🛫 Archer Aviation Stock Forecast | Let’s unlock your sky?

👉 30 Seconds Summary 👈

For Archer Aviation stock forecast, we can say that it is a strong entity in the urban aviation sector, offering promising growth potential for long-term investors. Since it is a new and upcoming sector, you have to be very patient if you are thinking of investing in it. As per our analysis of its fundamentals, technical trends, and the broader market outlook suggests that ACHR’s stock price could reach around $11.63 in 2025, $39.08 by 2030, $55.76 by 2035, $87.43 by 2040, and possibly $153.14 by 2050.

Welcome to our Archer Aviation stock forecast! Everyone is waiting for e-taxis right? But we will discuss how you can skyrocket your portfolio from these upcoming technologies.

Archer Aviation (NYSE: ACHR) is an exciting company in the fast-growing electric aviation industry, aiming to make air travel more sustainable and accessible. In this post, we’ll explore the future potential of Archer aviation’s stock, examine key factors that could shape its growth and provide insight into its long-term future value.

Whether you’re curious about investing in this innovative company or just want to learn more about the electric aviation market, let’s dive in and unlock what the future might hold for Archer Aviation.

About Archer Aviation (NYSE : ACHR)

| Company Name | Archer Aviation Inc. |

| Stock Exchange | NYSE |

| Ticker Symbol | ACHR |

| Sector | Aviation |

| Major Shareholder | Stellantis NV (~18.72%) |

| Market Cap. | $ 1.55 billion usd |

| Total Assets | $ 578.5 million usd |

| All-time high | $ 18.60 usd (Feb 18, 2021) |

| 52-week high | $ 12.48 usd (Jan 07, 2025) |

| 52-week low | $ 2.82 usd (Sept 26, 2024) |

| Peer Companies | Elbit Systems (ESLT), Embraer (ERJ), Joby Aviation (JOBY), EHang (EH), Ducommun (DCO), and Vertical Aerospace (EVTL) |

Archer Aviation Inc. (NYSE : ACHR) is a forward-thinking company in the electric aviation industry, focused on creating eco-friendly, electric vertical takeoff and landing (eVTOL) aircraft. It is headquartered in California, US. Archer aims to make urban air mobility a reality, offering an efficient and sustainable alternative to traditional ground transportation.

ACHR was founded with a vision for cleaner, faster travel, Archer is developing aircraft that could transform city commutes and reduce road congestion. As the demand for electric aviation grows, Archer Aviation has attracted significant attention from investors and the tech community, positioning itself as a key player in the future of air travel.

Archer Aviation (ACHR) Analysis | Past, Present & Future

We’ll look at both technical and key financial data to understand what could impact Archer Aviation’s stock price in the short and long term. If you’re concerned about ACHR’s growth potential, keep reading to see where this stock might be headed.

Archer Aviation Stock Price History

Here in the above 4 Year annual percentage change chart, we can observe that ACHR share price gave mostly negative returns to the investors. In 2021, it’s price got discounted by -36.96% & again in 2021 it gave a negative return of -69.04%. But in 2023, Archer aviation stock price gained its value by +228.34% when compared to previous year.

Since, the current trend of the ACHR stock is sideways (range bound), it would be better if you take some time before investing into it. We have provided more detailed analysis below which can help you better understand about your investment decision regarding Archer aviation stock.

Also Read : ✈️ Joby Aviation | JOBY stock forecast 2025, 2030 and more

Archer Aviation One year chart analysis

In one year Archer Aviation stock price chart, we can observe that after hitting its High of $7.02 on December 14, 2023 the stock began to fall with slight downtrend till June 2024.But from June, ACHR stock began to trade in a sideways trend which is continuing till today. In this time period, it made its new 52-week low of $2.82 on September 26, 2024.

From June, 2024, we have seen a range bound trend in ACHR stock where it traded between $5.34 to $2.82. By this, we can anticipate that, the ACHR stock might trade in sideways to up trend for some time. From all these analysis, we formulated the month-wise Archer Aviation stock forecast for 2025 below.

Archer Aviation Stock Live chart

Above is the ACHR stock’s live chart for you. Have a look and observe the patterns which ACHR stock created in the past. Below are the future value prediction for the stock, compare them with the above chart to get a clear idea about your investment decision.

Also Read : [🛩️] Spirit Airlines Inc | SAVE stock forecast 2025, 2030 to 2050

Time-Frame analysis of Archer Aviation : Hourly, Daily & Weekly

By combining different approaches and expert insights, you can get a more rounded view of ACHR’s potential, whether you’re interested in short-term gains or long-term growth. As by a simple technical chart analysis we can observe the following –

| Time Frame | Observation |

|---|---|

View Hourly Chart (Every candle represents NYSE : ACHR share’s trading session of one hour. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular hour) | On hourly time-frame, we can observe that ACHR stock is trading ABOVE all the 21 hour, 50 hour, 100 hour and 200 hour SMA. This indicates that the Archer Aviation’s stock is in Uptrend for short term. |

View Daily Chart (Every candle represents NYSE : ACHR share’s trading session of one day. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular day) | On daily time-frame, we can observe that ACHR stock is trading ABOVE 21 Day SMA, 100 Day & 200 Day SMA But BELOW 50 Day SMA. This is the sign of mixed sentiments in medium term. |

View Weekly Chart (Every candle represents NYSE : ACHR stock’s trading session of one week. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular week) | On the weekly time-frame ACHR stock is trading ABOVE all the 21 weeks, 50 weeks, 100 weeks & 200 weeks SMA. This indicates that ACHR stock has a clear Bullish sentiment, if we look at it from a long term perspective. |

All the SMAs are indicating a Bullish trend for Archer Aviation’s stock in short and Long term but in Medium term, there is a tie between Bulls and Bears. So, if you are a trader, you can use this volatility for some quick profits but if you are a medium to long term investor, you should wait for a clear sign before investing. Staying updated on the latest aviation news also gives you valuable insights to make smart choices when investing in ACHR stock.

Dow Jones, NASDAQ & Archer Aviation : A comparative Analysis

Check out the comparative year on year returns of Dow Jones, Nasdaq and ACHR. Here, we are showing the returns by comparing them on closing basis –

| Year | Dow Jones | Nasdaq | ACHR |

|---|---|---|---|

| 2024 | +12.88% | +28.64% | +58.79% |

| 2023 | +13.70% | +43.42% | +228.34% |

| 2022 | -8.78% | -33.10% | -69.04% |

| 2021 | +18.73% | +21.39% | -39.96% |

| 2020 | +7.25% | +43.64% | – |

Also Read : CrowdStrike | CRWD Stock Price Prediction 2025, 2030, 2040, 2050

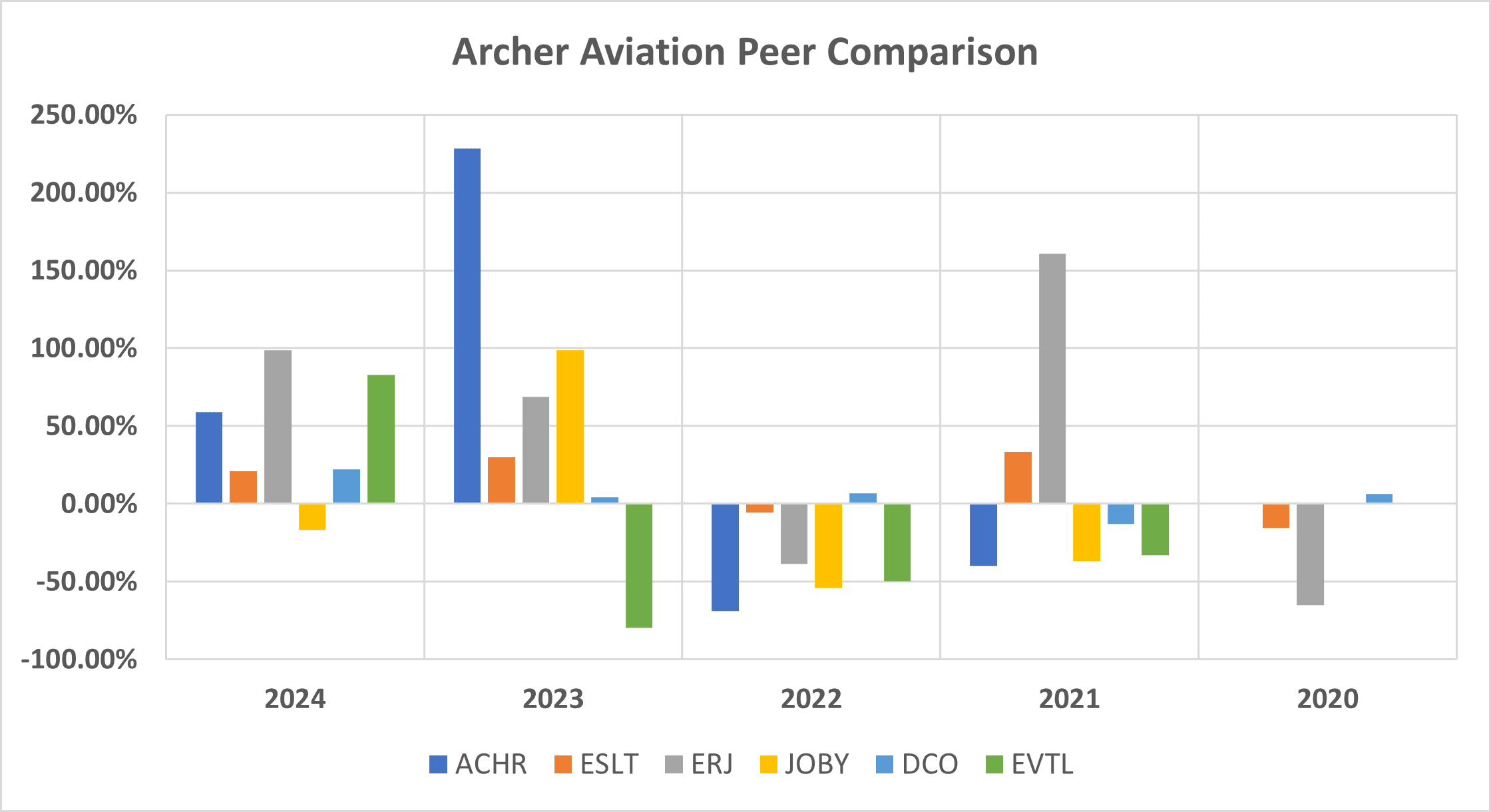

Archer Aviation Peer Comparison / Competitors Analysis

We will compare Archer Aviation Inc. (NYSE : ACHR) to its top competitors. We will see how its peer companies performed year-on-year . Below is the comparative table of Elbit Systems (ESLT), Embraer (ERJ), Joby Aviation (JOBY), Ducommun (DCO), and Vertical Aerospace (EVTL)’s returns from 2020 to 2024 based on CLOSING Prices.

| Year | ACHR | ESLT | ERJ | JOBY | DCO | EVTL |

|---|---|---|---|---|---|---|

| 2024 | +58.79% | +21.02% | +98.81% | -16.69% | +22.28% | +82.85% |

| 2023 | +228.34% | +30.00% | +68.80% | +98.51% | +4.20% | -79.71% |

| 2022 | -69.04% | -5.79% | -38.42% | -54.11% | +6.82% | -49.63% |

| 2021 | -39.96% | +33.13% | +160.65% | -36.85% | -12.91% | -33.03% |

| 2020 | – | -15.65% | -65.06% | – | +6.27% | – |

| Average Returns | +44.53% | +12.54% | +44.95% | -2.28% | +5.33% | -19.88% |

Here we can observe that ACHR’s performance is noticeably high par when compared to its peer companies if we look at the 5-year average returns.

Archer Aviation Stock Forecast : Short & Long Term

Archer Aviation Stock Forecast 2025, 2026, 2027, 2028, 2029

| Year | ACHR Price Target |

|---|---|

| 2025 | $ 11.63 |

| 2026 | $ 15.52 |

| 2027 | $ 19.33 |

| 2028 | $ 26.14 |

| 2029 | $ 33.93 |

According to these projections, Archer Aviation (NYSE: ACHR) stock could experience notable growth over the next few years. Starting from its current price of $8.72 (as of March 22, 2025), here’s a look at the expected prices and percentage increases each year through 2029:

- 2025: The stock price could reach $11.63, reflecting a +33.37% increase from today’s price of $8.72.

- 2026: The estimated price is $15.52, marking a +77.98% rise from today’s price.

- 2027: The forecasted price is $19.33, showing a +121.67% gain from today’s price.

- 2028: The anticipated price is $26.14, indicating a +199.77% increase from today’s price.

- 2029: The stock is expected to hit $33.93, representing a +289.11% surge compared to today’s price of $8.72.

These projections suggest a strong upward trend for ACHR stock, which could be promising for long-term investor who are looking to capitalize on the company’s growth.

Archer Aviation Stock Forecast 2030, 2035, 2040, 2050

| Year | ACHR Price Target |

|---|---|

| Archer Aviation stock price prediction for 2030 | $ 39.08 |

| Archer Aviation stock price prediction for 2035 | $ 55.76 |

| Archer Aviation stock price prediction for 2040 | $ 87.43 |

| Archer Aviation stock price prediction for 2050 | $ 153.14 |

Looking at Archer Aviation’s (ACHR) potential for long-term growth, the stock could offer solid returns for investors focused on the future. Starting from its current price of $8.72 (as of March 22, 2025), here are some potential projections:

- By 2030: The stock price might reach $39.08, representing a +348.17% increase from today’s price of $8.72.

- By 2035: It could climb to $55.76, marking a +539.45% return from today’s level.

- By 2040: The stock is projected to reach $87.43, showing an impressive +902.64% gain.

- By 2050: ACHR’s stock price could soar to $153.14, indicating a remarkable +1656.19% increase over the current price.

These projections highlight ACHR’s promising long-term growth potential, though it’s important to remember that all forecasts carry risks, as market and industry trends can shift over time.

Archer Aviation Stock Forecast 2025 (month-wise)

| Month | ACHR Price Target |

|---|---|

| ACHR stock price prediction for January 2025 | 7.12 |

| ACHR stock price prediction for February 2025 | 7.32 |

| ACHR stock price prediction for March 2025 | 8.15 |

| ACHR stock price prediction for April 2025 | 8.99 |

| ACHR stock price prediction for May 2025 | 9.46 |

| ACHR stock price prediction for June 2025 | 9.74 |

| ACHR stock price prediction for July 2025 | 10.57 |

| ACHR stock price prediction for August 2025 | 11.63 |

| ACHR stock price prediction for September 2025 | 11.01 |

| ACHR stock price prediction for October 2025 | 10.64 |

| ACHR stock price prediction for November 2025 | 10.13 |

| ACHR stock price prediction for December 2025 | 10.58 |

Based on our analysis, ACHR stock price could rise to around $11.63 by 2025, offering an estimated 33.37% return on the current price of $8.72 (as of March 22, 2025). This would provide a DECENT return for long-term investors. Want to know more about the company? Keep reading, we also have glimpse of our analysis that explains about how we get these forecasts.

Also Read : 💻 ACM Research Inc. | ACMR stock forecast 2025, 2030, 2040, 2050

Conclusion

Archer Aviation, with a market cap of $1.55 billion, is a leading company in the eVTOL (electric vertical takeoff and landing) aircraft sector. The stock reached an all-time high of $18.60 and has shown strong performance over the past five years, outpacing many of its industry peers. As the demand for advanced air mobility grows, Archer Aviation remains a promising investment with long-term growth potential in the evolving urban air mobility market.

For investors with a long-term focus, Archer Aviation (NYSE: ACHR) may be a solid option for steady growth. We hope this article, “Archer Aviation Stock Forecast | Let’s unlock your sky?” has provided valuable insights. Be sure to check out our videos and FAQs section for more detailed information and guidance!

Handpicked for you (MUST WATCH)

Frequently Asked Questions (FAQs)

1) How high will ACHR stock go?

ACHR can go up to $153+ per share till 2050 if we consider it as a super Long-term investment.

2) What is the Archer Aviation stock forecast for next 12 month?

The price target for ACHR stock can be $11.63 per share in next 12 months as per our analysis.

3) Is ACHR a good stock to buy?

Yes. As per our analysis, ACHR is a DECENT BUY. It is looking stable on charts as well as in fundamental analysis too. Although because it is a new growing sector, you have to invest in it patiently.

4) What is the Archer Aviation stock forecast for 2030 ?

In 2030, as per our analysis, we can see Archer Aviation stock price to reach $39.08 per share.

5) What is the Archer Aviation stock forecast for 2050 ?

For 2050, we are expecting Archer Aviation stock price to reach around $153.14 per share.

6) What is the Archer Aviation stock price target for 2025 ?

For 2025, we are expecting Archer Aviation stock price to reach around $11.63 per share.

7) What is the Archer Aviation stock forecast for 2040 ?

In 2040, we can see Archer Aviation stock price to reach around $87.43 per share.

Disclaimer : Not an Investment Advice

The content shared in the above article “Archer Aviation Stock Forecast | Let’s unlock your sky?” is for general information only. It’s not intended as financial, investment, or professional advice. Always consult a qualified professional—whether legal, financial, or tax-related—before making any investment decision

Someone essentially help to make seriously posts I would state. This is the first time I frequented your website page and thus far? I surprised with the research you made to create this particular publish amazing. Wonderful job!

You have mentioned very interesting details ! ps decent site.

Very efficiently written article. It will be beneficial to anybody who utilizes it, including me. Keep up the good work – looking forward to more posts.

As soon as I detected this web site I went on reddit to share some of the love with them.

Great post, I conceive website owners should acquire a lot from this website its really user pleasant.