⚠️ Marvell Technologies | MRVL Stock Forecast 2025-2050 with detailed analysis

➡️ 30 Seconds Summary ⬅️

Marvell Technologies Inc. (NASDAQ: MRVL) has established itself as a major player in the semiconductor industry, powering innovations across data infrastructure, 5G, cloud computing, and more. Founded in 1995, the company has consistently adapted to market trends and technological advancements. In this blog post “Marvell Technologies | MRVL Stock Forecast 2025-2050 with detailed analysis”, we present a detailed forecast of MRVL stock from 2025 to 2050, based on deep analysis of historical performance, financial trends, and future growth opportunities.

Whether you’re a long-term investor or just exploring semiconductor stocks, keep reading for a complete breakdown of Marvell’s potential journey ahead. We will also compare MRVL’s performance with major indices as well as with its peer companies. We will also analyze MRVL stock on multiple timeframe and based on this analysis, we will estimate its future prices which will help you in taking precise investment decision.

About Marvell Technologies Inc. (Nasdaq : MRVL)

| Company Name | Marvell Technologies Inc. |

| Stock Exchange | Nasdaq |

| Ticker Symbol | MRVL |

| Sector | Technology |

| Headquarter | California, US |

| Founded in | 1995 |

| Major Shareholder | FMR, LLC (~15%) |

| Market Cap. | $ 51.04 billion USD |

| Revenue | $ 5.77 billion USD |

| Total Assets | $ 20.20 billion USD |

| All-time HIGH price | $ 127.48 USD (Jan 23, 2025) |

| All-time LOW price (since 2015) | $ 7.40 USD (Jan 20, 2016) |

| Peer Companies | Analog Devices Inc (ADI), Micron Technology Inc. (MU), Arm Holdings plc. (ARM), Intel Corporation (INTC), NXP Semiconductors N.V. (NXPI) |

Marvell Technologies Inc. (NASDAQ: MRVL) is a leading semiconductor company known for driving innovation across key technology sectors like data centers, 5G, and cloud computing. Marvell has reported a revenue of $5.77 billion USD and holds total assets worth $20.20 billion USD. The company reached an all-time high stock price of $127.48 USD, highlighting its strong position in the industry.

With its robust financial foundation and forward-looking strategies, Marvell remains an attractive option for investors seeking long-term growth in the tech space. Now, we’ll begin by analyzing MRVL’s five year price movement for better understanding of MRVL’s performance before diving into its future.

Marvell Technologies Inc. (Nasdaq : MRVL) | Past, Present & Future

Marvell Technologies Inc. (MRVL) | Historical price analysis

| Year | Open | High | Low | Close | % Change |

|---|---|---|---|---|---|

| 2024 | 59.46 | 126.15 | 53.19 | 110.45 | +83.14% |

| 2023 | 37.91 | 67.99 | 33.75 | 60.31 | +62.82% |

| 2022 | 87.95 | 91.78 | 35.09 | 37.04 | -57.66% |

| 2021 | 47.81 | 93.85 | 37.92 | 87.49 | +84.03% |

| 2020 | 27.00 | 48.42 | 16.45 | 47.54 | +78.99% |

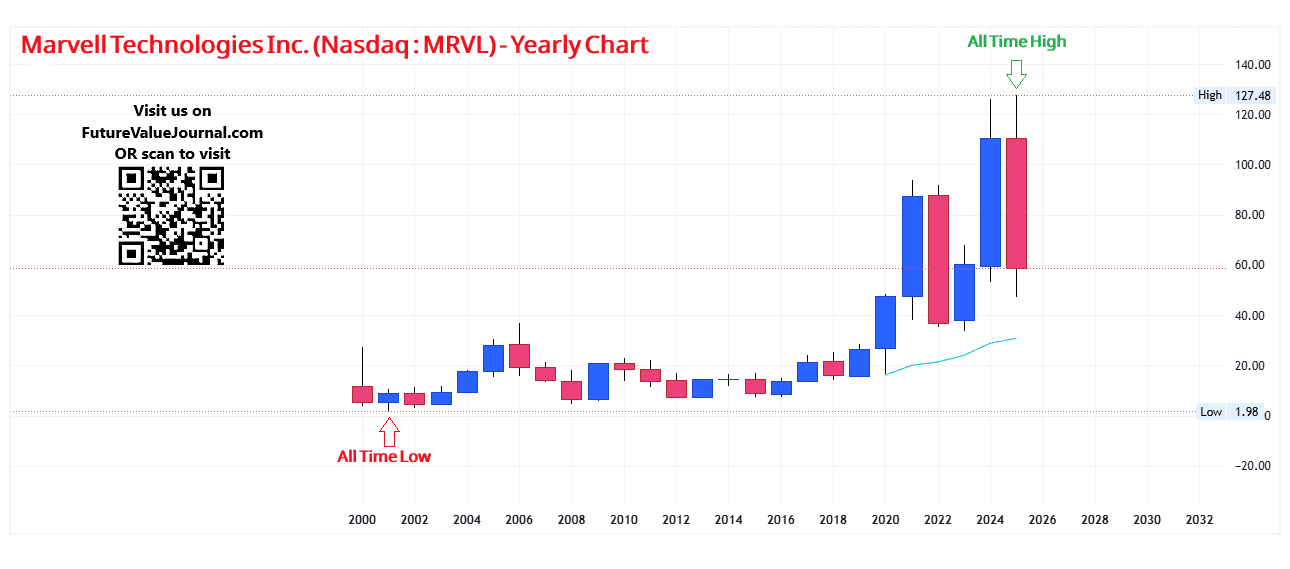

In the above graph, we can clearly see that MRVL stock price gave positive results to its investors every year (except in 2022). MRVL stock price hit its all-time high of $127.48 in January, 2025.

Also Read : JPMorgan Chase & Co. – JPM stock forecast 2025-2050 with detailed analysis🚨

Live chart analysis for MRVL Stock Price Forecast

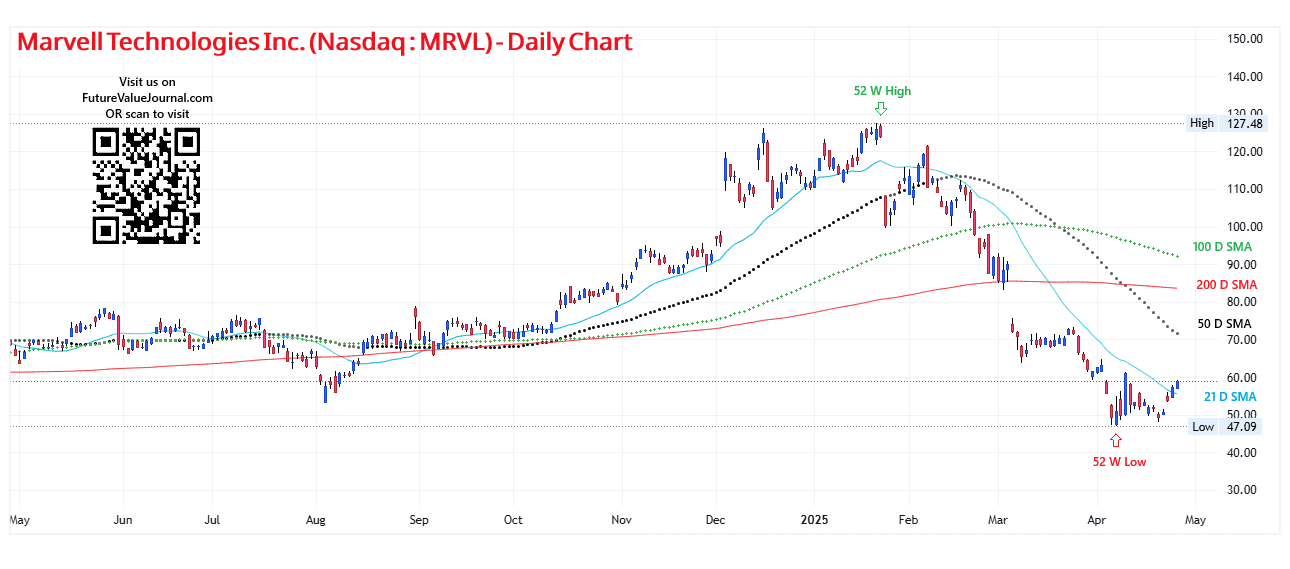

Before we start looking at the future values of MRVL Stock Prices, have a close look at the current chart so we can understand where it is heading in future. Here, in MRVL’s live chart, we can observe that, after hitting its all time high of $127.48 on January 23, 2025, MRVL started its down trend. With two gap down openings, one on Jan 27, 2025 & another on Mar 06, 2025, it lost confidence of many investors. Within 3 months, MRVL lost all the gains of 2024 & came back to the opening prices of previous year. Although, during April 2025, MRVL it trying to regain its upside momentum. Let’s see where it will go till 2025 end. Below is the multi-timeframe analysis of MRVL stock, have a look to understand more about its direction.

Time-Frame analysis of MRVL Corp. : Daily, Weekly, Monthly, Yearly

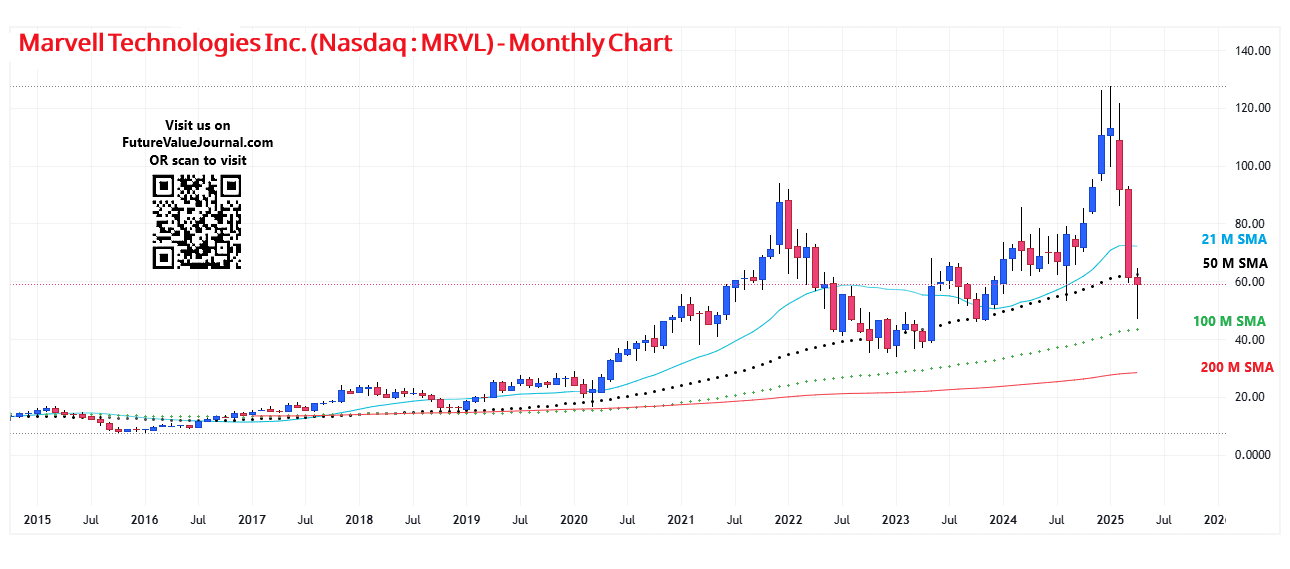

By a technical chart analysis of Simple Moving Averages (SMAs) on different timeframes, we can observe the following –

| Time Frame | Observation |

|---|---|

View Daily Chart (Every candle represents Nasdaq : MRVL share’s trading session of one day. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular day) | On the Daily time-frame MRVL stock is trading BELOW 21 Days, 50 Days, 100 Days & 200 Days SMAs. This indicates that MRVL stock has a Sideways to Negative sentiment in medium term. |

View Weekly Chart (Every candle represents Nasdaq : MRVL share’s trading session of one week. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular week) | On Weekly time-frame, we can observe that MRVL stock is trading BELOW all the 21 Weeks, 50 Weeks, 100 Weeks SMA & 200 Weeks SMAs . This is the clear sign of Sideways to Bearish trend in Long term. The support zone is marked in the chart, please note before taking any trade. |

View Monthly Chart (Every candle represents Nasdaq : MRVL stock’s trading session of one month. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular month) | On Monthly time-frame, we can observe that MRVL stock is trading BELOW 21 Months & 50 Months but ABOVE the 100 Months & 200 Months SMAs. This indicates that the MRVL stock is in Sideways to Bearish trend for Very Long term. |

View Yearly Chart (Every candle represents Nasdaq : MRVL stock’s trading session of one year. Each single candle represent the HIGH, LOW, OPEN, CLOSE of that particular year) | In the yearly chart also, we can clearly see the range of MRVL stock is between $60 to $127.48 for 2 years. All the gain of 2024 got vanished till mid-2025, lets see where MRVL will reach till the end of 2025. |

The major support can be seen at the levels between $80 – $60. If we go for the directional analysis of the SMAs, we can see a Sideways to Bearish trend in SMAs directions in multiple timeframes.

Dow Jones, Nasdaq & MRVL : A comparative Analysis

Check out the comparative year on year returns of Dow Jones, Nasdaq and Marvell Technologies Inc.. Here, we are showing the returns by comparing them on closing basis –

| Year | Dow Jones | Nasdaq | MRVL |

|---|---|---|---|

| 2024 | +12.88% | +28.64% | +83.14% |

| 2023 | +13.70% | +43.42% | +62.82% |

| 2022 | -8.78% | -33.10% | -57.66% |

| 2021 | +18.73% | +21.39% | +84.03% |

| 2020 | +7.25% | +43.64% | +78.99% |

Here in the above table, we can clearly see that their is a correlation between Dow – Nasdaq & MRVL stocks. The returns of MRVL got amplified in the direction of DOW & Nasdaq.

Also Read : Can your favorite OTT platform (Netflix) become profitable investment in 2025? Lets find out..

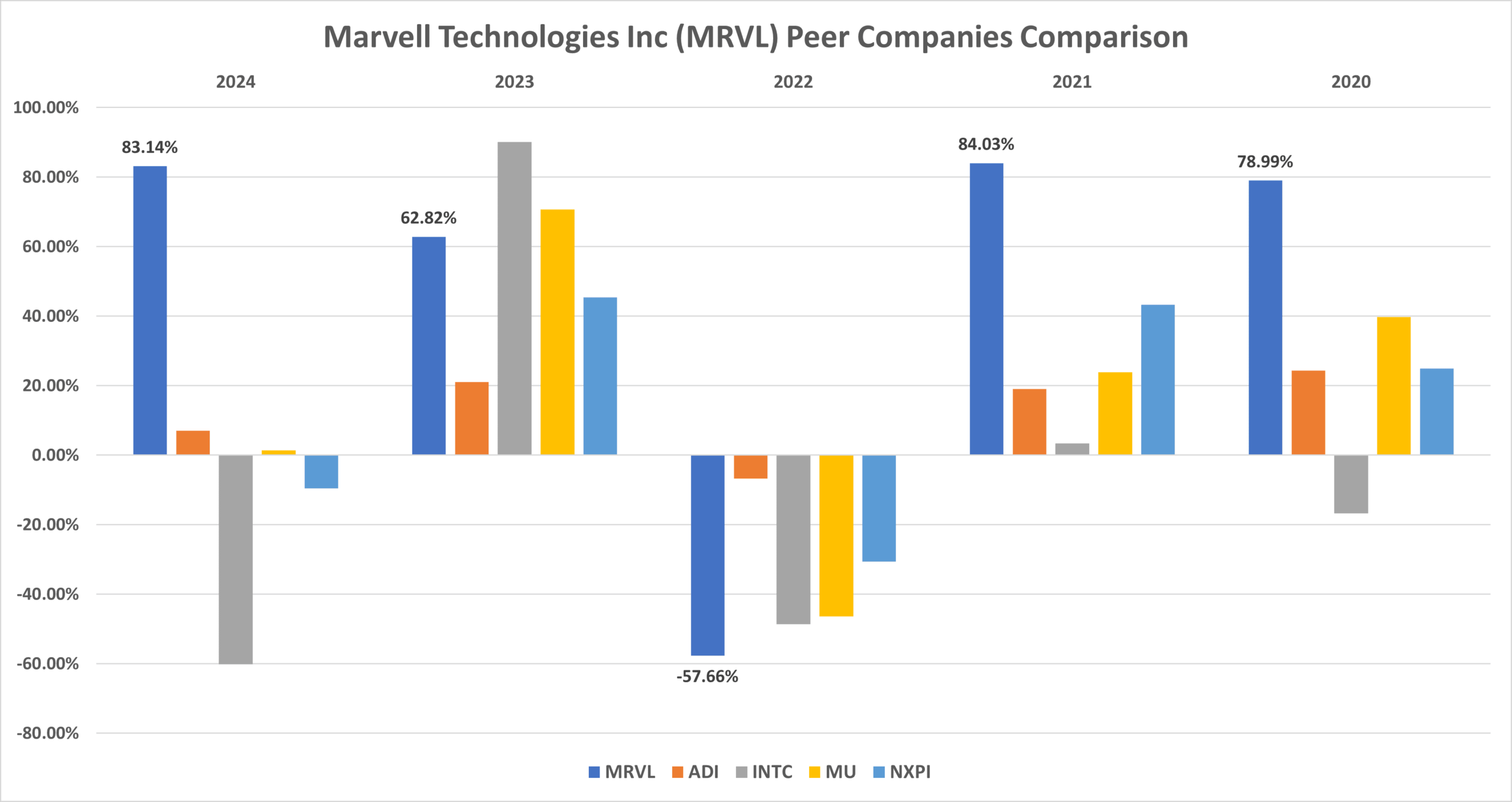

MRVL Peer Comparison / Competitors Analysis

We will compare Marvell Technologies, Inc. (Nasdaq : MRVL) to its top competitors. We will see how its peer companies performed year-on-year . Below is the comparative table of Analog Devices Inc (ADI), Micron Technology Inc. (MU), Intel Corporation (INTC) & NXP Semiconductors N.V. (NXPI)’s returns from 2020 to 2024 based on CLOSING Prices.

| Year | MRVL | ADI | INTC | MU | NXPI |

|---|---|---|---|---|---|

| 2024 | +83.14% | +7.00% | -60.10% | +1.38% | -9.50% |

| 2023 | +62.82% | +21.05% | +90.12% | +70.75% | +45.34% |

| 2022 | -57.66% | -6.68% | -48.68% | -46.34% | -30.62% |

| 2021 | +84.03% | +18.98% | +3.37% | +23.90% | +43.25% |

| 2020 | +78.99% | +24.31% | -16.76% | +39.79% | +24.95% |

| Average Returns | +50.26% | +12.93% | -6.14% | +17.89% | +14.68% |

MRVL has given a Commendable returns of +50.26% to its long-term investors if we look at the 5 years average returns. Since Arm Holdings plc. (ARM) got listed in 2023, we are didn’t considered it in the above comparison.

MRVL Stock Forecast : Short & Long Term

MRVL Stock Forecast 2025, 2026, 2027, 2028, 2029

| Year | Stock Price Target |

|---|---|

| MRVL stock forecast for 2025 | $ 122.54 |

| MRVL stock forecast for 2026 | $ 137.04 |

| MRVL stock forecast for 2027 | $ 154.45 |

| MRVL stock forecast for 2028 | $ 175.34 |

| MRVL stock forecast for 2029 | $ 200.41 |

- In 2025, we expect MRVL’s stock price to reach around $122.54, representing an increase of approximately 10.96% from its 2024 closing price of $110.45.

- Looking ahead to 2026, MRVL could rise to $137.04, showing a gain of about 24.11%.

- By 2027, the stock may climb to $154.45, marking an impressive increase of approximately 39.89%.

- Moving into 2028, we anticipate MRVL could reach $175.34, reflecting a gain of around 58.76%.

- Finally, by 2029, MRVL could hit $200.41, representing a substantial increase of approximately 81.44% from its 2024 closing price.

MRVL Stock Price Forecast 2030, 2035, 2040, 2050

| Year | Stock Price Target |

|---|---|

| MRVL stock forecast for 2030 | $ 230.50 |

| MRVL stock forecast for 2035 | $ 499.14 |

| MRVL stock forecast for 2040 | $ 1167.62 |

| MRVL stock forecast for 2045 | $ 2831.09 |

| MRVL stock forecast for 2050 | $ 6970.04 |

- By 2030, our long-term analysis forecasts MRVL’s stock price reaching $230.50, which would represent an increase of approximately 108.72% from its 2024 closing price of $110.45.

- Looking ahead to 2035, we estimate MRVL stock could reach $499.14, showing a remarkable return of around 351.99%.

- By 2040, the stock is expected to rise to $1167.62, reflecting a substantial gain of approximately 957.11%.

- By 2045, MRVL could climb to $2831.09, marking an outstanding increase of about 2,463.90%.

- Further into the future, by 2050, we forecast MRVL stock could hit $6970.04, indicating an impressive surge of roughly 6,211.45% from its 2024 closing price.

MRVL Stock Price Prediction 2025 (month-wise)

| Month | Stock Price Target |

|---|---|

| MRVL stock price prediction for March 2025 | $71.80 |

| MRVL stock price prediction for April 2025 | $69.65 |

| MRVL stock price prediction for May 2025 | $72.48 |

| MRVL stock price prediction for June 2025 | $80.19 |

| MRVL stock price prediction for July 2025 | $91.67 |

| MRVL stock price prediction for August 2025 | $102.15 |

| MRVL stock price prediction for September 2025 | $112.33 |

| MRVL stock price prediction for October 2025 | $122.54 |

| MRVL stock price prediction for November 2025 | $114.29 |

| MRVL stock price prediction for December 2025 | $102.64 |

As per our analysis of MRVL stock price, we are expecting that the prices may rise up to $122.54, offering an approximate 10.96% return on its 2024 closing price of $110.45. This represents a DECENT return (ROI) for investors.

Also Read : American Express Stock Forecast 2025-2050 with Complete Analysis 💳

Conclusion

Marvell Technologies (NASDAQ: MRVL) has established itself as a strong player in the semiconductor industry. With a market capitalization of $51.04 billion USD and FMR, LLC holding the largest share at around 15%, the company remains significant in the tech sector. After reaching an all-time high of $127.48 per share in January 2025, MRVL’s performance shows a sideways to bearish trend on multiple timeframes.

However, when compared to its peers, Marvell still stands out as a top performer. Based on our long-term analysis, MRVL stock has the potential to reach approximately $6,970.04 per share by 2050, offering strong opportunities for patient, long-term investors.

Frequently Asked Questions (FAQs)

1) Will MRVL stock price reach $500?

As per our current analysis, we could guess that it will be hard for MRVL stock to reach $500 in near future. Firstly, it is really very far from its current price. Unless Marvell Technologies Inc. innovate & launch something really groundbreaking, we cannot expect this price sooner. Although we can see this price during 2035-36.

2) Is MRVL a good stock to buy, sell or hold?

In our opinion, currently MRVL is an OK-OK stock to HOLD. BUT if you are looking for a fresh buy, you should wait for some time because it is roaming in the support zone. Although there are many more opportunities available in which you can invest other than semiconductor manufacturing industry.

3) What is the MRVL stock forecast for 2030?

In 2030, we are expecting MRVL stock price to reach around $110.45.

4) What is the MRVL stock forecast for 2050?

During 2050, we might see MRVL stock price to hit $6970.04.

5) What is the MRVL stock forecast for 2025?

As per current market conditions, MRVL stock price could reach up to $110.45 per share in 2025.

6) What is the MRVL stock price prediction for 2026?

In 2026, we are expecting MRVL stock price to reach around $137.04.

7) What is the MRVL stock forecast for 2027?

In 2027, we are expecting MRVL stock price to reach around $154.45.

8) What is the MRVL stock price prediction for 2028?

In 2028, we are expecting MRVL stock price to reach around $175.34.

9) What is the MRVL stock forecast for 2029?

In 2029, we are expecting MRVL stock price to reach around $200.41.

Disclaimer : Not an Investment Advice

The content shared here in “⚠️ Marvell Technologies | MRVL Stock Forecast 2025-2050 with detailed analysis” is for general information only. The stock price forecasts provided here are based on current market conditions which are subject to change with respect to change in market scenario. It’s not intended as financial, investment, or professional advice. Always consult a qualified professional—whether legal, financial, or tax-related—before making any investment decisions.

Hi there, I do think your site could be having browser compatibility problems.

Whenever I take a look at your website in Safari, it looks fine however, if

opening in IE, it has some overlapping issues. I just wanted to provide you with a quick heads up!

Other than that, fantastic website!

What’s Happening i’m new to this, I stumbled upon this I’ve found It positively helpful and it has helped me out loads. I hope to contribute & aid other users like its aided me. Good job.

I love examining and I think this website got some genuinely useful stuff on it! .

You actually make it appear really easy along with your presentation however I to find this matter to be actually one thing that I think I would never understand. It kind of feels too complicated and extremely large for me. I am looking ahead in your next post, I will try to get the cling of it!

Hello there, just became alert to your blog through Google, and found that it’s truly informative. I’m going to watch out for brussels. I will be grateful if you continue this in future. A lot of people will be benefited from your writing. Cheers!