📈 Insightful ARM Stock Forecast for 2025 to 2050 : You should know

👉 30 Seconds Summary 👈

Arm Holdings plc (Nasdaq : ARM) is semiconductor design entity with strong long-term growth potential. Our projections estimate ARM’s stock price could reach $171.64 by 2025, $378 by 2030, and $750 by 2035. By 2040, the stock may rise to $1230, and by 2050, it could hit $1840. These forecasts highlight ARM’s growing dominance and potential for significant returns over time.

Arm Holdings plc plays a crucial role in the tech industry. It is a British semiconductor and software design company headquartered in Cambridge, England. It is best known for designing CPU cores that use the ARM architecture. In this article ‘Arm Stock Forecast for 2025 to 2050’, we will not only get into its short term profitability but also a long term perspective.

If we look at the scope of their business then we can easily see their processors in almost all modern smartphones and a wide range of other computing devices. Beyond CPUs, Arm also designs other chips, provides software development tools, and offers system-on-chip (SoC) solutions.

ARM holdings was originally a part of Acorn Computers, Arm has grown into a global leader in semiconductor design, with its technology at the brain of embedded systems, mobile devices, and even servers. Since 2016, Arm has been majority-owned by Japan’s SoftBank Group, and after a failed acquisition attempt by Nvidia, the company went public on the Nasdaq in 2023.

Arm Holdings works in multiple sectors, from CPUs where it goes head-to-head with IBM, Intel, and AMD, to GPUs, where it rivals companies like Nvidia, Qualcomm, and Samsung. With its designs powering an array of modern technology, Arm remains a key player in the evolving tech landscape.

About Arm Holdings | Company Information

| Company Name | Arm Holdings plc |

| Stock Exchange | Nasdaq |

| Ticker Symbol | ARM |

| Sector | Technology (Semiconductors) |

| Headquarter | Cambridge, England |

| Founded in | November, 1990 |

| Founder | Jamie Urquhart, Tudor Brown, Mike Muller, Lee Smith, Harry Oldham, John Biggs, Dave Howard, Pete Harrod, Harry Meekings, Andy Merritt, Al Thomas, David Seal |

| Major Shareholder | Softbank Group Corp. (88.06%) |

| Market Cap. | $147.30 billion |

| Revenue(2024) | $3.23 billion |

| Total Assets | $7.93 billion |

| All-time high closing price | $186.46 on July 10, 2024 |

| 52-week low | $46.50 |

| 52-week high | $188.75 |

| Peer Companies | Broadcom Inc. (AVGO), Qualcomm Inc. (QCOM), Nvidia Corporation (NVDA), Taiwan Semiconductor Manufacturing Company Ltd. (TSM), Advanced Micro Devices Inc. (AMD) |

Unlike traditional microprocessor companies like Intel or NXP, Arm doesn’t manufacture and sell its own chips. Instead, it focuses on creating and licensing its technology as intellectual property (IP). This means Arm designs the CPUs, GPUs, and SoCs that other companies then manufacture.

It’s a model similar to other British tech firms like Imagination Technologies, where they design and license their products, while also providing tools and support services to help their clients bring those designs to life. Now, you know what this company is, let’s focus and Arm stock forecast and see what this company will be.

Also Read : SoFi Technologies | SOFI stock price prediction 2025, 2030, 2040 & 2050

Arm Holdings plc (ARM) Analysis | Past, Present & Future

We’ll look at both charts and key financial data to help you understand what could impact ARM’s stock price in the short and long term. If you’re wondering about ARM’s growth potential, keep reading to see where this stock might be headed.

ARM Stock Historical Price Data

ARM Holdings was listed on Nasdaq on 15, Sept 2023. The price it first traded after listing was $60 and now after 1 year, it is trading at $140.70 as on 27, Feb 2025. Within 1 year, this stock gave a return of almost 133% which is really very impressive, isn’t it?

One year chart analysis for ARM Stock forecast

As we can see, the ARM stock traded between $60-$85 from Dec 2023 to Feb 2024. But in mid-Feb, arm stock gave a huge spike and it raised from $65 to $150 within no time.

As we reached March 2024, ARM stock started ranging between $150-$120. It spent some Feb, whole March and Half of April in that range & broke it down sharply in April mid. A sudden dip to $90 can be seen.

After this dip, with a steady Bullish trend, it started a rally till $180. So, our point is, ARM is in Bullish trend but some sharp corrections can be expected at any time.

ARM Stock Live Chart

Also Read : Nexus Uranium Corp. stock forecast 2025 to 2050 | Future of uranium exploration

Time-Frame analysis of ARM : Hourly, Daily & Weekly

By analyzing a ARM stock price through a timeframe chart, we can gather some key insights that will assist us in determining the final ARM stock forecast : –

| Time Frame | Observation |

|---|---|

View Hourly Chart (Every candle represents Nasdaq : ARM share’s trading session of one hour. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular hour) | On hourly time-frame, we can observe that ARM stock is trading ABOVE the 21 hour, 50 hour & 100 hour SMA BUT BELOW 200 hour SMA. This indicates that the ARM stock is in Sideways to UP trend for short term. |

View Daily Chart (Every candle represents Nasdaq : ARM share’s trading session of one day. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular day) | On daily time-frame, we can observe that ARM stock is trading BELOW 21 Day SMA, 50 Day, 100 Day & 200 Day SMA. This is the sign of Bearishness in medium term. |

View Weekly Chart (Every candle represents Nasdaq : ARM stock’s trading session of one week. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular week) | On the weekly time-frame ARM stock is trading BELOW 21 weeks & 50 weeks SMA. This indicates that ARM stock has a clear Bearish sentiment. |

Since there is a NEGATIVE perspective shown by SMAs in Weekly & Daily time-frame while a SIDEWAYS to POSITIVE perspective in Hourly time-frames. This can be a little confusing for a trader & investors.

By observing the directions of the SMAs, we can find that ARM’s direction is always NEUTRAL to POSITIVE in Weekly & Daily time-frame while Highly Positive in Hourly Timeframe.

If you are a Short to Medium term trader/investor, you can consider this stock for BUYING (only if overall market conditions are favorable). But if you are a Long term investor, this is a sign of your waiting time, if you are thinking of investing in ARM stocks.

Dow Jones, NASDAQ & ARM : A comparative Analysis

Check out the comparative year on year returns of Dow Jones, Nasdaq and ARM. Here, we are showing the returns by comparing them on closing basis –

| Year | Dow Jones | Nasdaq | ARM |

|---|---|---|---|

| 2024 | +12.88% | +28.64% | +64.16% |

| 2023 | +13.70% | +43.42% | +33.93% |

| 2022 | -8.78% | -33.10% | – |

| 2021 | +18.73% | +21.39% | – |

| 2020 | +7.25% | +43.64% | – |

Also Read : CrowdStrike | CRWD Stock Price Prediction 2025, 2030, 2040, 2050

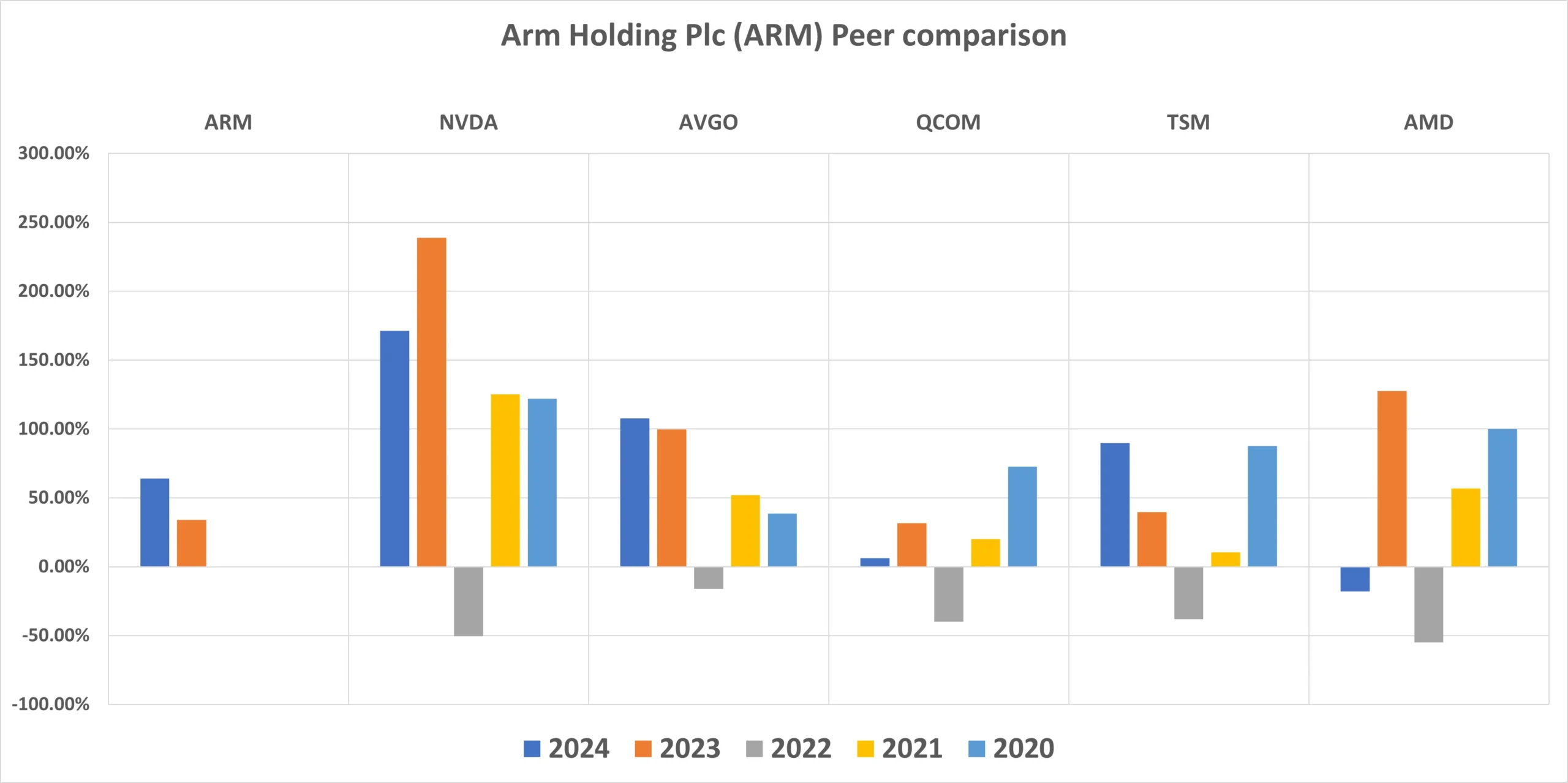

ARM Peer Comparison / Competitors Analysis

We will compare Arm Holdings PLC (Nasdaq : ARM) to its top competitors. We will see how its peer companies performed year-on-year . Below is the comparative table of Broadcom Inc. (AVGO), Qualcomm Inc. (QCOM), Nvidia Corporation (NVDA), Taiwan Semiconductor Manufacturing Company Ltd. (TSM), Advanced Micro Devices Inc. (AMD)‘s returns from 2020 to 2024 based on CLOSING Prices.

| Year | ARM | NVDA | AVGO | QCOM | TSM | AMD |

|---|---|---|---|---|---|---|

| 2024 | +64.16% | +171.17% | +107.70% | +6.22% | +89.89% | -18.06% |

| 2023 | +33.93% | +238.87% | +99.64% | +31.55% | +39.62% | +127.59% |

| 2022 | – | -50.31% | -15.97% | -39.88% | -38.08% | -54.99% |

| 2021 | – | +125.29% | +51.97% | +20.04% | +10.34% | +56.91% |

| 2020 | – | +121.93% | +38.55% | +72.66% | +87.68% | +99.98% |

| Average Returns | +49.04% | +121.39% | +56.37% | +18.12% | +37.89% | +42.28% |

Here we can observe that ARM’s performance is at par when compared to its peer companies even if we look at the 2-year average returns.

ARM Stock Forecast : Short & Long Term

ARM Stock forecast for 2025, 2026, 2027, 2028, 2029

| Year | Stock Price Target |

|---|---|

| ARM stock forecast for 2025 | $ 171.64 |

| ARM stock forecast for 2026 | $ 201.17 |

| ARM stock forecast for 2027 | $ 244.86 |

| ARM stock forecast for 2028 | $ 295.23 |

| ARM stock forecast for 2029 | $ 342.67 |

ARM’s Stock forecast presented above is based on our detailed analysis. Here, we are expecting ARM stock to rise up to $171.64 which is a return of 21% approx. This must be considered a good return from this stock. Since we are expecting many changes in IT industry in near future, our analyst are looking forward to steady growth in ARM’s stock.

Looking ahead to 2026, we estimate Arm’s stock price could reach $201.17, which is a 42.96% increase from today’s price of $140.70. By 2027, we expect the stock to rise to $244.86, reflecting a 74.02% gain. Further down the line, in three years or more, we anticipate Arm’s stock could hit $342.67, representing a 143.53% increase from its current price.

ARM Stock forecast for 2030, 2035, 2040, 2050

| Year | Stock Price Target |

|---|---|

| ARM stock forecast for 2030 | $ 378 |

| ARM stock forecast for 2035 | $ 750 |

| ARM stock forecast for 2040 | $ 1230 |

| ARM stock forecast for 2045 | $ 1475 |

| ARM stock forecast for 2050 | $ 1840 |

Our long-term projection sees Arm’s stock climbing to $378 by 2030, which would be a 168.88% surge over today’s price of $140.70. As we look at the very long term perspective of Arm stock forecast, we can only analyze it on today’s aspect but we know it is not enough to estimate the growth of such a unique company. The ARM holdings have potential to grow with the growing technology. Since it is in the business of manufacturing microprocessors, we can only imagine the demand when metaverse and VR will reach its peak.

ARM Stock forecast 2025 (month-wise)

| Month | Stock Price Target |

|---|---|

| ARM stock price prediction for January 2025 | $ 156.49 |

| ARM stock price prediction for February 2025 | $ 159.08 |

| ARM stock price prediction for March 2025 | $ 161.32 |

| ARM stock price prediction for April 2025 | $ 163.27 |

| ARM stock price prediction for May 2025 | $ 164.67 |

| ARM stock price prediction for June 2025 | $ 167.53 |

| ARM stock price prediction for July 2025 | $ 168.46 |

| ARM stock price prediction for August 2025 | $ 167.54 |

| ARM stock price prediction for September 2025 | $ 169.38 |

| ARM stock price prediction for October 2025 | $ 170.13 |

| ARM stock price prediction for November 2025 | $ 171.64 |

| ARM stock price prediction for December 2025 | $ 170.43 |

Conclusion

Lets summarize what we discussed. ARM holdings is a semiconductor and software design company & as we are living in a digital age, we are surrounded by these semiconductors. Since we are expecting some major advancement in technologies, we can predict the bright future of this company.

Also read : Microsoft stock price prediction for 2025 : You Must Know

Handpicked for you (MUST WATCH)

Frequently asked questions (FAQs)

1) Is ARM stock a strong buy?

ARM’s financial health and growth potential suggest that it might not perform as well as the market overall. Currently, it has a Low Growth Score, indicating average growth prospects. However, recent price fluctuations and earnings estimate revisions point to strong momentum, leading to a High Momentum Score. This combination makes ARM an attractive option for momentum investors looking for stocks with upward price trends.

2) Will ARM overtake Intel?

Arm has now surpassed Intel in market valuation, which is a significant milestone. Investors view Arm as a key player in the AI spending surge, particularly as it expands into the data center chip market. Additionally, with Japan’s SoftBank holding an 88% stake in the company, Arm benefits from substantial financial backing, which could enhance its growth and influence in the tech industry.

3) Is Nvidia going to buy ARM?

Nvidia announced plans to invest in Arm while it ensured that other companies could continue using ARM’s chip designs, which would keep the company’s licensing model untouched. However, the situation took turn when the FTC filed a court case in late 2021 to block the merger. Faced with this legal challenge and other regulatory pressures, the deal ultimately fall apart in less than three months.

4) What is the target price for ARM stocks?

The target price for the ARM stocks for the year 2025 could be $170 per share.

5) Is ARM a good stock to own?

ARM is a great company to hold for the long term. The key question for investors now is whether to buy shares right away or wait for a potential price drop after the stock’s recent surge, as illustrated below. Based on traditional metrics, it does seem like Arm’s stock may be overvalued at the moment.

6) Does ARM pay a dividend?

As of now, ARM holdings did not paid any dividend.

7) Who is the largest shareholder of ARM?

Softbank Group Corporation owns 88.06% i.e. 922,733,999 shares of ARM.

8) What is the ARM forecast for 2030?

Arm Holdings (NASDAQ: ARM) is projected to have strong growth potential, with forecasts suggesting a significant rise in its stock value by 2030. According to our analysts, ARM stock could reach $378.39 by 2030, marking a 168.88% increase from its current price.

9) Does ARM stock pay dividends to its investors?

ARM Holdings PLC did not paid any dividend till 2024.

10) Why are ARM stock falling ?

Arm’s recent stock price drop is mostly due to weak economic conditions, political dilemma, including rising unemployment and concerns about a potential recession. As ARM shares have fallen sharply, many investors are now wondering if it is a good buying opportunity.

Disclaimer : Not an Investment Advice

The content shared here in the article “Insightful ARM Stock Forecast for 2025 to 2050 : You should know” is for general information only. It’s not intended as financial, investment, or professional advice. Always consult a qualified professional—whether legal, financial, or tax-related—before making any investment decisions.

Howdy just wanted to give you a quick heads up.

The words in your content seem to be running off the screen in Internet

explorer. I’m not sure if this is a format issue or something to

do with browser compatibility but I thought I’d post to let you know.

The layout look great though! Hope you get the problem solved soon. Many thanks

I’m extremely impressed with your writing skills as well as with the layout on your weblog. Is this a paid theme or did you customize it yourself? Anyway keep up the excellent quality writing,it is rare to see a nice blog like this one today.

Its such as you read my mind! You appear to understand so much approximately

this, such as you wrote the guide in it or something. I believe that you simply can do with some

% to power the message home a little bit, however instead of that, that is fantastic blog.

A great read. I will certainly be back.

I do not even know how І ended up һere, but I thought this post was good.

I don’t know who you are but certainly you are goіng to a famous blogɡer if you are not alreaⅾy 😉 Cheers!

Spot on wijth this wrіte-up, I absolutely believe tha

this amazing site needs a ⅼot moгe attention. I’ll probably be returning too see more,

thanks for the information!