid Air sedan, in September 2021 at its Arizona factory. In this article “Lucid Stock Forecast for 2025 to 2050” we will discuss its long term as well as short terms perspective of Lucid stock prices.

The company is planning to increase its lineup with the Lucid Gravity, a luxury electric SUV set to begin production in late 2024. Beyond building its own cars, Lucid also supplies advanced powertrain systems to other automakers, including Aston Martin, supporting their shift to electric vehicles.

Financially, Lucid benefits from strong backing, with Saudi Arabia’s Public Investment Fund (PIF) holding a majority stake since 2019. Other key investors include Vanguard Group, BlackRock, and State Street Corporation. With its innovative technology, strong financial support, and ambitious growth plans, Lucid is ready to make a significant impact in the competitive electric vehicle market & this will also impact Lucid stock prices positively.

About Lucid Group Inc (LCID) | Company Information

| Company Name | Lucid Group, Inc. |

| Stock Exchange | Nasdaq |

| Ticker Symbol | LCID |

| Sector | Automotive |

| Headquarter | Newark, California, US |

| Founded in | 2007 |

| Founder | Bernard Tse, Sheaupyng Lin, Sam Weng |

| Major Shareholder | Public Investment Fund (59.77%) |

| Market Cap. | $7.75 billion usd |

| Revenue(2023) | $595.27 million usd |

| Total Assets | $8.51 billion usd |

| All-time high closing price | $58.05 usd |

| 52-week low | $1.93 usd |

| 52-week high | $5.58 usd |

| Peer Companies | EVgo Inc. (EVGO), Tesla Inc. (TSLA), Rivian Automotive Inc (RIVN), Forward Motors Company (F), (FORD), General Motors Company (GM) |

Lucid Group, Inc. began its production of electric Lucid Air sedan in Arizona in September 2021. Despite supply chain challenges, the company produced 7,180 vehicles in 2022 and 8,428 in 2023, meeting the higher end of its forecast. In June 2023, Lucid got a $450 million deal with Aston Martin to develop and supply electric motors, powertrains, and battery systems for Aston Martin’s future electric vehicles. As part of the agreement, Lucid gained a 3.7% stake in Aston Martin.

In August 2024, Lucid announced $1.5 billion in additional funding from Ayar Third Investment Co., its majority shareholder, with the funds coming from convertible preferred stock and an unsecured loan.

Lucid Group, Inc. (LCID) Analysis | Past, Present & Future

We’ll look at both technical charts and financial data to understand what could impact Lucid’s stock price in the short and long term. If you’re wondering about Lucid’s growth potential, keep reading to see where this stock might be headed.

Historical Lucid Stock Price Data

| Year | Year High | Year Low | Year Close | Annual % change |

|---|---|---|---|---|

| 2024 | $ 4.26 | $ 2.38 | $ 3.39 | -19.48% |

| 2023 | $ 12.87 | $ 3.75 | $ 4.21 | -38.36% |

| 2022 | $ 45.47 | $ 6.20 | $ 6.83 | -82.05% |

| 2021 | $ 58.05 | $ 10.01 | $ 38.05 | +280.12% |

While looking at the historical Lucid stock prices data, we can clearly see an year-on-year downtrend since 2022. In 2021, it gave a whooping returns of +280.12% to its investors but in 2022 it dropped by -82.05%. Furthermore, Lucid share prices were declined by -38.36% in 2023 and currently it declined by ~19.48%.

One year chart analysis for Lucid stock forecast

Let’s discuss what Lucid’s 1-year chart is telling us? Firstly we can see a sharp drop in Lucid stock prices from $5 to $2.86 within 15-days (end-Dec 23 to start-Jan 24).

After this drop, Lucid stock prices tried to get back to $4 but failed and while reaching May 24, it touched its 52-week low of $ 2.29 per share.

But, in June 24, it gave a steep up trend and reached a high of $ 4.32 and again after a sharp correction, it again stood strong and touched $ 4.43. Currently Lucid stock is trading in the middle of a range of $3-$4.

Lucid Stock Live Chart

Here is the Lucid share Live chart, please have a close look to see where it is heading today. Then you will understand better about the predictions we have provided below.

Time-Frame analysis of Lucid : Hourly, Daily & Weekly

By analyzing a Lucid stock price through a timeframe chart, we can gather some key insights that will assist us in determining the final Lucid stock predictions : –

| Time Frame | Observation |

|---|---|

View Hourly Chart (Every candle represents Nasdaq : LCID share’s trading session of one hour. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular hour) | On hourly time-frame, we can observe that Lucid stock is trading below the 21 hour, 50 hour, 100 hour and 200 hour SMA. This indicates that the Lucid stock is in Sideways to Downtrend for short term. |

View Daily Chart (Every candle represents Nasdaq : LCID share’s trading session of one day. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular day) | On daily time-frame, we can observe that Lucid stock is trading BELOW 21 Day SMA, 50 Day, 100 Day & 200 Day SMA. This is the sign of Bearishness in medium term. |

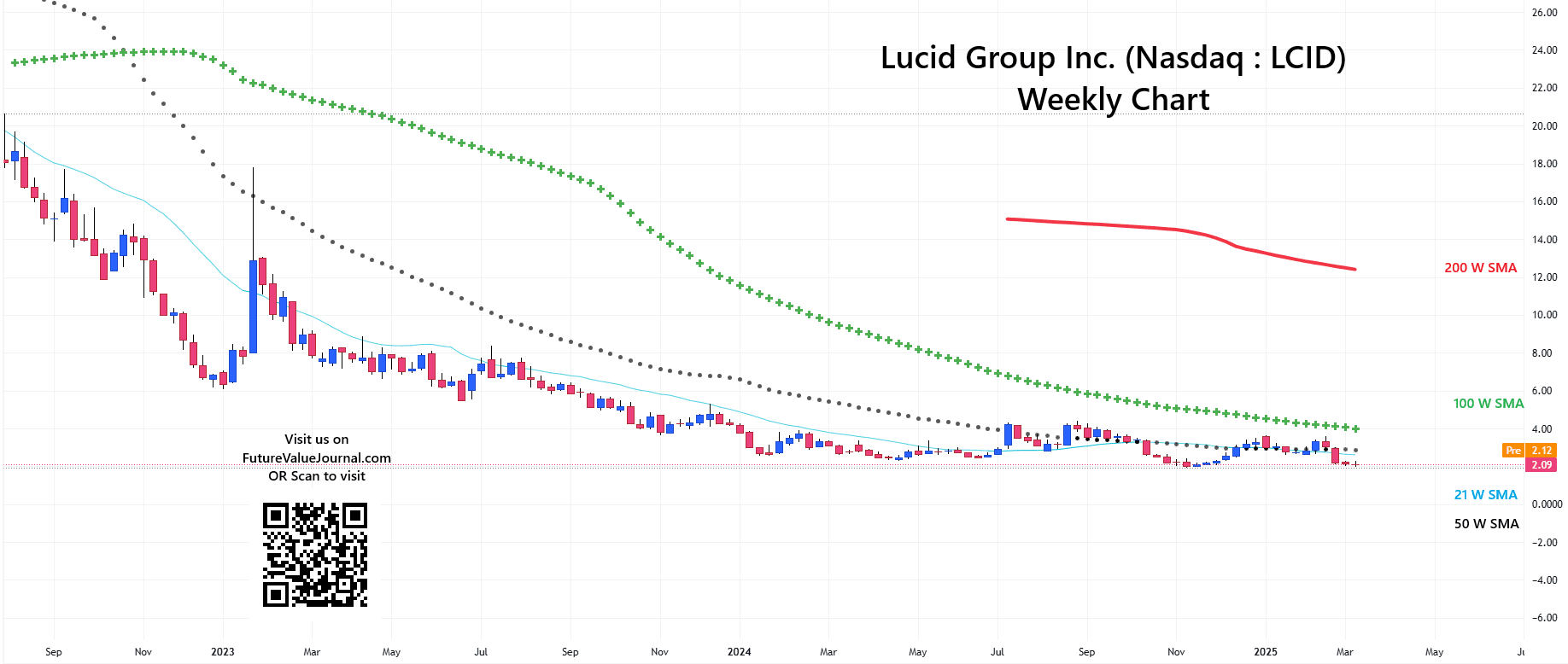

View Weekly Chart (Every candle represents Nasdaq : LCID stock’s trading session of one week. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular week) | On the weekly time-frame Lucid stock is trading below 21 weeks, 50 weeks, 100 weeks & 200 weeks SMA. This indicates that Lucid stock has a clear BULLISH sentiment, if we look at it from a very long term perspective. |

Since there is a BEARISH perspective shown by SMAs in Weekly, Daily as well as Hourly time-frame by Lucid stock. This can be a Scary scenario for a trader/investor. BUT before taking any decision, let’s analyze it by observing the directions of the SMAs.

Here, in Hourly time-frame, we can see the flat 21 Hour SMA, this indicates the change in sentiments from bullish to sideways in short term.

Dow Jones, NASDAQ & Lucid : A comparative Analysis

Check out the comparative year on year returns of Dow Jones, Nasdaq and Lucid. Here, we are showing the returns by comparing them on closing basis –

| Year | Dow Jones | Nasdaq | Lucid |

|---|---|---|---|

| 2024 | +12.88% | +28.64% | -28.27% |

| 2023 | +13.70% | +43.42% | -38.36% |

| 2022 | -8.78% | -33.10% | -82.05% |

| 2021 | +18.73% | +21.39% | +280.12% |

| 2020 | +7.25% | +43.64% | – |

Also Read : CrowdStrike | CRWD Stock Price Prediction 2025, 2030, 2040, 2050

Lucid Peer Comparison / Competitors Analysis

We will compare Lucid Corporation (Nasdaq : LCID) to its top competitors. We will see how its peer companies performed year-on-year . Below is the comparative table of EVgo Inc. (EVGO), Tesla Inc. (TSLA), Rivian Automotive Inc (RIVN), Ford Motors Company (F), General Motors Company (GM)‘s returns from 2020 to 2024 based on CLOSING Prices.

| Year | Lucid | EVGO | TSLA | GM | F |

|---|---|---|---|---|---|

| 2024 | -28.27% | +13.13% | +62.52% | +48.30% | -18.79% |

| 2023 | -38.36% | -19.91% | +101.72% | +6.78% | +4.82% |

| 2022 | -82.05% | -55.03% | -65.03% | -42.62% | -44.01% |

| 2021 | +280.12% | -7.19% | +49.76% | +40.80% | +136.29% |

| 2020 | – | – | +743.44% | +13.77% | -5.48% |

| Average Returns | +32.86% | -17.25% | +178.48% | +13.40% | +14.56% |

Here we can observe that Lucid’s performance was amazing in the year 2021 but it is in downtrend since 2022 if we look at the 5-year average returns. Rivian Automotive Inc. (RIVN) got listed in 2021, so we are not considering it for this comparison.

Lucid Stock Forecast : Short & Long Term

Lucid Stock Forecast for 2025, 2026, 2027, 2028, 2029

| Year | LCID Price Target |

|---|---|

| Lucid stock forecast for 2025 | $ 4.36 |

| Lucid stock forecast for 2026 | $ 6.54 |

| Lucid stock forecast for 2027 | $ 7.63 |

| Lucid stock forecast for 2028 | $ 9.27 |

| Lucid stock forecast for 2029 | $ 12.45 |

Looking ahead to 2026, we estimate Lucid stock prices could reach $6.54, which would be a 95.81% increase from today’s price of $3.34. By 2027, we expect the stock to rise to $7.63, representing a 128.44% gain.

Further into the future, over the next three years, we anticipate Lucid stock prices could hit $9.27, reflecting a 177.84% increase from its current price. In the long term, we project Lucid stock prices to climb to $12.45 by 2029, which would represent a substantial 272.75% surge from today’s price of $3.34.

Lucid Stock Forecast for 2030, 2035, 2040, 2050

| Year | LCID Price Target |

|---|---|

| Lucid stock forecast for 2030 | $ 17.50 |

| Lucid stock forecast for 2035 | $ 22.73 |

| Lucid stock forecast for 2040 | $ 43.28 |

| Lucid stock forecast for 2050 | $ 55.13 |

Our long-term analysis forecasts Lucid stock prices reaching $17.50 by 2030, which would represent a significant 423.65% increase from today’s price of $3.34. Looking ahead to 2035, we estimate Lucid stock prices could reach $22.73, which would represent a remarkable 579.64% increase from today’s price of $3.34.

By 2040, we expect the stock to rise to $43.28, reflecting a substantial 1,294.13% gain from the current price. Further into the future, in 2050 we anticipate Lucid stock prices could hit $55.13, indicating an impressive 1,548.80% increase from its current price.

While it’s challenging to predict the full extent of Lucid stock prices future growth, the company holds strong potential, particularly with the rising adoption of electric vehicles (EVs). As Lucid continues to innovate in the EV sector, it stands to benefit from the growing demand for electric vehicles in the coming years. Though current data provides only a snapshot of Lucid’s potential, its unique position in the market suggests promising growth as EV technology reaches new heights.

Lucid Stock Forecast 2025 (month-wise)

| Month | LCID Price Target |

|---|---|

| Lucid stock price prediction for January 2025 | $3.71 |

| Lucid stock price prediction for February 2025 | $3.83 |

| Lucid stock price prediction for March 2025 | $3.95 |

| Lucid stock price prediction for April 2025 | $4.08 |

| Lucid stock price prediction for May 2025 | $4.12 |

| Lucid stock price prediction for June 2025 | $4.17 |

| Lucid stock price prediction for July 2025 | $4.25 |

| Lucid stock price prediction for August 2025 | $4.29 |

| Lucid stock price prediction for September 2025 | $4.32 |

| Lucid stock price prediction for October 2025 | $4.36 |

| Lucid stock price prediction for November 2025 | $4.28 |

| Lucid stock price prediction for December 2025 | $4.21 |

Our analysis of Lucid stock forecast projects the price to rise to $4.36, offering an approximate 30.53% return on its current price of $3.34 as of February 20, 2025. This represents a solid return for investors in the stock.

Given the expected changes in the electric vehicle (EV) industry in the near future, our analysts anticipate slow but steady growth for Lucid stock prices. While the market may experience fluctuations, the long-term outlook for Lucid remains positive as it continues to innovate and adapt to industry changes.

Also Read : Nvidia Share Price Predictions

Conclusion

Let’s summarize what we discussed so far. Lucid Group Inc. (Nasdaq : LCID) is an electric vehicle company founded in 2007. It has a market capitalization of $7.75 billion and earns $595.27 million in revenue. Right now, its stock is moving down on daily and weekly charts. However, over the past five years, it has given an average return of +32.86%. Looking ahead, experts believe its stock price could go up to $55.13 by 2050, making it a company with long-term growth potential.

Also Read : Microsoft Stock Prediction 2025 to 2050 : Should You Worry?

Handpicked for you (MUST WATCH)

Frequently asked questions (FAQs)

1) What is Lucid Stock Forecast for 2025?

We anticipate Lucid stock prices to rise to $4.36 by December 2025, which represents a 60.48% increase from the current price of $3.34.

2) Will Lucid stock prices reach $100?

Currently, $100 seems to be a really long shot for Lucid stock. It looks possible but it may take a really long time. We do not see any current possibility which can take Lucid stock prices to $100.

3) Is Lucid Group, Inc stock a good buy ?

If you can hold the stock for more than 5 years, you can expect good returns from this stock but currently it looks like a sell / hold as in our recommendations because there are many more attractive investment options available.

4) Why Does Lucid stocks stand out from the Crowd?

To tackle the challenges of the electric vehicle (EV) industry, companies need both high-quality, unique products and a solid financial foundation, supported by investors willing to sustain ongoing cash needs & Lucid has both. The luxury carmaker Aston Martin has even partnered with Lucid to purchase electric motors and batteries, reinforcing Lucid’s reputation for delivering world-class products. Additionally, Lucid’s batteries are highly efficient, allowing its vehicles to achieve a much longer range.

5) Is Lucid stock a hold, buy or sell ?

According to our analysts, the ratings for Lucid stock prices is “Sell.” While some price targets are set higher than the current market value, recent analyst updates have lowered both price targets and their overall outlook, leading to downgrades in the stock’s rating. We are on sell side because there are so many other good options available which can give you good returns on your investment.

6) Who is the major shareholder of Lucid Stock?

The Saudi Arabia’s Public Investment Fund (PIF) is the major shareholder of Lucid stocks. They are the owner of ~60% of the shares.

7) What is the price prediction of Lucid Stock Inc. for 2030?

Based on our long-term analysis, we expect Lucid stock prices to reach $17.50 by 2030, which would be an impressive 423.65% increase from the current price of $3.34.

8) What is the price prediction of Lucid Stock Inc. for 2040?

By 2040, we anticipate Lucid stock prices to reach $43.28, marking a remarkable 1,294.13% increase from its current price.

9) What is the price prediction of Lucid Stock Inc. for 2050?

By 2050 we expect Lucid stock prices to reach $55.13, representing an impressive 1,548.80% increase from its current price.

10) Why Lucid stock is so low?

By the end of last year, Lucid faced significant challenges due to the ongoing price war in the electric vehicle (EV) market. This pressure caused a drop in both deliveries and production during the fourth quarter of 2023, leading to a sharp decline in its stock, which hit a record low.

11) Where will Lucid Stock be in 5 years?

Over the next five years, Lucid has a real good chances of becoming a key player in the EV industry. Its focus on luxury and cutting-edge technology sets it apart, allowing the company to carve out a niche in the high-end market. While bigger competitors may focus on lowering prices and possibly sacrificing quality, Lucid’s approach could attract customers looking for premium electric vehicles.

12) What is Lucid highest stock price?

Lucid stock prices reached its all-time high closing price of $58.05 on February 18, 2021, marking a significant peak in its trading history. Over the past 52 weeks, the highest price Lucid stock achieved was $5.68, which is 58.2% higher than its current market value.

On the other side, the stock hit a 52-week low of $2.29, which is 36.2% below its present price. This wide range in price movement reflects the volatility Lucid has faced in the market, largely influenced by the evolving dynamics of the electric vehicle sector and broader economic conditions.

13) Is Lucid stock risky?

Lucid currently lacks the financial resources and time to become a strong competitor in the broader EV market. At best, it functions as a luxury electric vehicle manufacturer catering to wealthy buyers only. While that’s not necessarily a bad business model, it may not be enough to make Lucid stock a worthwhile investment at this point.

Disclaimer : Not an Investment Advice

The content shared here in “💸 Lucid Stock Forecast for 2025 to 2050 [updated]” is for general information only. It’s not intended as financial, investment, or professional advice. Always consult a qualified professional—whether legal, financial, or tax-related—before making any investment decisions.

I wasn’t expecting to resonate so much with this article, but you captured the nuances of the topic so well. Thank you for your perspective.

Great post. I was checking continuously this blog and I am impressed! Extremely useful info specially the last part 🙂 I care for such info a lot. I was looking for this particular information for a long time. Thank you and best of luck.

Definitely believe that which you said. Your favorite justification appeared to

be on the net the simplest thing to be aware of. I say to you,

I certainly get annoyed while people consider worries that they just do not know about.

You managed to hit the nail upon the top as well as

defined out the whole thing without having side effect , people could take a signal.

Will probably be back to get more. Thanks

I have not checked in here for a while because I thought it was getting boring, but the last few posts are great quality so I guess I will add you back to my daily bloglist. You deserve it my friend 🙂

This design is spectacular! You definitely know how to keep a reader entertained. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Wonderful job. I really loved what you had to say, and more than that, how you presented it. Too cool!

I like this web blog so much, saved to bookmarks.

Sweet blog! I found it while surfing around on Yahoo

News. Do you have any suggestions on how to get listed in Yahoo News?

I’ve been trying for a while but I never seem to get there!

Thanks